The Nobel Economists Petitiion on Carbon Tax And Dividend Plan As many now know, a large group of prominent economists, led by a large group of Nobel Prize winners, has published a petition in the Wall Street Journal. This petition declares the idea of putting a tax on carbon and then returning the receipts from it to the population on an even per capita basis to be the best and most efficient plan for dealing with global warming. This group continues...

Read More »Weirdly Non-Monotonic Yield Curves

Weirdly Non-Monotonic Yield Curves This is a situation that may be on the verge of disappearing and more or less normalizing, but over the last couple of months US bond markets have exhibited a weird phenomenon of non-monotonicity. It has been even weirder than what we saw during the period of negative nominal interest rates, when what we saw was interest rates on US treasury securities fell from the shortest time horizon to a low usually around the...

Read More »Rare Yglesias Google Fail

(Dan here…lifted from Robert’s Stochastic Thoughts) Rare Yglesias Google Fail (Most boring title after “Worthwhile Canadian Initiative” but I couldn’t resist) Web savvy ultra wonk Matthew Yglesias wrote “There’s no polling on specific brackets or exactly who counts as rich that I can find,” Matty just google [income to be rich poll]. Jeez. Americans have varying ideas of how much money you need to earn each year to be considered “rich,” but most people...

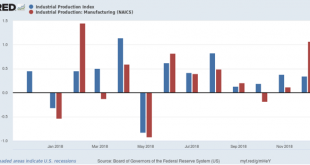

Read More »Industrial production: strong finish to 2018

Industrial production: strong finish to 2018 Industrial production for December was reported this morning at +0.3%, slightly better than estimates. But what was really surprising is how strong the manufacturing component was, up over 1%: With this reading, YoY industrial production for manufacturing improved to +3.4%, and overall production came in just below 4%: This is in contrast to the sharp slowdown we saw in both the December regional Fed indexes...

Read More »Whatever Happened To Iran?

Whatever Happened To Iran? Who? What? Where? Long a headliner in the news, Iran has disappeared from the headlnes, and even the lower pages. It has largely disappeared from the news, after being the g=big headline for a long time. This is probably good for Iran, despite its many flaws. I have made a big effort to find out its current economic status. The little data out there seems to suggest that not much is happening. GDP had been falling in the...

Read More »Why I’m expecting a 2nd half rebound in housing

by New Deal democrat Why I’m expecting a 2nd half rebound in housing In all of the storm und drang about yield curve inversions in the bond market, one important and overlooked consequence is how it is likely to help the very important housing sector. This post is up at Seeking Alpha. As usual, clicking over should be educational for you and helps me with a penny or two.

Read More »Notes on the government shutdown

Notes on the government shutdown I have a post on the housing market pending at Seeking Alpha. If and when it goes up there, I will link to it here. In the meantime, here are a few important notes on the shutdown. I can’t find the quote now, but about a week ago it was floated that Trump could “save face” by declaring an emergency, starting to build the wall, and then allow the government to open. Then Trump indicated that if he declared a state of...

Read More »Getting Ever More Surreal

Getting Ever More Surreal I am referring to a comment Sean Hannity made on his show earlier this evening in his monologue. The reports tht President Trump was under investigation by FBI Counterintelligence as being a possible “Russian asset” supposedly taking orders from Vladimir Putin has pushed uber Trump defender Hannity to ever more surreal forms of defense, in this case one especially bizarre given the cloase association in Trump’s early career...

Read More »Flying blind

Flying blind The government shutdown is affecting some important economic indicators. All of the series published by the Census Bureau, including retail sales, manufacturers’ and wholesalers’ data, personal income and spending, new home sales and housing permits and starts, are not being published. It appears that GDP is not going to be published by the BEA either. In the past I have created work-arounds for a few economic series, in particular new...

Read More »The Key to Gentrification

The Key to Gentrification In the world of urban politics, there is probably no more potent populist rallying cry than the demand to halt gentrification. Activists have fought it on multiple fronts: zoning, development subsidies, permitting, rent control—every lever housing policies afford. But what if they’re mistaking cause for effect, hacking away at the visible manifestations of the problem while leaving the problem itself intact? Pivot to...

Read More » Heterodox

Heterodox