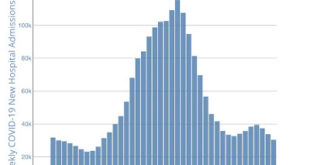

Coronavirus update through October 30, 2023 – by New Deal democrat No important economic news today, but it’s been a while since I took a look at the COVID-19 data, and there is an interesting trend, so let’s have at it! But first, some bad news. The most reliable data for infections for the past year has been from Biobot, which tracked wastewater nationwide. Well, they lost their contract, which was won by a Google subsidiary called...

Read More »Blog Archives

Powell pivots!

What the monetarist zombies have been waiting for for the last 20 months.

Read More »Atlanta Fed

Oops! Down to 1.2% projected for Q4…. Let’s see if the MMT people repost this one … (Tip: don’t hold your breath waiting doesn’t fit the Democrat narrative).On November 1, the initial #GDPNow model nowcast of real GDP growth in Q4 2023 is 1.2%. https://t.co/OnYxN0CQUF #ATLFedResearch Download our EconomyNow app or go to our website for the latest GDPNow nowcast. https://t.co/ISzNblWfFW pic.twitter.com/u9CweBwBaD— Atlanta Fed (@AtlantaFed) November 1, 2023 Hard to see how a few $100B of...

Read More »Socialism vs Capitalism

Socialism vs Capitalism

Read More »No, QE Is Not Costless — Brian Romanchuk

I ran across a couple lame attempts at blaming the U.S. Treasury for not extending the duration of issuance during the pandemic low in yields. This is entirely typical for market commentary — going after fiscal policymakers and ignoring the major culprit, which is the central bank. To the extent that the United States has put itself into an awkward macro stabilisation situation with respect to interest rate expenditures, it is the result of the brain trust at the Federal Reserve.One could...

Read More »Bank of Japan shifts ground – just a little but there is no sign of a major adjustment any time soon — Bill Mitchell

It’s Wednesday and I use this space to write about any number of issues or items that have attracted my interest and which I consider do not require a detailed analysis. The issues discussed may be totally unrelated. Today, I provide my response to yesterday’s decision by the Bank of Japan to vary its Yield Curve Control (YCC) policy, which some commentators are frothing about. The change was very minor and is not a sign that the expansionary position of the Bank is shifting significantly. I...

Read More »Beyond the NAIRU – 7th Godley-Tobin Lecture

The 7th Godley-Tobin Lecture will be given by Antonella Stirati at the Eastern Economic Association meeting next Spring in Boston. The previous lecture by Professor Joseph Stiglitz will be published in the January issue of ROKE.

Read More »Housing and homelessness study tour of London (UK)

[unable to retrieve full-text content]Registration is now open for a housing and homelessness study tour of London (UK) that I’m helping to organize. More information is available here: https://pheedloop.com/form/view/?id=FOR596K0XGYKSXE78

Read More »Mao with money

The October 30 issue of The New Yorker has a piece on Xi’s China called “China’s Age of Malaise.” While the mainstream media continues to promote the idea that China has become a wellspring of creativity and economic competition, the reality is that China is retreating into the rigid, sclerotic political dogmatism that characterized the Mao era and that brought down the Soviet Union. The money grafs:“Early this year, the Party launched a campaign to...

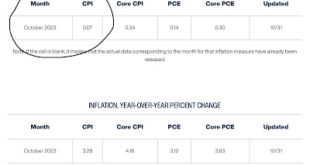

Read More »“Inflation” Now

Cleveland Fed now at 0.07% for October:Projects to less than half their alleged “inflation” target… Meanwhile these psychos want to still appear “hawkish”… ?

Read More » Heterodox

Heterodox