Share the post "The Biggest Risk of Passive Investing"There’s been a lot of outcry over the years about how passive investing is creating all these new risks. High fee active managers are always critical because they say silly things like “indexing is average” (see my response). Some other people say it’s hurting the economy (see my response). Others have even compared it to Marxism (see my LOL here). Okay, there’s a lot of hyperbole here mainly because there’s a lot of emotion surrounding a...

Read More »The Most Dangerous Narratives are Usually the Smartest

Share the post "The Most Dangerous Narratives are Usually the Smartest"You’ve probably read a million market narratives that sound super smart. But have you ever read one that was so over-the-top smart that it just sounded like it had to be true? I consider myself to be a pretty smart market participant (this conclusion is under considerable debate in most circles) and in recent years I keep coming across narratives that sound so smart that I actually believe they might be true. Then I dig...

Read More »Let’s Talk About Shrinkage

Share the post "Let’s Talk About Shrinkage"There’s a lot of concern these days about shrinkage. No, not Seinfeld shrinkage. We’re talking about Federal Reserve Balance Sheet shrinkage and how the Fed might go about reducing the size of its balance sheet.When the Fed started expanding their balance sheet in 2008 during the financial crisis there was a great deal of outcry and misinformation floating around. I wrote about 10 billion posts on this trying to clear up the misunderstandings. Let’s...

Read More »The Evidence Based Investing Conference

Share the post "The Evidence Based Investing Conference"I am really excited to announce that I will be speaking on a panel at the upcoming Evidence Based Investing Conference in Dana Point, CA from June 25-June 27 hosted by the great people at Ritholtz Wealth. My panel is titled: “Is Economics an Evidence-Based Proposition?” Can investors make use of economic data in formulating strategies or managing expectations? Is economics an art or a science?The panelists will include Mark Dow, Tim...

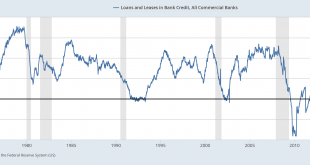

Read More »(Another View on) The Slowdown in Lending: A Rorschach Test

Share the post "(Another View on) The Slowdown in Lending: A Rorschach Test"A lot of ink has been spilled about the “decline” and even “collapse” in bank lending in recent months. Let’s take a closer look and see if we can’t find some pragmatic conclusions here.¹The Big Picture: Aggregate lending data tends to be noisy and it’s not at all uncommon to see sharp slowdowns in lending during expansions. That said, Total Lending is growing at 3.8% per year vs a ten year average of 4.4% so the...

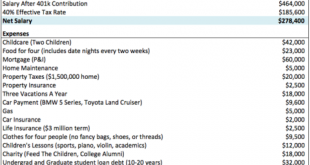

Read More »What is “Enough”?

Share the post "What is “Enough”?"I got an email from a college student this morning asking me for financial advice and tips as they near graduation. I always respond to emails like this and try to give people useful advice. But deep down in my heart I know I am mostly just repeating mundane and useless bull shit. You know, work hard, do something you love, etc. But then I sat down and I started thinking about my own situation and I realized that one of the big reasons I am happy is...

Read More »The Biggest Myths in Investing

Share the post "The Biggest Myths in Investing"The following ten posts include some of the biggest myths in the investing world. I hope you find them educational and informative. If you finish this and feel ultra nerdy you might enjoy my post on the Biggest Myths in Economics.¹Myth #1 – The “Investing” MythMyth #2 – The Stock Market Is Where You Get RichMyth # 3 – You Need To Beat The MarketMyth # 4 – Indexing is AverageMyth # 5 – Bonds Lose Value if Rates RiseMyth # 6 – Gold is a Good...

Read More »The Biggest Myths in Investing, Part 10 – Forecasts are Useless

Share the post "The Biggest Myths in Investing, Part 10 – Forecasts are Useless"This is the tenth instalment of a ten part series similar to what I did with “The Biggest Myths in Economics”. Many of these will be familiar to regular readers, but I hope to consolidate them when I am done to make for easier reading. I hope you enjoy and please don’t forget to use the forum for feedback, questions, angry ranting or adding myths that you think are important. Smart asset allocation is really...

Read More »Why Capitalism Can’t Fix Healthcare

Share the post "Why Capitalism Can’t Fix Healthcare"I’m a staunch capitalist. I mean, I run a website called “Pragmatic Capitalism”. But here’s the thing – I know that capitalism isn’t a cure-all. It has to be implemented pragmatically. And while it works well most of the time there are times when capitalism isn’t the right answer. For instance, capitalism and national defense don’t work so great because producing things, blowing them up and losing your workforce in the process is a pretty...

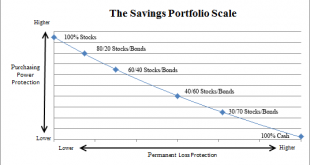

Read More »The Biggest Myths in Investing, Part 9 – Risk Is Something we Can Quantify

Share the post "The Biggest Myths in Investing, Part 9 – Risk Is Something we Can Quantify"This is the ninth instalment of a ten part series similar to what I did with “The Biggest Myths in Economics”. Many of these will be familiar to regular readers, but I hope to consolidate them when I am done to make for easier reading. I hope you enjoy and please don’t forget to use the forum for feedback, questions, angry ranting or adding myths that you think are important. The idea of risk is a...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism