May industrial production: meh Industrial production is the ultimate coincident indicator. It is almost invariably the number that determines economic peaks and troughs. In May it declined -0.1%. While that obviously isn’t a positive, it does nothing to suggest any sort of change of trend: and is in line with any number of similar monthly numbers during the expansion. In this second graph I’ve broken it down into manufacturing (blue, left scale)...

Read More »May retail sales come in strong

May retail sales come in strong Real retail sales for May came in strong, up +0.6% just in the month: As the graph shows, this is on trend for the entirety of this expansion, and is also a new high, surpassing that of last winter. Per capita real retail sales also made a new high, an indicator that the expansion is likely to continue at least one more year: Finally, the YoY% growth in real retail sales has also been increasing:...

Read More »Chewing over the message of online job postings

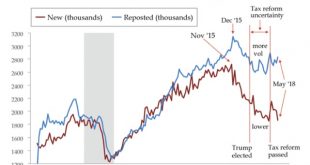

Chewing over the message of online job postings Here’s an interesting graph I came across yesterday. It’s from the Conference Board. What it does is track the number of job postings online, and breaks them down between first postings and repeat postings: Let me say first of all that it is of limited use. The data only goes back to 2005, so there isn’t much history — heck, online job postings didn’t even *exist* until the end of the 1990s! Further,...

Read More »Is Strengthening Labor Good for Development?

Is Strengthening Labor Good for Development? Servaas Storm, who’s always worth reading, has posted on the INET website a summary of a new working paper he coauthored. This issue goes way back with me—I first started looking into and writing about the labor rights/wage/trade/development nexus back in the 1980s. Working on my own, I had a lot of false starts, and I’m happy to see others digging much more deeply today. I won’t comment on the substance of...

Read More »Gas- and housing-powered inflation mean real wages are going nowhere

Gas- and housing-powered inflation mean real wages are going nowhere This morning consumer price inflation for May was reported at +0.2%. YoY inflation was 2.8%. This is tied for the highest in six years (blue): The cause of the increase was primarily twofold — and neither one reflective of wage inflation. First, gas prices have increased by over 20% in the past year (red, right scale above). Second, the costs for shelter (housing) are picking up...

Read More »The Singapore Deal

The Singapore Deal I have refused to forecast what two unpredictable leaders will do, and I shall continue that, other than to say I do not believe North Korea will denuclearize. Otherwise, well, the written deal was mostly aspirations while there seem to be disagreements about the verbal deals. DPRK says US has agreed to lift sanctions but US says no. As it is, at least it happened and there will be more talk, according to the paper agreement. As...

Read More »Update: wholesalers’ sales and inventories — it’s all good

Update: wholesalers’ sales and inventories — it’s all good Another slow start to the data this week, so let’s take a look at relationship I haven’t updated in awhile. Total sales in the economy are broken up into three categories: manufacturers’, wholesalers’, and retailers’. We’ll get retail sales, the biggest component of the three, later this week. But wholesalers’ sales and inventories were released last week, and are a useful coincident...

Read More »Backstabbing Over Cows

Backstabbing Over Cow What is it with cows? I mean their flatulence does add to global warming, but they seem so benign, chewing their cud while producing milk and meat. Why is it that national leaders get into fits of backstabbing over them, or especially over all that milk they produce? Well, of course, that is it; they produce a lot of it, and a variety of products come from the milk, which sometimes markets do not want as much of as some of the...

Read More »A comment on Ballance

(Dan here…lifted from Robert’s Stochastic Thoughts.) by Robert Waldmann In a generally good article on how Trump got nothing out of Kim in Singapore, David Nakamura, Philip Rucker, Anna Fifield, and Anne Gearan make a false claims “Deals reached between Washington and Pyongyang under Presidents Bill Clinton, George W. Bush and Barack Obama collapsed after North Korea conducted additional missile and nuclear tests.” This implies in particular that the...

Read More »Robert J. Samuelson Also Exaggerates Social Security Problems

Robert J. Samuelson Also Exaggerates Social Security Problems Not really a surprise, after all, it is Monday, and RJS has been at this for quite a long time at his post at WaPo. But the recent release of the Trustees’ Report has not only gotten the Associated Press all bent out and shrieking “insolvency,” but I think with the push coming from the recent massive tax cuts that are swelling the budget deficit, the usual old gang of “cut the entitlements!”...

Read More » Heterodox

Heterodox