by New Deal democrat February jobs report: hitting on all cylinders but wages HEADLINES: +236,000 jobs added U3 unemployment rate down -0.1% from 4.8% to 4.7% U6 underemployment rate down -0.2% from 9.4% to 9.2% Here are the headlines on wages and the chronic heightened underemployment: Wages and participation rates Not in Labor Force, but Want a Job Now: down -142,000 from 5.739 million to 5.597 million Part time for economic reasons: down -136,000 from...

Read More »A quick primer on interest rates and rate hikes

by New Deal democrat A quick primer on interest rates and rate hikes With increasing speculation that the Fed will again raise interest rates this month, I thought I would take a look at how long term rates, and the yield curve, react. As most everybody who follows this stuff knows, in the last 60 years the yield curve has always inverted before the onset of a recession — which presumably means that it narrows before it inverts. But *how* does it...

Read More »The Emerging Market Economies and the Appreciating Dollar

by Joseph Joyce The Emerging Market Economies and the Appreciating Dollar U.S. policymakers are changing gears. First, the Federal Reserve has signaled its intent to raise its policy rate several times this year. Second, some Congressional policymakers are working on a border tax plan that would adversely impact imports. Third, the White House has announced that it intends to spend $1 trillion on infrastructure projects. How all these measures affect the U.S....

Read More »Meanwhile this is still going on during the week….

From Diane Ravitch’s blog: While we’re consumed 24/7 with the Trump/Russia psychodrama, Republicans are quietly, under the cover of darkness and diversion, introducing these new bills in the House: HR 610 Vouchers for Public Education — (The bill also repeals basic nutrition standards for the national school lunch and breakfast programs) HR 899 Terminate the Department of Education HR 785 National Right to Work (aimed at ending unions, including teacher...

Read More »Do “high pressure” low unemployment economies lead to more capital investment?

by New Deal democrat Do “high pressure” low unemployment economies lead to more capitalinvestment? The Atlanta Fed’s Macroblog has an interesting article today on whether a “high pressure” low unemployment economy leads to more capital investment. At least based on surveys, they answer in the negative, with companies pulling out the old chestnut of being unable to find qualified help “(at the wage we want to pay”). But the article reports on one survey only,...

Read More »Larry Summers: genius economist, failure at Psychology 101

by New Deal democrat Larry Summers: genius economist, failure at Psychology 101 One of my recurring themes is how macroeconomic theory, no matter how elegant mathematically, consistently errs because it fails to take into account basic psychology — i.e., how the human animal actually works. A big component of this failure is that humans, like other primates and apparently like just about every other social species, are hard-wired to inflict punishment on...

Read More »Do healthier longevity and better disability benefits explain the long term decline in labor force participation?

by New Deal democrat Do healthier longevity and better disability benefits explain the long term decline in labor force participation? A few weeks ago I took another deep dive into the Labor Force Participation Rate. There are a few loose ends I wanted to clean up (at least partially). One of the most noteworthy things about the LFPR in the long term is that, for men, it has been declining relentlessly at the rate of -0.3% YoY (+/-0.3%) for over 60 years!...

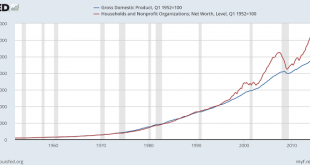

Read More »The “Cutz & Putz” Bezzle, Graphed by FRED

by Sandwichman The “Cutz & Putz” Bezzle, Graphed by FRED anne at Economist’s View has retrieved a FRED graph that perfectly illustrates the divergence, since the mid-1990s of net worth from GDP: The empty spaces between the red line and the blue line that open up after around 1995 is what John Kenneth Galbraith called “the bezzle” — summarized by John Kay as “that increment to wealth that occurs during the magic interval when a confidence trickster knows...

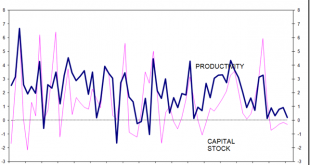

Read More »Productivity and Capital Stock Per Employee

Last week Timothy Taylor at Convertible Economist did a very good post on gross vs net capital spending. http://conversableeconomist.blogspot.com/2017/02/declining-us-investment-gross-and-net. He showed that in recent years the more rapid growth of high tech spending has had an unanticipated impact. The new high tech equipment has a much shorter life span that more traditional equipment. Consequently, more and more of gross capital spending is just...

Read More »Wages and household income vs. housing

by New Deal democrat Wages and household income vs. housing: which leads which? Sometimes I look into a relationship that doesn’t quite pan out, but it’s still useful to flesh out the process. That’s the story of real wage growth vs. housing. In the last few months I ‘ve pointed out that real wage growth has been slowing. In January, it went negative YoY. Since, all else being equal, having less money to save for a downpayment, or to pay the montly mortgage...

Read More » Heterodox

Heterodox