by Steve Roth What Causes Recessions? A Physicists’ Complex Systems Model I received some very interesting comments from Yaneer Bar-Yam to my recent Evonomics post— “Capital’s Share of Income is Far Higher than You Think.” He pointed me to his very interesting paper, “Preliminary steps toward a universal economic dynamics for monetary and fiscal policy.” I’m using this space to reply with with some stuff that can’t display in that comments space. I...

Read More »The disastrous German Emperor who was a doppelganger to Donald Trump: Kaiser Wilhelm

The disastrous German Emperor who was a doppelganger to Donald Trump: Kaiser Wilhelm You know the drill. It’s Sunday, so I write about whatever else is on my mind. I am presently reading Miranda Carter’s “George, Nicholas, and Wilhelm,” her 2009 biography of the three grandchildren of Queen Victoria who were respectively, the King of England, Tsar of Russia, and Kaiser of Germany at the time of the outbreak of World War 1. I was gobsmacked by her...

Read More »The Wage[s]-Lump Doctrine — still dogma after all these years

The Wage[s]-Lump Doctrine — still dogma after all these years “The wage-fund doctrine was the quintessential product of what Marx termed vulgar political economy; a dogma concealing real economic relations, on the one hand, and justifying them, on the other. It was a transparent effort to disarm the working-class movement, and an attempt (largely successful) to rally public opinion behind bourgeois resistance to the demands of working people for a...

Read More »Sanction Trump not Bourbon

This post “America’s allies should respond to steel tariffs with targeted sanctions on the Trump Organization” by Matthew Yglesias is brilliant (even though he is mainly agreeing with the prior brilliant article by Scott Gilmore “Trade sanctions against America won’t work. Sanctioning Trump himself might.” The proposal is so brilliant and the case for it so clear, that, I think, each title is enough to convey the idea. Yglesias elaborates while quoting...

Read More »Brief JOLTS update

Brief JOLTS update I’m still traveling, so this will be a quick update. In re yesterday’s JOLTS report (June 7), the main take seems to be that job openings were higher than the total number of unemployed, so presumably they could all be hired and we’d have actual full employment next month, right? I don’t think so. Month after month, hires have totaled considerably fewer than openings for several years. If full employment were so close, why wouldn’t...

Read More »AP Exaggerates Social Security Problems

AP Exaggerates Social Security Problems Dean Baker at Beat-the-Press has pointed out (sorry, not able to link to it) that Associated Press put out a tweet that presents an essentially hysterical story about future prospects for Social Security following the recent release of the Trustees. This report says that as of 2026 Medicare and as of 2034 Social Security will face a “shortfall.” However, the AP tweeted that what they face is “insolvency.” ...

Read More »SOCIAL SECURITY TRUSTEES REPORT

by Dale Coberly SOCIAL SECURITY TRUSTEES REPORT: There is yet time, brother. But not much. The Social Security Trustees have issued their annual report. It is not much changed from last year. In fact it is a little better. Last year’s Report projected that by this year Social Security would have reached “short term financial inadequacy.” This year’s projections put that off for another year or possibly two. Short term financial inadequacy means that in...

Read More »The Spillover Effects of Rising U.S. Interest Rates

by Joseph Joyce The Spillover Effects of Rising U.S. Interest Rates U.S. interest rates have been rising, and most likely will continue to do so. The target level of the Federal Funds rate, currently at 1.75%, is expected to be raised at the June meeting of the Federal Open Market Committee. The yield on 10-year U.S. Treasury bonds rose above 3%, then fell as fears of Italy breaking out the Eurozone flared. That decline is likely to be reversed while the...

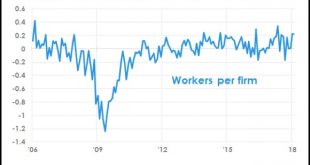

Read More »Wage growth: is the dam finally breaking?

Wage growth: is the dam finally breaking? [Apologies for the light posting: I’ve been traveling, and there isn’t a lot of news this week.] A couple of months ago I wrote that raising wages may have become a “taboo,” i.e., that in some cases employers may be refusing to raising wages, even though it may be costing his money. One of the items I relied upon was from the NFIB, as small business owners presumably are not “monopsonies.” As of February, the...

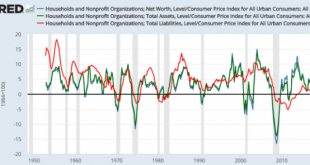

Read More »Capital’s Share of Income Is Way Higher than You Think

By Steve Roth (originally published at Evonomics) The shares of income going to “capital” and “labor” are vexed issues. How much is received for doing work, and how much is unearned “property income”— interest, dividends, etc.? For a long time, economists thought these relative shares stayed roughly unchanged over time. But since the 70s, and especially sincely the latter. And the ownership share of income goes to a small slice of households that own...

Read More » Heterodox

Heterodox