I was reading this article in the NY Times about a wide ranging diet study. They performed a meticulously controlled test to study what type of diet works best. Their conclusion: “The bottom line is that the best diet for you is still the one you will stick to. No one knows better than you what that diet might be. You’ll most likely have to figure it out for yourself.” One of my favorite things about investing is its similarities with dieting and health. Mainly, investing is really...

Read More »3 Tips to Avoid the Active vs Passive Trap

As financial products evolve into increasingly automated and systematic strategies I have begun to notice a big problem – fund managers are increasingly referring to their strategies as “passive”. It’s clear why this is happening – a systematic strategy could arguably be referred to as a passive strategy and passive is synonymous with good. So it’s in the interest of fund companies to avoid being labelled as “active” because then they can call themselves passive and still charge higher...

Read More »Why are Money Managers Paid so Much?

I really liked this article by Noah Smith at Bloomberg about why money managers get paid so much. The conclusion was basically: we don’t fully know why asset managers get paid so much and whether they get paid too much. I’ve spent A LOT of time thinking about this so I figured I might be able to shed some light on the issue. My opinion is that asset managers generally get paid way too much. For instance, the average investment advisory fee is still close to 1%.¹ And the average equity...

Read More »Three Things I Think I Think V. 1,204

Here are some things I think I am thinking about: 1) Larry Kudlow as Chief Economic Advisor. Donald Trump has tapped Larry Kudlow of CNBC to be his Chief Economic Advisor. It’s an interesting and perfect pick if you ask me. Kudlow fills all the right boxes – he’s a yes man. He’s not a real economist. He’s a supply sider. And he’s a Reagan nostalgic who served as an associate director at the OMB during the Reagan administration. Kudlow’s economic views are pretty benign in my view. He’s a...

Read More »Passive Investors Don’t Need No Stinkin’ Votes

People are still losing their minds over “passive investing”. Here’s the CEO of a high fee fund management company complaining: “Passive investors don’t engage the market with finely tuned attention to each company. They don’t help allocate capital specifically to well-run companies with competitive advantages and long-term growth prospects. Nor do they invest in discovering price disconnects between securities, undervalued assets, or future innovators.” Oh man. Lots to unpack there. Let’s...

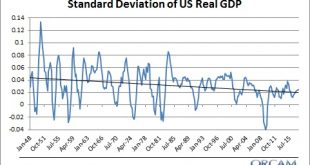

Read More »Why is the US Economy Becoming More Stable?

I was reviewing yesterday’s Z.1 release from the Federal Reserve and all I could think to myself was “man, this is all so boring.” Boring is good in economic terms. It means there are no outlier sectors doing weird stuff that can create future instability. But this is all part of a broader theme that I’ve talked about regularly here – the US economy is becoming increasingly stable.¹ Now, I know what you’re thinking – “Cullen, we’ve had two stock market busts and a financial crisis in the...

Read More »Why is Trump’s Tariff Talk Attractive (To Some)?

One of the first things I learned in undergrad economics was the idea that free trade is one of the only things that most economists agree about. The idea is simple and was probably said best by Joan Robinson: “If your trading partner dumps rocks into their harbor, you do not make yourself better off by dumping rocks into your own harbor.” Donald Trump’s “America first” thinking on this idea is an attractive, but basic fallacy of composition – if you impose restrictions on your trading...

Read More »Why Does Money Make Some People Miserable?

I have a general theory of happiness that can be roughly summarized as follows: “Human beings find happiness by finding affirmation in their existence.” Basically we are all wandering through life knowing we have a limited amount of time here hoping there might be somewhere else we all go when we die, but really hoping this isn’t all for nothing. And in the case that this is all for nothing we seek affirmation from other humans that our time here was meaningful and important, even if...

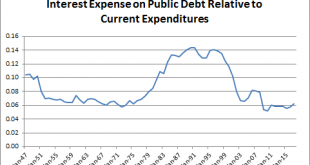

Read More »Tremors was a Very Bad Movie

Do you remember the movie Tremors with Kevin Bacon about underground monsters? It was terrible. But they ended making like 5 or 6 of them. It was like a bad nightmare that wouldn’t end. Which is similar in many ways to a recurring theme on this website where I explain how the USA isn’t bankrupt. I was reminded of this while reading this post titled “Tremors” by Stanford economist John Cochrane in which he explains how rising interest rates pose a threat to the US government’s ability to...

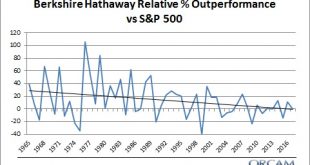

Read More »Here’s a (Not So) Pretty Picture – Buffett vs the S&P 500

Warren Buffett has become a big advocate of index funds in the last decade or so. Which is interesting because he does not eat his own cooking when it comes to this advice. Instead, Berkshire continues to own a huge amount of public companies. It’s especially odd in the wake of his index fund bet since Berkshire Hathaway also undperformed the index fund. I’ve called this a contradiction over the years and it has angered a lot of Buffett’s stock picking disciples. But I think it’s a topic...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism