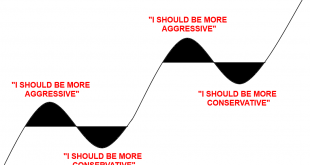

What a wild year it’s been. You could say that the pandemic was like an entire market cycle all rolled into one year. A boom, a bust and a boom. In January I wrote the following piece about how to manage a crazy booming stock market and avoid the temptation to get overly aggressive. Then just 3 months later I wrote this piece about how to manage a crazy collapse and avoid the temptation to get overly conservative. But this is the battle we constantly wage with ourselves. Successful...

Read More »Revisiting S = I + (S – I)

Warning – this one could put you to sleep if you’re not an econ nerd. I will do my best to translate this into English for those who feel like it’s Chinese. About 10 years ago a huge war broke out in Post-Keynesian circles. Modern Monetary Theory (MMT) was becoming somewhat popular, but many people (including some rather prominent Post-Keynesians like Tom Palley and Marc Lavoie) thought they were being a bit loose with some of their descriptions. One of the big debates that raged had to...

Read More »The Other Side of the Trade

Joe Biden will be the next President of the USA. To many people this is happy news. To many others it’s sad news. Like 2016, it was a remarkably close race and our country is going to be divided as we head into 2021. This division could sow the seeds of further division and dysfunction. Or, if we choose to understand that division it can help us compromise and function better. One of the nice things about thinking of the world from a macro perspective is that you necessarily have to...

Read More »The Markets and the Economy Don’t Care About Your Politics

In 2017 I wrote a detailed post about how political biases consistently hurt people’s portfolios. In that post I provided some historical data showing that the President doesn’t determine market returns. But I want to be even more direct about this – there’s zero reliable data on this point and the data points that would impact the outcomes are so random that they will render the data meaningless. Let’s take two recent examples to emphasize this point. In the post 2009 era we heard a lot...

Read More »What the Heck Just Happened?

A post-election autopsy of what just happened and whether it matters…. 1) What Happened to the “Blue Wave”? As of this morning it looks like the Republicans will retain the Senate and the White House will likely go to Biden. The blue wave turned into more of a blue ripple. What’s going on here? I think the big takeaway from this election is that the country is much more moderate than most people assume. There’s no need to over-complicate this. While there are clearly two tribes the...

Read More »Three Things I Think I Think – Grossly Rich Edition

Here are some things I think I am thinking about: 1 – Rich People Being Gross. Do you remember that episode of the Sopranos when Tony sends a boat over to a neighbor’s house and blasts Dean Martin music to annoy him? This is, you know, the kind of stuff you only see in TV shows. Oh, but this is 2020 and anything goes this year so it’s no surprise that this is actually happening. According to the LA Times, former “bond king” Bill Gross has been blasting the Gilligan’s Island theme song...

Read More »Three Things I Think I Think – Cycles, Hunting Biden and Hacking Life

Here are some things I think I am thinking about: 1) When the boom doesn’t cause the bust. The new Howard Marks missive is typically excellent. Howard cites something that I discussed in my April note about the markets and why this market recovery could end up being much faster than many expect. My working thesis for the last 6 months has been that this decline isn’t a “cycle” resulting from a boom. It’s just an exogenous shock. Said differently, the boom didn’t cause the bust. The bust...

Read More »Government Bond Markets Aren’t “Free” Markets

This is one of those posts that is operational in nature, but will sound political to some people. Before you send me a mean email please try not to politicize the issue.¹ I hope this is helpful. Here’s a question I got from Twitter: “Cullen, why not let government bond markets be free and not manipulated?” I see this one a lot and it’s based on a misunderstanding of “free markets” and how they relate to the government. So let’s dive in. First, currencies are essentially imposed on us. So...

Read More »Three Things I Think I Think – Muting Trump and Biden

Sorry for the recent radio silence. I’m trying to focus my energy on writing about the markets when it’s pertinent as opposed to just spewing a daily or weekly note for the purpose of generating eyeballs. 1) Hit the mute button. There is going to be a lot of noise in the coming months about who will win the Presidency and why that person is good or bad for the country. As I’ve noted on many occasions, politics is the absolute best way to wreck your portfolio. The objective fact is that...

Read More »* Cullen Roche 2/2

2017 Stansberry Conference & Alliance Meeting

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism