First, a twitter thread on war reporting (click through if interested): A thread about how we report supposed victories in war (this one and others), why they dont matter nearly as much as people claim, and how they actually deceive us into understanding what really matters. Partly motivated by this @nytimes headline. pic.twitter.com/oGRK4Niac2— Phillips P. OBrien (@PhillipsPOBrien) March 20, 2022The pictures coming out of Ukraine have played an...

Read More »Mixed Bag; Crude Oil, SPR, Oil and Product Supply, Distillates, etc.

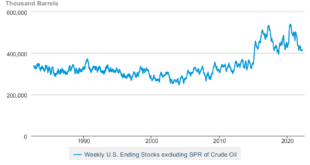

RJS, Focus on Fracking, Commercial crude supply rise as SPR falls to 19½ year low, total oil + products supply at new 95 month low; exports of distillates at a 20-month high after largest drop in domestic demand in 18 months The Latest US Oil Supply and Disposition Data from the EIA US oil data from the US Energy Information Administration for the week ending March 11th indicated that even after a big increase in our oil exports, we...

Read More »Why Is Germany Increasing Defence Spending ?

Recently we have learned that the Russian military is vastly less capable than anyone imagined. Also in three whole weeks Ukrainians have markedly reduced the capabilities of the Russian military. Therefore, naturally many governments (including the German government) have decided they must spend more on their militaries to face the Russian threat. This makes no sense. To deal with Russian Germany needs liquified natural gas terminals and...

Read More »A Recipe for Failure

A government to consist of three coequal branches, the Legislative, the Executive, and the Judicial was chartered in that order by the first three articles of the U.S. Constitution. Three coequal in order to provide checks and balances on one another lest any one of them should become too powerful was the reasoning. Perfectly understandable, given the world of the late 18th. To have foreseen a time when one or more of the branches didn’t believe...

Read More »Housing permits and starts: still an economic positive – for the moment

Housing permits and starts: still an economic positive – for the moment As you know, I consider housing, and in particular single-family housing permits, one of the very best long leading indicators for the economy. In the past year, however, there has been a unique divergence between housing permits and housing starts, necessitating some adjustments. In the past year, permits soared then sank, while starts held much more steady. The explanation...

Read More »Industrial production nowcasts that the economy continues to perform well

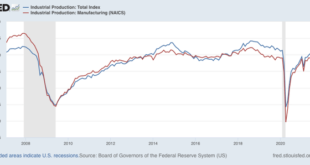

Industrial production nowcasts that the economy continues to perform well Industrial production increased in February by 0.5%, its highest reading ever with the exception of two months in 2014, and the second half of 2018. Manufacturing production increased 1.2%, also its highest ever with the exception of 24 months from late 2006 through early 2008:Of course, considering population and GDP growth in the past 15 years, this is hardly...

Read More »Coronavirus dashboard for March 18: the BA.2 variant behaves just like original Omicron

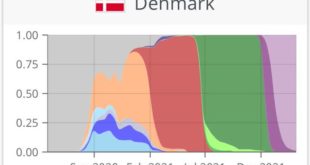

Coronavirus dashboard for March 18: the BA.2 variant behaves just like original Omicron In the last several days, the 7 day average of cases in the US has increased slightly from 30,700 to 32,700. The rate of decline w/w has decelerated to only 10%. Meanwhile, deaths have finally declined to slightly below 1000 at 995. The number of jurisdictions where cases increased week over week has increased to 7 or so in the past several days, compare...

Read More »On that “deep feeling that something is wrong…”

On that “deep feeling that something is wrong…” Georg Simmel called it “a faint sense of tension and vague longing” connected with the modern preponderance of means over ends. What Simmel calls estrangement [We] feel as if the whole meaning of our existence were so remote that we are unable to locate it and are constantly in danger of moving away from rather than closer to it. Furthermore, it is as if the meaning of life clearly confronted...

Read More »On Education

Time was when being able to read and write was good enough to meet the demands of industry. After a while, workers needed to have an eighth grade, then a high school education to be of much value. That was then, back before the world became complicated. Today, in order to understand what is going on at work, workers need a good foundation in mathematics and science, and to be able to read and understand fairly complicated instructions in order to...

Read More » The Angry Bear

The Angry Bear