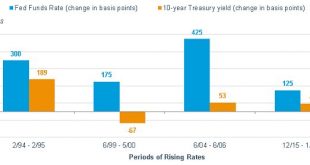

Well, we’ve been here before. In 2006 house prices were booming, stock prices were surging and the Fed was raising rates aggressively trying to get ahead of what looked like an overheating economy. But as the Fed raised short-term rates the end of the curve refused to budge. It was Alan Greenspan’s famous “conundrum”. None of this is that unusual though. When the Fed raises rates they are typically signalling that they want the economy to slow. So short rates rise and long rates barely...

Read More »The Difference Between Asset Price Inflation & Consumer Price Inflation

One of the more common responses to the fact that inflation is low is the idea that the inflation is all in asset prices. So, for instance, if someone were to say that all the Fed’s post-crisis stimulus didn’t result in inflation you might look at stock prices and argue that the price increases all flowed into stocks. That’s not necessarily wrong, but I think it needs to be well understood because asset price inflation is generally good for the economy while consumer price inflation could...

Read More »Timing the Market is Hard

It’s February of 2016 and the stock market has rallied over 250% off the 2008 lows in an almost uninterrupted bull market. But some cracks appeared to be showing. China was looking wobbly and the market had flash crashed a few times. Emerging markets were down 30%+ from their highs. Oil had cratered from $110+ to under $30 in 18 months. Industrials and manufacturing sectors in the USA appeared to be in a legitimate recession. And interest rates were still hovering at 0% on the overnight...

Read More »These Are Not Good Indexing Criticisms

As indexing becomes more and more popular it is also coming under increasing fire. I’ve written a lot about some of the more common indexing myths, but I also wanted to discuss a few myths and misunderstandings that have become more common in recent months: 1. Index funds are increasingly exposed to tech and therefore don’t diversify investors This one was front and center in a Barrons article last month. The basic argument is that equity index funds are turning increasingly into big...

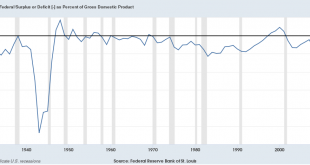

Read More »Yeah, That Debt Article Was Kinda Bad….

John Cochrane is upset that people didn’t like his article about how the US government is about to encounter a debt crisis. I love Cochrane’s finance work. But he seems to let some politics seep into his economic work. I thought this one was missing some key elements connecting the probable dots and outcomes. So let me see if I can explain my point and turn this into a good thought experiment so we can all learn from it. In my view Cochrane’s article was missing a first principles...

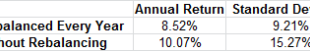

Read More »Why Does the Rebalancing Bonus Work?

One of the best parts about Twitter is that you can follow super smart people and just read their interactions. For instance, yesterday I was creeping on Jeremiah Lowin, Jake from Econompic and Corey Hoffstein. These are three super smart finance guys who were going back and forth about the rebalancing bonus which was made famous by William Bernstein. I will let you assess their comments as you wish, but I have a A LOT to say about rebalancing because it’s so central to everything I...

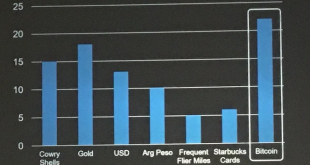

Read More »Why Bitcoin Will Never Be the Dominant Form of Money

The ultimate dream of the crypto currency enthusiasts is for money to become decentralized and essentially removed from the hands of banks and Central Banks who can “manipulate” it for their own benefit. This is a nice thought, but most of it is based on misunderstandings about what “money” is. Let me explain. I was browsing Twitter this weekend when I ran across this post that was being retweeted by a bunch of the top crypto enthusiasts: When banks stored all our money, the bankers...

Read More »The Most Important Investment Factor – Behavior

I used to think that beating the market was the only thing that mattered when it comes to investment returns. Then, after a few bear markets I began to realize that beating the market was vastly overrated because beating the market almost always requires one to take a significant amount of risk. By reaching for more return I was reaching for more risk which was actually hurting my potential returns by increasing my behavioral risk. To correct for this, I slowly realized that I wanted a...

Read More »Wisdom on Real Returns

Tadas Viskanta put together a great compilation of thinking about future real returns. I was included in this “financial blogger wisdom” series which makes a lot of sense because my mom always told me that I am very smart and she’s never wrong.¹ So here’s what I said: “It’s difficult to put together a high real return scenario given the many positives we’ve seen for the last 10+ years. The historical earnings and dividend yield has been about 7% on a rolling 10 year historical basis. But...

Read More »2 Thoughtful Concerns on the US National Debt

Greg Ip, Chief Economics Commentator at the WSJ, recently had some thoughtful comments on the national debt: “There are at least two reasons [the growing debt] matters. First, when the next recession hits, the U.S. may want to open the fiscal taps but instead have to do the opposite as tax collections sink and deficits mount. Second, while markets and the Federal Reserve both doubt interest rates will go much above 3% for the foreseeable future, the U.S. is acutely vulnerable if that is...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism