In this series we explore marketing farm fresh goods in the litany of different ways as a direct consumer edibles farmer. Many types of farms exist within the framework of directly edible, from market gardens, to 100 acre California avocado fields, dairy barns, hen houses, and multiple large monocrop “people food” producers. Direct to Consumer is exactly what it implies. A farmer seeds, grows, reaps or milks, slaughters and packs food and then...

Read More »April Construction Spending Up 2%, March Spend Revised

RJS: MarketWatch 666 Summary: Construction Spending Up 0.2% on Higher Prices in April, after March Spending was Revised 0.6% Higher The Census Bureau’s report on construction spending for April (pdf) estimated the month’s seasonally adjusted construction spending was at a $1,744.8 billion annual rate during the month. Up 0.2 percent (±0.8 percent)* from the revised March annual spending rate of $1,740.6 billion, and 12.3 percent (±1.3...

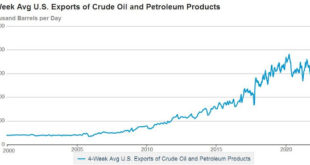

Read More »Supply and Distribution Data from EIA Pretty much the same

RJS: Focus on Fracking Summary: US oil supplies at a 17 ½ year low with SPR at a 34½ year low; gasoline exports at a 3½ year high; 4 weeks of total oil + product exports at a record high and leads to total oil + products supply at a 13½ year low total oil + product supplies at a 13½ year low after record exports.. The Latest US Oil Supply and Disposition Data from the EIA US oil data from the US Energy Information Administration for the...

Read More »Biden Visits Saudi Arabia

Biden Kowtows To Saudi Arabia Apparently, President Biden will be visiting Riyadh as part of his forthcoming Middle East tour. The report on this coincides with an apparent end to negative comments about the nation’s Crown Prince Mohammed bin Salman (MbS), whom the CIA has accused of having ordered the execution and chopping up of journalist Jamal Khashoggi. It must be admitted that MbS has made some progressive moves, allowing women to drive and...

Read More »In The Throes Of Change

After all this time, and even with the benefit of history, the causes of World War One (WWI) are still a matter of discussion amongst scholars. For scholars living then to have understood what the causes were, they would have needed to have known an awful lot about all that was going on at the time; which would have been difficult. They would also have needed to cross the philosophical Rubicon and not have allowed long-held beliefs and norms to...

Read More »Ways Of Dying

Ways Of Dying The Economist in each issue has an obituary on its final page. The one for May 21 was of Saotome Katsumoto of Tokyo, Japan, whom I had never heard of who just died at age 90. Apparently, he had been the main person documenting details of the event that involved more people dying at a single time in a single place in world history, although the obit did not specifically point that out. It did note that the event did involve more...

Read More »May 29th Planted Progress, Caught Up To Averages

The USDA Planted Progress report has just been released today and the progress report now puts 2022 plantings at around the five year averages. Sugar beets are continuing to plant behind average time-frames as Minnesota and North Dakota struggle with weather delays. Per the USDA report, corn, soybeans and other silage are looking about in target. Wheat condition continues to be an issues year over year for the winter crop, but the headings are...

Read More »The Cultural Marxism – Conservative Christian Consensus on America’s Culture of Violence

The Cultural Marxism – Conservative Christian Consensus on America’s Culture of Violence Gun Culture and the American Nightmare of Violence by Henry Giroux, January 10, 2016: Mass shootings have become routine in the United States and speak to a society that relies on violence to feed the coffers of the merchants of death. Given the profits made by arms manufacturers, the defense industry, gun dealers and the lobbyists who represent them in...

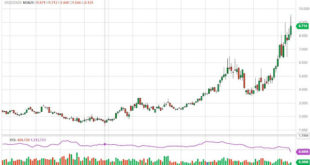

Read More »Natural gas prices hit 13½ year high, Oil Exports at 26 Month High . . .

RJS: Focus on Fracking Summary: natural gas prices hit 13½ year high after a six-fold increase in less than 2 years; US oil exports at a 26 month high even with SPR at a 34½ year low & US oil supplies at a 17 year low; total oil + products inventories at a new 13½ year low even with highest refinery utilization rate since 2019 & greatest refinery throughput in 11 months; rigs down first time in 31 weeks Natural gas prices hit 13½ year...

Read More »An Army of All-American Paramilitary Death-Squad Soloists

An Army of All-American Paramilitary Death-Squad Soloists In their 2014 Super Bowl ad (declined by the NFL), Daniel Defense, the AR-15 merchants of death, EXPLICITLY tied a ‘paramilitary army-of-one’ motif to its role as a military-industrial complex supplier. A man arrives home — presumably from a tour of duty — and enters the house past a conspicuously displayed, framed photo of him in his Marine uniform. Behind that photo is another photo...

Read More » Heterodox

Heterodox