I guess I am going to lose some of my writer reputation now as I look at the aspect of how certain “legal” migrants in San Antonio, Texas were treated by the governor in Florida. These people did not sneak into the US. They were granted asylum after presenting themselves to border guards, registered in the system, and released to a shelter. In turn they were scammed by a representative sent by Florida’s Governor DeSantis to go to Massachusetts where...

Read More »A dastardly plot

Infidel753: “A dastardly plot,” Infidel753 Blog While winning a Senate majority increasingly looks out of reach for Republicans, a House majority is distinctly possible. If they get it, they plan to force Democrats to make concessions which would almost certainly include cuts to Social Security and Medicare — possibly by drastically raising the eligibility age, though if they really want to cut spending quickly, it’s hard to see how they could...

Read More »New Deal democrat’s Weekly Indicators for October 10 – 14

Weekly Indicators for October 10 – 14 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. Just about everything looks awful. And one bright spot, consumer spending as measured by Redbook, just got dimmer. Needless to say, if consumer spending rolls over, that’s pretty much the ball game.. You can be brought up to the virtual moment in the ugliness by clicking over and reading, and it will reward...

Read More »Iranian Demonstrations Spread to Oil Workers

Iranian Demonstrations Spread to Oil Workers by Barkey Rosser The death of a Kuidish-Iranian woman not wearing a hijab to cover her hair has led to weeks of demonstrations led by mostly young women especially in the Kurdish parts of Iran. However, they have gained the support of young men as well, despite a severe crackdown by the authorities that has now killed over 100 of the protestors. The latest development that marks this becoming a...

Read More »GM Strikes $69M Deal to Source Nickel and Cobalt for Car batteries

“GM Strikes $69M Deal to Source Nickel and Cobalt from Australia,” DBusiness Magazine, Tim Keenan Like the rest of the big three and other auto manufacturers, GM is preparing to go electric for cars and abandon oil. GM Detroit secured a new source of cost-competitive nickel and cobalt in Australia for its Ultium battery cells. This is coming after negotiating a $69 million investment with Queensland Pacific Metals of Australia. Queensland...

Read More »September real retail sales lay another egg

September real retail sales lay another egg – by New Deal democrat One of my favorite indicators, retail sales, was reported for September this morning, and it came in unchanged. Which means that after factoring in +0.4% inflation in September, real retail sales were down -0.4%. Which is not good, because real retail sales have gone nowhere in 18 months, and have been down every single month since April with the exception of August, and are...

Read More »A Stale Beeveridge Debate

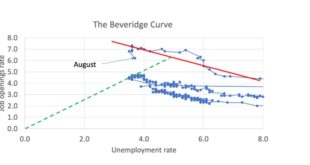

It’s that time again*: we have reached the stage in the business cycle when normally sensible economists are alarmed that the Beveridge curve has shifted up. Paul Krugman is (as usual) on the side of relative reason, but he miss-used the curve in this figure Here he uses the data *and* the assumption that there is a stable Beveridge curve which can be used for medium term forecasting to calculate a level of unemployment consistent with a normal...

Read More »The Republican assault on social insurance continues apace

Republicans have made their desire to cut – or gut – Social Security, Medicare, and Medicaid clear for decades. Jack Fitzpatrick tells us that they are gearing up for another bite at the apple: Social Security and Medicare eligibility changes, spending caps, and safety-net work requirements are among the top priorities for key House Republicans who want to use next year’s debt-limit deadline to extract concessions from Democrats.The four...

Read More »Patagonia: Life Imitates Theory

“Patagonia: Life Imitates Theory,” Econospeak by Peter Dorman When Yvon Chouinard, the founder of Patagonia, completed the transfer of that company’s ownership to an environmental trust fund, it was front-page news across the country. It came as something less than a shock to me, however, because I had described a very similar structure in a paper I wrote a few years ago about “pluralist social ownership”. First, it’s interesting what...

Read More » The Angry Bear

The Angry Bear