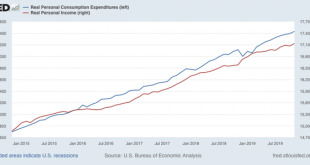

The consumer vs. producer divergence widens at year end My economic theme for about the past half year has been the contrast between the floundering producer sector vs. the decent consumer sector. With two of the last important reports of the year out this morning, that divergence has been highlighted. First, the good news: real personal income rose +0.4% in November, and real personal spending rose +0.3%. Here’s a look at the past five years: Figure...

Read More »Political leanings through time for birth cohorts

Political leanings through time for birth cohorts A chart on “political preferences by generation” from Pew Research has been making the rounds in the past few days. Here it is: Figure 1 This chart tells the simplistic story that older generations are more conservative than young ones. It’s considerably misleading. After all, how did the democrats ever win if older generations, who vote in higher percentages, are always more conservative than younger...

Read More »Open thread Dec. 20, 2019

The Afghanistan War

The Afghanistan War (posted by run75441) The Washington Post has over the last 7 days published a detailed account based on many secret documents they have spent years obtaining to provide an accurate account of what has happened during what is now the longest war the US has been engaged in. It is an impressive account, which I have tried to follow, although with finishing a semester I did not read every word of it. But it is a serious and important...

Read More »The oncoming generational UK and US political tsunamis

The oncoming generational UK and US political tsunamis No big economic news today, so let me put up a couple of striking charts about the UK election last week. First, the change in party results in 2019 (left) vs. 2017 (right) in millions: Tories: 13.9. 13.6 Labour: 10.3. 12.9 (a 20% decline!) Lib Dems: 3.7 2.4 SNP: 1.2 1.0 Total turnout was down 1.5%. As should be obvious, as the accompanying commentary said, the Tories didn’t win; Labour...

Read More »The field was rigid and closed until Mark Thoma’s Economist’s View opened the debate to all comers

Noah Smith’s The End of Econ Blogging’s Golden Age, Bloomberg Opinion. December 17, 2019. “If someone asked you to name the greatest economics blogger of all time, you might name Paul Krugman, or my Bloomberg Opinion colleague Tyler Cowen. But there’s a third name that deserves to be on that short list: Mark Thoma, an economics professor at the University of Oregon. On Friday, Thoma announced a well-deserved retirement. But the changes his blog made in...

Read More »The Art of Conservative Persuasion, Don Boudreaux Edition:

Being an economist can be frustrating. Most people do not understand how markets work, and economists spend a good deal of time arguing against bad policy ideas that appeal to non-economists, and for good ideas that do not appeal to common-sense. This can sometimes feel like pushing rocks uphill. Plus it can lead people to suspect that you are carrying water for the corporate rich, which is unpleasant. But what is it like to be an extreme right-wing...

Read More »Live-blogging the Fifteenth Amendment: December 17, 1868

Live-blogging the Fifteenth Amendment: December 17, 1868 In the Senate, Senators Dixon and Ferry, both Republicans from Connecticut, continued the debate from several days prior concerning a federal imposition of African-American voting rights on the States: Dixon: [M]y colleague … proposes to amend the Constitution of the United States in a manner which to me is very revolting, not because I hate negro suffrage, but, sir, I do desire that the proud old...

Read More »Review: Secondhand

by David Zetland (originally published at One-handed Economist) Review: Secondhand I read this 2019 book at record speed due to its breezy (“magazine”) tone and discussion of one of my favorite passions: reusing old stuff. A few years ago Adam Minter wrote Junkyard Planet about the trash trade, but many readers told him about how they reused stuff rather than about their trash. Their passion led to this book (subtitle: Travels in the New Global Garage...

Read More »Trump’s Six Page Letter to Congresswoman Nancy Pelosi

Amazing . . . President Trump’s Letter to the Speaker of the House Congresswoman Nancy Pelosi The first clue that much of the six pages of this letter was not written by Mr. Trump is the salutation; “Dear Madam Speaker.” Then it goes through a series of rants. You can catch a version on Politico also.

Read More » The Angry Bear

The Angry Bear