– by New Deal democrat The FHFA and Case Shiller repeat sales indexes are the last home sales and price data for the month. Two months ago I wrote that “for the next seven months the comparisons will be against an average 0.7% increase per month in 2023. Because house price indexes have shown a demonstrated lead over shelter costs as measured in the CPI, if present trends continue, as these YoY comparisons drop out, the YoY deceleration in OER...

Read More »The business of pot

When I was in high school and college in the 1970s, marijuana was (a) illegal and (b) plentiful. I may or may not have inhaled, but people I knew were certainly growing, drying, selling and buying dope at the time. From a public health standpoint, marijuana is more benign than alcohol and tobacco.I’m happy to see the cannabis industry taxed. Cannabis, while organic, isn’t exactly health food and certainly isn’t the staff of life. But from an economic...

Read More »The Failing Battle for Health and Healthcare in These All Too Disunited States

Tom Dispatch site commentary suggested by Dale Coberly . . . Tom: It’s not complicated. This country, as TomDispatch regular and co-chair of the Poor People’s Campaign Liz Theoharis makes clear today, is simply unprepared — unprepared, that is, to keep all too many Americans even reasonably healthy and well. It matters little that this may be the wealthiest country on the planet . . . The Great Unwinding by Liz Theoharis TomDispatch.com...

Read More »Greed killed Red Lobster

I seldom eat at chain restaurants, and I’ve never set foot in a Red Lobster. So the latest bankruptcy of Red Lobster doesn’t affect me personally, but it does serve as yet another illustration of pernicious consequences of vulture capitalism.When the private equity firm Golden Gate Capital bought Red Lobster, the chain was already beaten down by the COVID pandemic and rising operating costs. “Typically, when a private-equity firm takes over a company,...

Read More »Anatomy of a policy failure

by Merrill Goozner GoozNews How high-deductible health insurance plans, touted by free marketeers, caused the medical debt crisis and degraded public health. ~~~~~~~~ The 2003 Medicare Modernization Act, best known for its senior citizen drug plans, also encouraged the rapid expansion of high-deductible health plans (HDHPs). It allowed people, mostly well-off, to put pre-tax earnings into health savings accounts (HSAs) – the equivalent of...

Read More »New Deal democrat Weekly Indicators May 20-24, 2024

– by New Deal democrat My “Weekly Indicators” post is up at Seeking Alpha. While the inverted yield curve and negative money supply growth keep the long leading indicators negative, both the short leading and coincident indicators have almost all turned neutral or positive. As usual, clicking over and reading will bring you up to the virtual moment as to the state of the economy, and bring me my lunch money for the coming week. The...

Read More »Real disposable personal income per capita is also hoisting a yellow caution flag

– by New Deal democrat To reiterate my Big Picture theme for this year, now that the supply chain tailwind has ended, will the effects of the 2022-23 Fed rate hikes drag the economy down towards recession at last, or will there be a “soft landing” (or no landing at all) instead, because interest rates have not increased in the past 12+ months? As a result, I am focusing most heavily on the leading sectors of manufacturing production and...

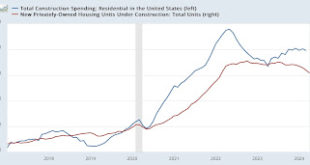

Read More »New home sales: all of the shoes have dropped except one . . .

Angry Bear is fortunate to have amongst its stable of writers, New Deal democrat. I can always count on his having a commentary on a daily basis. If you have not been following his reports on the economy, you should be. A double header today. New home sales: all of the shoes have dropped except one . . . – by New Deal democrat I am departing from my typical recap of new home sales this month. There is an important turn that was...

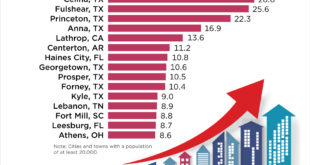

Read More »Just Some Census Stats

Yes, the South is increasing in population according to these Census numbers. There appears to be a reversal in or new growth in the Midwest and the Northeast. The growth is not as great. Texas appears to be growing faster than other parts of the country. I believe the limiting factor is going to be water, the same as it will be in Arizona. Unless there is continuous rainfall, both areas will be growth restrictive. I am going to tie to this in...

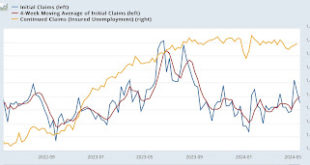

Read More »After a two-week excursion, initial claims fall back into range; the “quick and dirty” forecast model stays positive

– by New Deal democrat Initial claims declined -8,000 last week to 215,000, well within its recent nine month range, after a two week elevated excursion. The four week moving average, reflecting that excursion, increased to a nine month high of 219,750. Continuing claims, with the usual one week delay, rose 8,000 to 1.794 million, also well within their recent nine month range: As per usual, the YoY% change is more important for forecasting...

Read More » Heterodox

Heterodox