Revisions to Q4 GDP made real final sales worse, a potential portent of near in time recession – by New Deal democrat A month ago, following another blogger, I took a look at real final sales, and real final sales to domestic purchasers, in the GDP – which increased less than 0.5% and just above 0% in Q4, and showed that in the past 60 years, only in the deep slowdowns of 1966 and 1987 were the numbers that low without having been followed...

Read More »Blog Archives

Finance Creates Wealth and Debt.

Defense One — Milley: Don’t Invade Mexico

This is not the Onion. Looks like the military is afraid that the civilians have lost their marbles (they have) in promoting the MICIMATT (Military-Industrial-Congressional-Intelligence-Media-Academia-Think-Tank complex).Defense One[Chairman of the US Joint Chiefs of Staff Gen. Mark] Milley: Don’t Invade Mexico Kevin Baron, Executive Editor of Defense OneSee also at Defense One‘Lower the Rhetoric’ on China, Says Milley

Read More »Climate change, ironically,reduces the heat in the South China Sea

That’s the headline for a piece I published in the Lowy Interpreter. The shorter version Despite noisy sabre-rattling China has allowed other countries to extract oil and gas from disputed parts of the South China Sea That’s because the resource has never been valuable enough to fight over, and will soon be worthless Australia’s decision to go ahead with the purchase of nuclear-powered submarines from the United States and United Kingdom reflects a judgement that China, and...

Read More »My podcast interview with MMT professor Randy Wray.

[embedded content]

Read More »My podcast interview with MMT professor Randy Wray.

L. Randall Wray Senior Scholar, Levy Economics Institute Professor of Economics, Bard College Mark and Melodye Teppola Distinguished Visiting Scholar, Willamette University, for the 2022-23 academic year. Books Understanding Modern Money https://www.amazon.com/Understanding-Modern-Money-Employment-Stability/dp/1845429419 Money for Beginners https://www.politybooks.com/bookdetail?book_slug=9781509554607 Modern Money Theory: A Primer on Macroeconomics for Sovereign Monetary Systems...

Read More »How Market Disruption Drive Innovation

RT — Russian central bank reveals how it braced for Western dollar grab

The Bank of Russia had been preparing for an escalation of Western sanctions since 2014 and was beefing up additional funds as a hedge against future restrictions on its foreign exchange reserves, the regulator revealed on Wednesday.Amid “increasing geopolitical risks” the central bank ramped up investments in assets “that cannot be blocked by unfriendly nations” and transferred part of its reserves to gold, Chinese yuan and foreign currency in cash, the regulator announced in its annual...

Read More »V. Ramanan — Nicholas Kaldor On Monetary Policy And Stability Of Financial Instituitions

Via Eric Tymoigne’s blog post, I came across this quote from Nicholas Kaldor in 1982 (page 13) on stability/solvency of financial institutions, especially relevant in recent times:The Case for Concerted ActionNicholas Kaldor On Monetary Policy And Stability Of Financial InstituitionsV. Ramanan

Read More »Modern Monetary Statistics

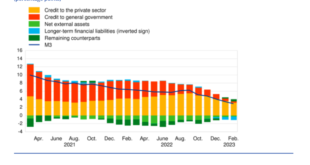

This ECB graph below, showing the interrelation between credit and money in the Euro Area (source) is thoroughly (Post-)Keynesian in nature: Modern Monetary Statistics (MMS). I’ll return to that. First, what does it tell? For some months, a gentle Euro Area ‘liquidity crunch’ has been going on. The yellow and the orange bars are getting smaller meaning that year on year growth rates of ‘M3’ money creating ‘credit’ are declining. Three month flow data are already negative. Loans are...

Read More » Heterodox

Heterodox