Value of the Chrysler Building and California Property Taxes The big news in New York City is that the Chrysler Building is for sale: New York City’s iconic Chrysler Building has appeared in dozens of movies and remained an Art Deco jewel of the Manhattan skyline for decades. Now, the 89-year-old skyscraper can be yours. Located on 42nd Street just east of Grand Central Terminal, sale price estimates for the famed Chrysler Building vary, but its...

Read More »How did they get so rich ?

I hope and trust that this will be an amusing display of my ignorance. I don’t hope to reach David Graeber’s level David Graeber: Apple Computers is a famous example: it was founded by (mostly Republican) computer engineers who broke from IBM in Silicon Valley in the 1980s, forming little democratic circles of twenty to forty people with their laptops in each other’s garages… 1. How did Jeff Bezos get so rich ? His wasn’t a subtle idea. The first...

Read More »How Shocking Was Shock Therapy?

How Shocking Was Shock Therapy? In 2007 Naomi Klein got quite a bit of attention and mostly favorable comment for her book, Shock Doctrine. It promulgated that global elites used periods of crisis around the world to force damaging neoliberal policies derived from the Chicago School and Washington Consensus upon unhappy populations that suffered greatly as a result. This was “shock therapy” that was more like destructive electroshock than any sort of...

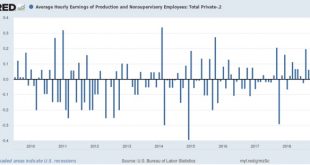

Read More »Good news from the employment report: workers are finally getting raises!

Good news from the employment report: workers are finally getting raises! When it comes to jobs, if there is one trend that really set apart 2018 from any prior year of this expansion, it is that ordinary workers are finally getting decent raises. Let’s start by looking at the monthly % change in average hourly wages for non-managerial workers for the entire duration of this expansion. Since this has averaged about +0.2%/month, I’ve subtracted that so...

Read More »December jobs report: 2018 goes out with a bang

December jobs report: 2018 goes out with a bang HEADLINES: +312,000 jobs added U3 unemployment rate rose +0.2% from 3.7% to 3.9% U6 underemployment rate unchanged at 7.6% Here are the headlines on wages and the broader measures of underemployment: Wages and participation rates Not in Labor Force, but Want a Job Now: declined -70,000 from 5.397 million to 5.327 million Part time for economic reasons: declined – 124,000 from 4.781 million to 4.657...

Read More »Can We Minimize Econogenic Outcomes?

Can We Minimize Econogenic Outcomes? I am back from the annual ASSA/AEA meetings in Atlanta. I learned a new term that on checking I find has been around for about five years. It is “econogenic,” coined by George DeMartino, who spoke on this in a session on “Ethics and Economics” held by the Association for Social Economics. It means “harm done by economists,” and it is inspired by “iatrogenic,” referring to harm done by physicians. His talk focused...

Read More »Romer & Romer on Taxes

Given the debate about returning to 60s level top marginal tax rate of 70% amazingly re-opened by Alexandria Ocasio-Cortez, I decided to actually read the Romer and Romer paper (pdf warning) which includes evidence suggesting an even higher rate is optimal. It is a masterpiece, which I won’t try to summarize. Read it. I do however, want to grind a very old ax related to “Schlock Economics”. I am thinking of the time that Robert Lucas totally humiliated...

Read More »On Some Predictions

On Some Predictions I am not somebody who makes endo/beginning of year predictions, and I am not about to stsrt now. But I have just read a guest post by Jeffrey Frankel on Econbrowser where he brags about making six accurate predictions for 2018 while not reporting on some others he made that did not work out so well. I happened to largely agree with them when I saw him making them, with some questions on two, while myself quitely making some that...

Read More »Optimal Taxation of Capital Income 2019 (let them Bern).

I wrote a post about optimal taxation of capital income which (the web is sometimes wonderful) was made legible by the blessed [person who choses to remain anonymous]. But that was back in Obama center left 2008. I want to update given what I learned since then and given the appearance of socialist US citizens. First, what I should have known already is that the standard Judd 85/86 result that the optimal rate of taxation of capital income goes to zero...

Read More »Economic Growth and Climate Change: Mistaking an Output Variable for an Instrument

Economic Growth and Climate Change: Mistaking an Output Variable for an Instrument When I first started arguing against the degrowthers, I thought they were a small, uninfluential fringe, important only because they had a sway over a portion of the left—what we might call the Naomi Klein left. That was then. Today degrowth is entering the mainstream, as can be seen by the latest David Roberts piece in Vox. Roberts reviews a discussion between several...

Read More » Heterodox

Heterodox