The coming slowdown in employment Last summer I wrote a piece entitled “What the compressed yield curve means for employment.” I re-read it over the weekend, and in light of what has been going on in the bond market, I thought it was worth an update. Let me pretty much re-quote the entire piece: ———— Four times during the 1980s and 1990s the difference in the interest yield between 2 and 10 year treasury bonds got about as low as it is now [Note:...

Read More »Weekly Indicators for March 18 – 22 at Seeking Alpha

by New Deal democrat Weekly Indicators for March 18 – 22 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. As you can imagine, the big news was about the fact that almost every single yield curve there is – except the one I report on every week in that post – inverted yesterday. Also, as I mentioned in an e-mail to a couple of folks this morning, the big thing that bothers me is that ***EVERYONE*** is watching it. And a forecasting tool...

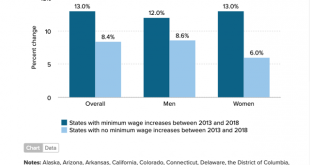

Read More »Over 50% of all wealth in the US is inherited not earned

Over 50% of all wealth in the US is inherited not earned I got waylaid putting together a very detailed post about how the newly-widened Panama Canal is disrupting the internal US transportation network. When it goes up at Seeking Alpha, I’ll link to it. In the meantime, here is something that I found a week or two ago for you to chew on. Over half of all US wealth is not earned but inherited: Click on picture to enlarge. According to a report...

Read More »… And, the 10 year treasury yield inverts

… And, the 10 year treasury yield inverts Yesterday over at Seeking Alpha I wrote about how the Fed is boxed in. The essence of the article is that, while lower rates are good for the housing market, a fuller yield curve inversion adds to the evidence that a recession may take place first, unless the Fed completely reverses course and starts cutting interest rates very soon. Please click on over and read the whole article. Not only should it be...

Read More »A couple of nuggets of good economic news

A couple of nuggets of good economic news Sometimes there is almost no economic news at all. This isn’t one of those times. Because there have been increasingly ominous signs among the long leading indicators, that have been spilling over into the short leading indicators, suddenly there are a lot of signs and portents to look at. A lot less about jobs and wages that I keep exclusively here. So, once again I got waylaid preparing a long piece for...

Read More »No More Fed Rate Hikes in 2019…

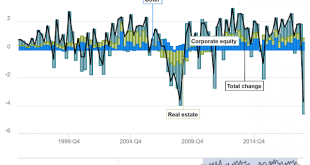

No More Fed Rate Hikes in 2019… The fundamentals are “sound”?: PICTURE = 1000 WORDS

Read More »The widened Panama Canal is disrupting internal US transportation patterns

by New Deal democrat The widened Panama Canal is disrupting internal US transportation patterns The newly-widened Panama Canal opened to traffic in late 2016. Since then, there have been several ongoing disruptions in how goods are transported from suppliers in Asia to their ultimate markets in the US, including affects on seaports, trucking, and rail. This post is up at Seeking Alpha. As usual, clicking over and reading should be educational for you,...

Read More »Introductory Econ Textbooks: A Different Take on the Issues

Introductory Econ Textbooks: A Different Take on the Issues My eyes were drawn to Timothy Taylor’s gloss on Greg Mankiw’s ruminations on the life of an econ textbook author. As such an animal myself (Microeconomics and Macroeconomics: A Fresh Start), I’ve thought about many of the same questions. Differently. Issue #1: How do you teach the introductory economics courses if you have a dissenting perspective? Mankiw lays out three alternatives,...

Read More »Tax the Rich

Dylan Matthews has a typically excellent explainer about taxing the rich. Just click the link. I have one thought. Matthews is soft on capital income. Matthews wrote Saez and Diamond also argued that capital income — income from things like capital gains, corporate profits, dividends, etc. — should be taxed, which broke with previous models of optimal tax theory. (Our current capital gains top rate is 23.8 percent.) Those models had suggested the...

Read More »A Small Anecdote about Alan Krueger

A Small Anecdote about Alan Krueger It was back at the beginning of the 1990s, and I was putting together a panel on NAFTA for the ASSA meetings. This would be URPE’s big plenary at the event, and, among others, I was able to enlist Cuauhtémoc Cárdenas, a leader of uncommon integrity and seriousness of purpose whose victory in the 1988 Mexican presidential election was overturned through blatant fraud. I wanted someone of stature to present the case...

Read More » Heterodox

Heterodox