Commenter Fred Dobbs had much of this in the Open Thread, June 19th at 9:33AM. I highjacked it, added more up to date detail, and an opinion. I did find it interesting. Somewhere there is a print(s) and BOM for this structure along with specifications (which were alluded to as BD vs BC steel) for materials along with a comparison of structural strength necessary. The Chinese did not build this on a whim. And why Chinese steel and components?...

Read More »May housing permits and starts continue down from recent peak

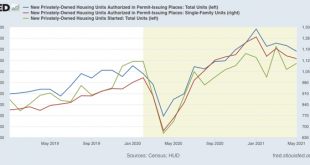

May housing permits and starts continue down from recent peak In May housing permits (blue in the graph below), including the least volatile single-family permits (red, right scale), continued to decline from their January peak. Meanwhile, the more volatile and slightly lagging housing starts (green) increased, but remained below their March peak: The level of construction activity as high as or higher than its pre-pandemic peak is continuing....

Read More »The decline in new jobless claims stalls, as the “delta” variant is ready to strike the unvaccinated States

The decline in new jobless claims stalls, as the “delta” variant is ready to strike the unvaccinated States New jobless claims continue to be the most important weekly economic data point, as increasing numbers of vaccinated people and outdoor activities have led to an abatement of the pandemic, with both new infections and deaths at their lowest point since the onset of the pandemic in March 2020. I’ll have more to say on the intersection of the...

Read More »Why Are Infrastructure Costs So High In The US?

Why Are Infrastructure Costs So High In The US? Sorry, but anybody wanting some simple answer on this one, especially an ideologically neat one, sorry, there is not one, Indeed, on this important issue, there is a large problem, but not remotely a clear answer regarding why there is this large and important problem. For numbers on this problem, I draw on a Washington Post column yesterday by Catherine Rampell. Here are some of the crucial data....

Read More »Hook and Peg

Your money or your life. Highway robbery has been around since. On the high seas, was known as piracy. Been writ that pirates didn’t always even offer the choice. All made for generations of good bedtime reading for youth. And, for mock sword, and bow and arrow, fights. And, really bad movies. Thanks, Howard Pyle, Robert Louis Stevenson, …, and Walt Disney. No thanks, Errol Flynn. These days, it’s neither sword nor bow and arrows, musket nor...

Read More »Industrial production on the verge of exceeding pre-pandemic level

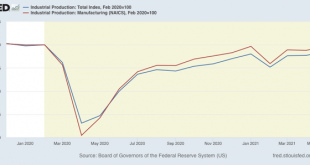

Industrial production on the verge of exceeding pre-pandemic level Industrial production is the King of Coincident Indicators. It is the single datum that most frequently coincides with the NBER determination of the beginning and end of recessions. In May, total production increased +0.8%. Manufacturing production increased +0.9%. Both current readings are the highest since the onset of the pandemic: Figure 1 Total production is only 1.4%...

Read More »Measures of Global Income

by Joseph Joyce Measures of Global Income The difference between the income generated by the domestic production of goods and services and the income received by the residents of a country is the basis of the distinction between Gross Domestic Product (GDP) and Gross National Income (GNI). The latter measure includes net foreign-sourced income, the income domestic residents receive from foreign sources for providing productive resources (such...

Read More »May retail sales decline, but 10%+ gain in retail sales since the onset of the pandemic remains intact

May retail sales decline, but 10%+ gain in retail sales since the onset of the pandemic remains intact [Note: I’ll comment on industrial production in a separate post later]I feel like I could simply repost my retail sales piece from one month ago, because the story is the same: at first glance, May’s retail sales report, like April’s, looks like a big miss, as sales declined -1.3% nominally, and after adjusting for inflation, declined...

Read More »The Cornwall Paradox

The Cornwall Paradox The County of Cornwall has been in the news as the site of the G7 summit, just ended. In today’s Washington Post an article “In Cornwall, a jarring contrast of power and poverty,” by Karla Adam and Loveday Morris, a paradox of this visit is highlighted and brought out, indeed, that Cornwall is one of the poorest places in Great Britain, indeed in Northern Europe more generally, but that it is drawing much attention and some...

Read More »The Zhou Enlai Paradox

The Zhou Enlai Paradox A bit over a half century ago when Henry Kissinger was organizing Richard Nixon’s visit to China, he was largely interacting on this matter with Zhou Enlai (Chou-Enlai in Wade-Giles transliteration). He reported that during their negotiations he asked Zhou what he thought of the French Revolution. Zhou replied that “It is too soon to tell.” This has since been taken as deep insight by Zhou on a deep historical issue, which...

Read More » Heterodox

Heterodox