Cullen Roche on endogenous money. Source: https://youtu.be/rIXCWtgid8Q

Read More »Cullen Roche on endogenous money.

Cullen Roche on endogenous money. Source: https://youtu.be/rIXCWtgid8Q

Read More »The Biggest Myths in Investing, Part 8 – More Information Will Give me an Immediate Advantage

Share the post "The Biggest Myths in Investing, Part 8 – More Information Will Give me an Immediate Advantage"This is the eighth instalment of a ten part series similar to what I did with “The Biggest Myths in Economics”. Many of these will be familiar to regular readers, but I hope to consolidate them when I am done to make for easier reading. I hope you enjoy and please don’t forget to use the forum for feedback, questions, angry ranting or adding myths that you think are important. The...

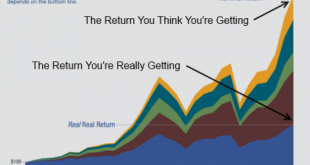

Read More »The Biggest Myths in Investing, Part 7 – Fees are a Small Price to Pay for Expert Advice

Share the post "The Biggest Myths in Investing, Part 7 – Fees are a Small Price to Pay for Expert Advice"This is the seventh instalment of a ten part series similar to what I did with “The Biggest Myths in Economics”. Many of these will be familiar to regular readers, but I hope to consolidate them when I am done to make for easier reading. I hope you enjoy and please don’t forget to use the forum for feedback, questions, angry ranting or adding myths that you think are important. I’m not...

Read More »Learning to be a Good Loser

Share the post "Learning to be a Good Loser"I’ve spent a lot of my life losing at things. In fact, I’ve lost at so many things that I’ve gotten really good at it. I’d say I am a proficient loser. Which, in a weird way has really helped me improve my winning percentage over time. It seems strange, but by getting really good at losing you can improve the way in which you win.The reason why being a good loser makes you a better winner is counter-intuitive, but simple. Michael Maubboussin has...

Read More »The Biggest Myths in Investing, Part 6 – Gold is a Good Portfolio Hedge

Share the post "The Biggest Myths in Investing, Part 6 – Gold is a Good Portfolio Hedge"This is the sixth instalment of a ten part series similar to what I did with “The Biggest Myths in Economics”. Many of these will be familiar to regular readers, but I hope to consolidate them when I am done to make for easier reading. I hope you enjoy and please don’t forget to use the forum for feedback, questions, angry ranting or adding myths that you think are important. This one is really going to...

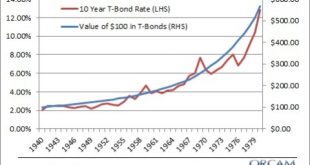

Read More »The Biggest Myths in Investing, Part 5 – Bonds Lose Value if Rates Rise

Share the post "The Biggest Myths in Investing, Part 5 – Bonds Lose Value if Rates Rise"This is the fifth instalment of a ten part series similar to what I did with “The Biggest Myths in Economics”. Many of these will be familiar to regular readers, but I hope to consolidate them when I am done to make for easier reading. I hope you enjoy and please don’t forget to use the forum for feedback, questions, angry ranting or adding myths that you think are important. This is a long one so hang in...

Read More »The Biggest Myths in Investing, Part 4 – Indexing is Average

Share the post "The Biggest Myths in Investing, Part 4 – Indexing is Average"This is the fourth of a ten part series similar to what I did with “The Biggest Myths in Economics”. Many of these will be familiar to regular readers, but I hope to consolidate them when I am done to make for easier reading. I hope you enjoy and please don’t forget to use the forum for feedback, questions, angry ranting or adding myths that you think are important.It’s been well established that picking stocks is...

Read More »“Weak Dollar?” “Strong Dollar?” Who the Hell Knows Dollar!

Share the post "“Weak Dollar?” “Strong Dollar?” Who the Hell Knows Dollar!"Excuse me for interrupting my series on investment myths while I take some time to bust an economic myth. I will return to our regularly scheduled myth busting series tomorrow. So, there’s this big story out today about how Donald Trump asked his National Security Adviser about the economic impact of the dollar. He apparently called Mike Flynn at 3AM to ask him about it. Flynn didn’t know the answer and recommended...

Read More »The Biggest Myths in Investing, Part 3 – You Need To Beat The Market

Share the post "The Biggest Myths in Investing, Part 3 – You Need To Beat The Market"This is the third of a ten part series similar to what I did with “The Biggest Myths in Economics”. Many of these will be familiar to regular readers, but I hope to consolidate them when I am done to make for easier reading. I hope you enjoy and please don’t forget to use the forum for feedback, questions, angry ranting or adding myths that you think are important.Myth # 3 – You Need To Beat The MarketWe all...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism