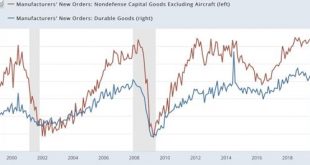

The quick and dirty leading indicator watch has been stagnant for 18+ months [Note: I’ve been working on my “what leads consumer spending” opus, and as often happens, I don’t want to publish anything until I’m sure I’ve got something good – which means lots more research and saved graphs — and nothing whatsoever published! I owe you something for today, so here’s a little nugget ….] If you want a “quick and dirty” forecast for the economy over the next 4...

Read More »Consumer spending leads employment — but what leads consumer spending?

Consumer spending leads employment — but what leads consumer spending? One relationship I have consistently flogged for the past decade is that consumer spending leads employment. That’s still true. Here is one of the graphs on that score going back over 50 years, the YoY% change, averaged quarterly, in real aggregate payrolls (blue) vs. real retail sales (red): 1965-90: 1991-2019: It is absolutely crystal clear that sales have consistently led total...

Read More »Martin Weitzman RIP

Martin Weitzman RIP Born on April Fool’s Day in 1942, Martin Weitzman died yesterday on August 27, 2019 at age 77. Several of us here had long advocated that he share the first Nobel Prize to be given for environmental economics. That award seems to have been given last fall, but only William Nordhaus got it for environmental while Paul Romer shared the prize for endogenous growth theory. Mary missed out unfortunately, even though many of us think...

Read More »Short leading indicators show slowdown, not recession (for now anyway)

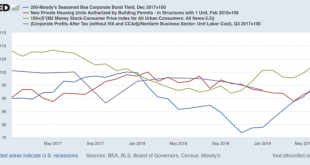

Short leading indicators show slowdown, not recession (for now anyway) Amount 10 days ago, I wrote that backward revisions to adjusted NIPA corporate profits meant the long leading indicators were more negative than originally believed one year ago. Which means that watching the short leading indicators for signs of rolling over became more important. I took a comprehensive look at the short leading indicators late last week. This post is up at Seeking...

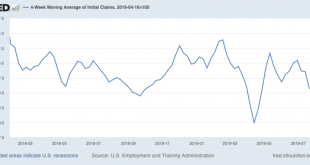

Read More »An extended look at jobless claims, and a note about payrolls

(Dan here…better late than not) by New Deal democrat An extended look at jobless claims, and a note about payrolls Let’s take an extended look at jobless claims, with a side note about payrolls. First, I have started to monitor initial jobless claims to see if there are any signs of stress. My two thresholds are:1. If the four week average on claims is more than 10% above its expansion low. 2. If the YoY% change in the monthly average turns higher.Here’s...

Read More »Digital Sales Tax v. Tariffs on French Wine

Digital Sales Tax v. Tariffs on French Wine Even before Donald Trump departed for the G7 in Biarritz France, he threatened another trade war this time with the host country over the digital sales tax: U.S. President Donald Trump on Friday reiterated criticism of a French proposal to levy a tax aimed at big U.S. technology companies and threatened again to retaliate by taxing French wine. Speaking to reporters at the White House before leaving for a...

Read More »Not doomed yet v.2.0: beware recession porn

Not doomed yet v.2.0: beware recession porn Way back when I first started writing online almost 15 years ago, my very first post on Daily Kos was a little note called “Not Doomed Yet.” It was pretty pathetic compared with the standards of my writing since the Great Recession, but the point of it was, back in 2005, that the conditions necessary for an economic downturn hadn’t quite happened yet. Needless to say, it went nowhere. To the contrary, my big...

Read More »Record Income Taxes?

Record Income Taxes? I should read more posts from Kevin Drum: The Yahoo News reporter comes close to explaining what happened by noting that there were more returns in 2018 than 2017. As you might guess, this happens every year as the US population increases. So let’s take a look at personal income tax receipts adjusted for inflation and population growth … In reality, income tax receipts were down 2.6 percent in 2018 compared to 2017. What this means,...

Read More »Why the revised Q2 GDP report next week may be the most important release in 10 years

by New Deal democrat Why the revised Q2 GDP report next week may be the most important release in 10 years Last Thursday there were major backward revisions to unit labor costs. Since corporate profits deflated by unit labor costs are a long leading indicator, this had a big negative effect on the forecast for the next six months or so. Corporate profits for Q2 of this year will be released next week as part of the first revision of the GDP report, and...

Read More »Cheerleading for Austerity

Cheerleading for Austerity Not content to follow a news strategy that maximizes Trump’s prospects for re-election, the New York Times leads today with a story that combines economic illiteracy and reactionary scaremongering in a preview of what we’re likely to see in the 2020 presidential race. “Budget Deficit Is Set to Surge Past $1 Trillion” screams the headline, and the article throws around a mix of dollar estimates and vague statements about...

Read More » Heterodox

Heterodox