“Stocks are overvalued and risky. Bonds yield nothing and expose you to interest rate risk. So you need to invest in alternative assets.” – Pretty Much Everyone I am a big advocate of a core and satellite approach to asset allocation. For instance, in my book I talked about the Total Portfolio approach. That is, everyone should own a diverse group of assets and consider how their Total Portfolio relates to what we typically think of as our “investment portfolio”. This might include real...

Read More »How Worrisome is the Rise in Interest Rates?

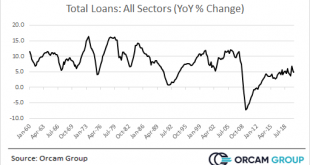

The key to understanding the COVID-19 recession was in understanding that it was an exogenous shock. This made it quite different from your standard recession in the sense that a boom did not cause the bust. There was no endogenous build up of unsustainable forces that led to the decline in output. COVID was much more akin to a natural disaster. This meant that the recession could be deep and painful, but it was unlikely to last very long. This was crucial to understand (and a key...

Read More »Why Pump & Dumps Are Dangerous

On Sunday evening, before GameStop had fallen 85% from its peak, I said: My guess is GME will collapse in the coming months or year when this charade passes and a lot of people will get hurt along the way. I can’t lie. I am really mad to be right about this. Mainly because all of the narratives surrounding this whole charade have been so disingenuous/misinformed and a lot of famous people promoted those bad narratives along the way. And now we’re finding out that a lot of small retail...

Read More »What is Modern Monetary Theory (MMT)?

In this excerpt from our interview with Cullen Roche, we talk about Modern Monetary Theory and what is means for our economy. FULL EPISODE https://youtu.be/fh5sDAZMD4E FOLLOW CULLEN ON TWITTER https://twitter.com/cullenroche ABOUT THE PODCAST Excess Returns is an investing podcast hosted by Jack Forehand (@practicalquant) and Justin Carbonneau (@jjcarbonneau), partners at Validea. Justin and Jack discuss a wide range of investing topics including factor investing, value investing,...

Read More »Three Things I Think I Think – YOLO Gambling is Reckless

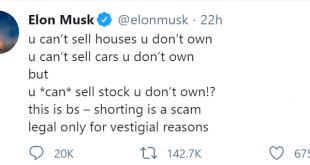

Here are some things I think I am thinking about. Actually, they’re all basically the same thing and they’re all GameStop, of course. But whatever. 1) The Short Sellers Did It! The GameStop saga has been a nearly endless stream of bad narratives. And the one narrative that no one is discussing, the one that actually makes sense is “YOLO gambling is reckless”. But we’ll come back to that in a minute. The bad narratives started with evil short sellers. You know how it goes – short sellers...

Read More »My View On: Short Selling

The recent craziness in Gamestop has resulted in a lot of hot takes on short selling. I have the hottest takes, of course, so let’s dive into this a bit deeper and put this debate to rest. Here’s a piping hot take from the richest man in the world: Wow. That kinda makes sense. But wait, does it really? No, Cullen, stop. Back up. Let’s explain how this works first. Just so we’re all on the same page. Short Selling Basics. This whole convo kinda reminds me of the buyback debates or the...

Read More »Three Things I Think I Think – GAMESTONK!

I’d love to talk about the mechanics of Central Banking or index funds, but the only thing that matters in financial markets right now is Gamestop. So…we’re going to talk about index funds. Seriously. But also we’ll talk about Gamestop so don’t worry. If you haven’t been reading up on the Gamestop saga then maybe circle back to yesterday’s article. 1) Robin Hood or Robinhood? The big story of the day is that Robinhood the trading platform shut down access to buying new shares of Gamestop....

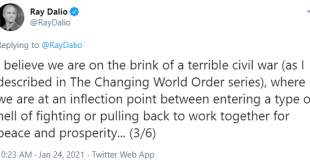

Read More »Three Things I Think I Think – Civil WHAT?

Here are some things I think I am thinking about: 1) There’s Gonna be a Civil WHAT? Here’s an interesting tweet from Ray Dalio: I really like Ray Dalio. His All Weather portfolio is more or less the kind of permanent portfolio that I think most savers should try to implement (for most of their savings). But I have a hard time figuring out how some of his broader macro views fit into all of this. For instance, he believes that there are long-term debt cycles that create patterns in social...

Read More »Rational Reminder Podcast – Understanding the Modern Monetary System

I recorded this podcast a few weeks ago with Cam Passmore and Ben Felix on the Rational Reminder show. Ben had read some of my work over the years and reached out to me before publishing this absolutely wonderful explanation of QE. He asked for my critique of the video, but I couldn’t find any. He had succinctly and thoroughly explained the topic like few can. Then he asked me to come on his podcast to do something I’ve never done before – go through my popular paper “Understanding the...

Read More »RR #132 – Cullen Roche: Understanding the Modern Monetary System

With so many moving parts, it’s difficult to develop a clear view of the US monetary system. Today we speak with Pragmatic Capitalism author and Founder of Orcam Financial Group Cullen Roche, leveraging his expertise to build a comprehensive understanding of the monetary system. We open our interview with Cullen by asking him the deceptively simple question, “what is money?” We then explore where money comes from, the role of the central bank in securing our money supply,...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism