if long-term interest rate r is less than the trend growth rate of GDP g Yesterday (technically very early today) I promised a post on why long-term Treasury interest rates are very important. In particular it is very important if the long-term interest rate r is less than the trend growth rate of GDP g. If r<g then the public sector intertemporal budget constraint is not binding. This means that public policy is not even Pareto efficient. In...

Read More »US 10 Year Interest Rates

Why have they increased so much. The US Treasury constant maturity 10-year interest rate has increased dramatically since the FED started fighting inflation (after falling dramatically during the Covid 19 epidemic). The increase is not unusual — Monetary policy effects GDP and employment through medium and long term interest rates, especially including the interest rate on 30 year mortgages. But I think it should be surprising. Before going...

Read More »Bar semiconductor producers who receive government subsidies from stock buybacks

Subscriber to Reich’s column so I steal a commentary now and then. Funds given to Semiconductor corporations are being used to buy back stocks rather than invest in new capabilities and facilities. In 2010, we took hits on pricing by as much as a 20% increase in pricing. A take it or leave it proposal. Sure there was increased demand which has nothing to do with cost. Indeed, the price increase did similar to what Robert discusses below....

Read More »Drugs that cost money and save money

Big Pharma has become a familiar whipping boy in the debate over healthcare costs. CAR-T therapies to treat certain cancers, for example, can cost between half a million and a million dollars for a single treatment course. What’s the prospect of a cancer cure worth to you?GLP-1 receptor agonists like semaglutide (Ozempic, Wegovy) and tirzepatide (Mounjaro, Zepbound) are transforming the lives of obese patients. For most people, these drugs will have...

Read More »US for-profit healthcare system still ranks dead last

It should come as no surprise to regular AB readers that the US for-profit healthcare system is a disaster for everyone except the executives and stock-holders. Here’s yet another confirmation:“A report out Thursday shows that the United States’ for-profit healthcare system still ranks dead last among peer nations on key metrics, including access to care and health outcomes such as life expectancy at birth. “The new analysis from the...

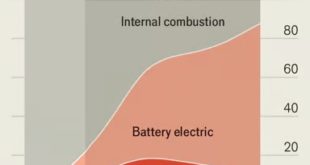

Read More »The hype for hybrid cars will not last

I am reading this short piece and wondering how many people will commit to full electric? I do not see this occurring for a while. The batteries just do not last long enough for many people to accept electric vehicles today. Hybrids are going to be around for a while till the technology catches up. I am thinking 5 years out before there is a battery which will handle a large load for a long period of time before needing recharge. How fast can you...

Read More »Jim, this is nothing like before. These guys are ahead of us.

These guys are ahead of us. What Scared Ford’s CEO in China, WSJ Jim Farley had just returned from China. What the Ford Motor chief executive found during the May visit made him anxious: The local automakers were pulling away in the electric-vehicle race. In an early-morning call with fellow board member John Thornton, an exasperated Farley unloaded. The Chinese carmakers are moving at light speed, he told Thornton, a former Goldman...

Read More »Riding the Northern Explorer or How to Run a Passenger Railroad.

I spent much time over my 50 years working in foreign countries. I needed something to do so I would sight see on weekends and in the early evenings. The Germans gave me a car so I would take off to visit castles, etc. Ended up in Czech Republic, off to Prague on a Sunday. The Germans paid for my gasoline and meals as they sent me to those countries. Cut over to Strausberg France, Zurich. The same in China, Thailand, Philippines, Malaysia. I...

Read More »U.S. Defense Spending in Historical and International Context

The U.S. economy has been growing faster than military spending, so defense spending as a share of GDP has been decreasing. While the $dollars spent are increasing, the percentage of GDP Defense Spending takes up has been decreasing since 1952. Perhaps a better question is do we really need to spend this much on Defense? Perhaps wiser and defined expenditures may be in order? U.S. Defense Spending in Historical and International Context...

Read More »Immigrant Deportations During the Trump Administration as Compared to Previous Administrations

by Tara Watson Williams College EconoFact “Relative to the late Bush and early Obama eras, the Trump administration removed a modest number of immigrants from the nation’s interior.” One would not think such was true. Apparently and as in other instances, the numbers say differently. Keep in mind this report is from 2021. It does give detail on the differences between Customs and Border Patrol (CBP) and Customs Enforcement (ICE). Immigrant...

Read More » Heterodox

Heterodox