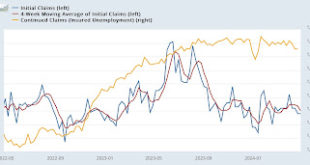

– by New Deal democrat The snooze-a-thon in jobless claims continues, as both initial and continuing claims are well-behaved within the narrow range where they have been generally for the past six months. Initial claims were unchanged least week at 208,000, while the four week moving average declilned -3,500 to 210,00. With the usual one week delay, continuing claims were unchanged at 1.774 million, which is tied for the lowest level in...

Read More »Monthly payments could get thousands of homeless people off the streets

Doug Smith Los Angeles Times Monthly payments for housing could get thousands of homeless people off the streets. It sounds like a voucher idea where the funds could only be used only for housing, apartments and heat and electricity. Or paid directly. A stipulated basic income to house thousands of homeless people in various situations (apartments, boarding, with family or friends, etc.) as advocated by researchers. The idea or potential...

Read More »A Doctor at Cigna Said Her Bosses Pressured Her to Review Patients’ Cases Too Quickly

I first caught up with this article on MedPage Today, “Doc Blows Whistle on Cigna.” I also read the ProPublic report. Both are reporting on denial of claims before and after treatment and the productivity of claims reviewers. Additionally, the report discusses the use of labor (nurses, etc.) outside of the US to evaluate claims and their errors. All of these attempts are examples of what is going on to cuts costs by reducing the time to decide on...

Read More »How Did Under-40s Get So Much Richer During Covid?

by Steve Roth Wealth Economics This picture from the Center for American Progress, and variations, have been making the rounds on the interwebs lately, eg here, here, and here. The headline is that younger households got 49% richer during/since Covid, in inflation-adjusted “real” terms. But some drill-down is in order here. What actually happened? Start with background. There are about 38 million households with under-40 heads of...

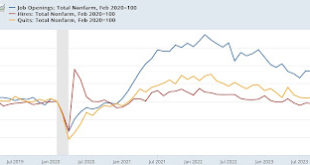

Read More »March JOLTS report: declines in everything, fortunately including layoffs

– by New Deal democrat After almost half a year of general stabilization, or very slow deceleration, the JOLTS report for March featured multi-year lows in almost all of its components. Job openings (blue in the graph below), a soft statistic that is polluted by imaginary, permanent, and trolling listings, declined -325,000 to a three year low of 8.488 million. Actual hires (red) declined -281,000 to 5.500 million, the lowest level since the...

Read More »Manufacturing treads water in April, while real construction spending turned down in March (UPDATE: and heavy truck sales weren’t so great either)

by New Deal democrat The Bonddad Blog A preliminary programming note: In addition to the manufacturing and construction reports, today we also get the JOLTS report for March, and updated motor vehicle sales reports. Yesterday we also got the Employment Cost Index for Q1. I will comment on the JOLTS report later today. I’ll comment on the ECI along with jobless claims tomorrow. Additionally, Wolf Richter made an interesting point yesterday...

Read More »Repeat home sale prices accelerated in February (but don’t fret yet)

– by New Deal democrat The Bonddad Blog Our final housing statistics of the month are the FHFA and Case Shiller repeat sales indexes. As usual, keep in mind that mortgage rates lead home sales, which in turn lead prices. Which, in turn, lead the official CPI measure of shelter by a year or more. This morning the FHFA purchase only price index through February spiked a sharp 1.2% (!) on a seasonally adjusted monthly basis, causing the YoY...

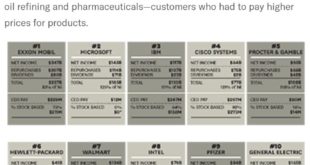

Read More »Sorta a book review “Wall Street’s War on Workers”

By Les Leopold Chelsea Green Publishing Interesting book I just started to touch upon. Book review by Paul Prescod. Last section touches upon why layoffs may happen . . . Stock Buybacks and Deregulation. Across the political spectrum, it seems as if the right to decent employment has disappeared from the agenda. Wars, natural disasters, and Donald Trump’s antics grab headlines while the closing of a major factory doesn’t register a blip....

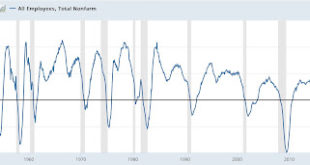

Read More »Looking at historical “mid cycle indicators” – what do they say now?

– by New Deal democrat The Bonddad Blog About 10 years ago, I went looking for what I called “mid cycle indicators.” In other words, I wanted to go beyond leading or lagging indicators to find at least a few that tend to peak somewhere near the middle of an expansion. That synapse was jangled when I read the title of a recent update by financial analyst Cam Hui, “Relax, it’s just a mid-cycle expansion.” Since I hadn’t looked at the...

Read More »Why Isn’t The USA in a recession ?

Oddly I am back here posting. Even more oddly I am posting on the topic I am paid to address. I start by noting two things. About one year ago, many macroeconomic forecasters predicted that a recession would have started by now in the USA. I forget who placed the probability at 100%. In spite of sltightly disappointing 0.4% (1.6% if annualized) real GDP growth in the first quarter of 2024, we are not in a recesion. What went right ? The...

Read More » Heterodox

Heterodox