RJS: Focus on Fracking Summary: US oil exports at a 26 month high with SPR at a 34½ year low & US oil supplies at a 17 year low; total oil + products inventories at a 13½ year low even with highest refinery utilization rate since 2019, greatest refinery throughput in 11 months… The Latest US Oil Supply and Disposition Data from the EIA US oil data from the US Energy Information Administration for the week ending May 20th indicated that...

Read More »Households are getting much more overextended

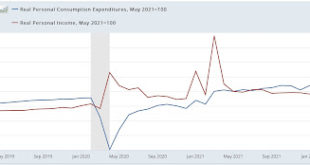

Real income and – especially – spending increase in April, but households are getting much more overextended by NewDealdemocrat In April nominal personal income rose 0.4%, and spending rose 0.9%. March’s spending was revised up from 1.1% to 1.4%. In more good news, the personal consumption deflator, i.e., the relevant measure of inflation, rose only 0.2%, so real income rose 0.2%, and real personal spending rose 0.7%. So far, so good. While...

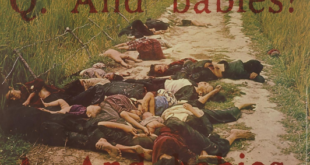

Read More »And Babies?

And Babies? Uvalde = My Lai. This is not hyperbole. War crimes are an inevitable byproduct of war. Mass shootings are an inevitable byproduct of militarism and a militarized culture. The same political process that led to and perpetuated the war in Vietnam continues to perpetuate the slaughter of innocents in American schools, supermarkets, nightclubs, subways, and synagogues. It is not just the “extreme right” doing this. It is the...

Read More »May 23rd Planted Progress Report

Planters have been running all out over the last few weeks as the envelope to get spring planted before summer heat and drought sets in even further. We will start with what the market was expecting yesterday and the results of the USDA Planted Progress Report as of yesterday. Discussed at length on yesterday’s Go Farm Yourself spaces meeting via Ag Twitter, the hosts, commodity traders, and the listeners, mostly agriculture producers, farmers,...

Read More »Outlawing Abortion, It is a costly Endeavor

Boston Public Radio May 19th episode held a discussion of the consequences for the nation when abortion is outlawed. The guest was Jonathan Gruber, the Ford Professor of Economics at MIT. He was involved with the ACA and the Mass health insurance system. Getting right to it: Based on studies: Women who wanted an abortion but could not get one are more likely to die in child birth, have worse mental health outcomes and a huge increase in...

Read More »Age of Warfare is Changing

Not quite star wars yet. The past and old age of warfare is changing as we watch the conflict in the Ukraine between one ill equipped small defender and the more modern equipped large attacker. It is only because of NATO and the US equipping Ukraine has the stubborn resistance held up. The lessons to be learned from watching the Ukrainians beat the Russians is something which the US should be paying attention too. While our military may not be as...

Read More »Expanding BRICS?

Expanding BRICS? Chinese paramount leader Xi Jinping has called for the BRICS group to expand to include Kazakhstan, Uzbekistan, Thailand, Indonesia, Argentina, Nigeria, Senegal, Egypt, and Saudi Arabia. The original group, suggested by the research department at Goldman Sachs in 2001 as a group to leading future world economic growth was Brazil, Russia, India, and China, who then decided to officially form a group, which then added South Africa...

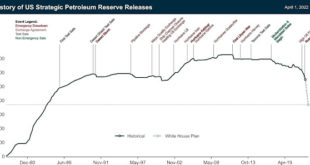

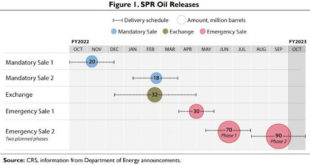

Read More »SPR and Supplies Low, Total Oil and Products the Same

RJS, Focus on Fracking Summary: Strategic Petroleum Reserve at a 34 year low, US oil supplies at a 17 year low, total oil + products inventories at a 13½ year low The Latest US Oil Supply and Disposition Data from the EIA US oil data from the US Energy Information Administration for the week ending May 13th indicated that after a jump in our oil exports, another oil withdrawal from the SPR, and an increase in demand that could not be...

Read More »Weekly Indicators for May 16 – 20

– by New Deal democrat Weekly Indicators for May 16 – 20 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. The yield curve tightened some more this week (but did not invert). Meanwhile, I am seeing a fair amount of commentary suggesting that a recession is imminent. This is jumping the gun, and is mainly relying on the downturn in the stock market as well as the increase in gas prices. These are short leading indicators,...

Read More »Review of “The Prophet” by Isaac Deutcher

“Until we are done with the ironies of history (because they will never be done with us), the image of Trotsky will not dissipate.”~Christopher HitchensI’ve had a lifelong fascination with socialism, communism and the Cold War. This probably springs from having grown up during the Cold War at nuclear ground zero for World War III. Also contributing was that I came of age near the end of the Vietnam War, a proxy war between the US and the USSR into...

Read More » Heterodox

Heterodox