Well, it’s that time of year – the annual Buffett letter is out. Love him or hate him, these letters are always must reads as they’re filled with awkward sex jokes and investment knowledge that you can pass on to your kids. The investment knowledge, that is, not the sex jokes. Here are some key takeaways from this year’s letter: Stocks are really expensive. He writes: “In our search for new stand-alone businesses, the key qualities we seek are durable competitive strengths; able and...

Read More »WealthFront’s Risk Parity Fund is a Raw Deal

When Robo Advisors first came on the scene they differentiated themselves by claiming to be fiduciaries who didn’t have all the conflicts of interest that Wall Street had. They were right. But they were also wrong in thinking that this was a sustainable business model. In 2015 I wrote a series of posts critiquing these services (see here and here): “The smaller Robos are in a branding bind here. They are hesitant to adopt their own ETFs because then they begin to blur the lines on being...

Read More »Why is the Gun Crisis So Difficult to Solve?

My recent post on guns got a lot more attention than I expected. It wasn’t a fully hashed out view of mine which was careless and unfortunate because I got a flood of emails from people on both sides who thought I was overlooking important points. Which I was, because it was a short blog post. The most common response was that I was not actually proposing anything. Which is true. I think this is an impossible issue to solve because I think it’s a serious cultural problem that is so...

Read More »How Worrisome is Future Inflation?

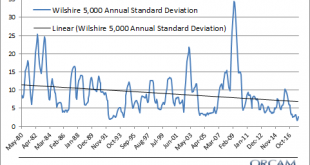

Recent economic data has bond yields jumping a little bit on the worry of higher future inflation. According to many this is the main concern behind the recent volatility in stock and bond markets so let’s see if we can’t put some of this data in perspective so we can better understand the risks to our portfolios. Secular vs Short-Term Trends in Inflation Inflation is closely correlated to secular macro trends in the economy.While short-term counter-trends will appear worrisome at times...

Read More »Guns

Let’s take a break for a minute from the usual economic and finance commentary to talk about something that I think is important – guns in the U.S. I won’t profess to have some profound ideas about how to change what is clearly a crisis in this country. This problem is more complex than most people make it appear, but I wanted to spill some thoughts because I feel like I understand the issue fairly well. So, I grew up around guns in Virginia and West Virginia. Me and my brothers and...

Read More »Whodunit?

In the wake of a relatively meager 10% sell-off in the stock market we’re seeing the old financial “blame game” play out all over the place. Here’s an article blaming inflation. Here’s an article blaming machines. And you know, there’s probably a shred of truth to all of these articles, but I hate this idea that there’s an antagonist and protagonist in this story. The market is more complex than that. It all kind of reminds me of the financial crisis. The financial crisis blame game still...

Read More »Cullen Roche 1/2

2017 Stansberry Conference & Alliance Meeting

Read More »Cullen Roche 2/2

2017 Stansberry Conference & Alliance Meeting

Read More »Cullen Roche 1/2

2017 Stansberry Conference & Alliance Meeting

Read More »Cullen Roche 2/2

2017 Stansberry Conference & Alliance Meeting

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism