by Peter Dorman (originally published at Econospeak) Fifty Shades of Yellow? Post-Truth Then and Now Simon Wren-Lewis can’t take it anymore. I’ve just read his fulminations on the blatant dishonesty of right wing media outlets in the US and the UK, untethered to any residual professional attachment to standards of evidence and nakedly in the service of political ideologues. He’ll get no argument from me about that. But I think his distinction between...

Read More »What’s behind stalled nonsupervisory wage growth?

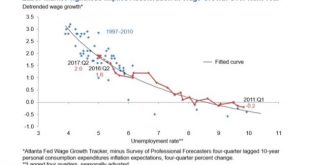

by New Deal democrat What’s behind stalled nonsupervisory wage growth? Wage growth for nonsupervisory workers nominally has been stuck in the +2.3% to +2.5% range (or worse) for three years. Why? Over the weekend I was cleaning out some old graphs, and came across this one from the Atlanta Fed, suggesting that the Phillips Curve (the tradeoff between unemployment and inflation) is very much alive, with the tweak that the amount of wage growth follows a...

Read More »Housing, production, and JOLTS all good news

by New Deal democrat Housing, production, and JOLTS all good news We’ve had a good run of economic news this week. First, in the leading housing sector, both of the most important datapoints made new highs. Single family permits, which are just as leading as permits overall, but much less volatile, made yet another post-recession high. Further, the three month rolling average of housing starts, which are more volatile and a little less leading, but...

Read More »It Takes “Alternative Math” to Claim That Redistribution Is Futile

Via Economists View (some of the comments are worth review as Deirdre McCloskey comments). Also see below Peter Dorman’s Review of Economism: Bad Economics and the Rise of Inequality by James Kwak at Econospeak. Adam M. Finkel at RegBlog: It Takes “Alternative Math” to Claim That Redistribution Is Futile: The unequal distribution of costs and benefits across society is one of the hottest topics in the regulatory arena—and one that, regretfully, has sparked...

Read More »The Battle for Healthcare in the US

In 2026, an estimated 52 million would be uninsured in the US, a dramatic reversal from the 2016 uninsured count of 28/29 million. Pretty much, the Republicans will put healthcare back to the way it was pre-2014 if Paul Ryan’s bill is passed by Congress and Donald signs the bill in its present form. - By 2018, 14 million could be uninsured with many of the uninsured practicing the tyranny of a minority, as John S. Mill might call it, upon the rest of the...

Read More »Where Should We Put Economic Empiricism on the Hubris-Humility Spectrum?

by Peter Dorman (originally published at Econospeak) Where Should We Put Economic Empiricism on the Hubris-Humility Spectrum? A bit of a kerfuffle has broken out over the claim that, as economics gets more empirical, it also gets more reliable. Russ Roberts says that, in the name of empiricism, economists are trotting out contested results to adjudicate questions that are vastly more complicated than their methods can allow for, and that they should acquire a...

Read More »The Budget

Via Econospeak from Sandwichman:

Read More »Should The Complacent Class Be Called The Fearful Class?

by Barkley Rosser (originally from Econospeak) Should The Complacent Class Be Called The Fearful Class? Tyler Cowen has published his most successful book yet, The Complacent Class, now on the Washington Post nonfiction bestseller list and getting reviewed by everybody from The Economist to the New York Times and on. It is the Book de Jour that all are commenting on one way or another. Is America declining because so many of its people have become...

Read More »Trumpcare Saves Social Security By Killing People!

by Barkley Rosser (originally from Econospeak) Trumpcare Saves Social Security By Killing People! Yes, there it is in black and white in footnote f on p. 33 of the Congressional Budget Office (CBO) official report on the proposed American Health Care Act, aka Trumpcare. Between now and 2026 spending by the Social Security Administration is projected to decline by $3 billion if Trumpcare passes. This is due to a projected 1 out of 830 people dying who would...

Read More »Measures of underemployment continue to show improvement

by New Deal democrat Measures of underemployment continue to show improvement The unemployment rate, at 4.7%, is generally acknowledged to be decent, although not great. But what of the underemployed? Typically as an economy expands, the U6 (unemployed + underemployed) rate has declined more than the U3 (unemployed only) rate, as shown on the below graph which subtracts U3 from U6, thus leaving us with just the underemployed: As the recovery matures, the...

Read More » Heterodox

Heterodox