Share the post "Have We Reached Peak Robo Advisor?"The news of an executive reshuffling at WealthFront comes at an interesting juncture for the Robo Advisory space. With growth slowing for some of the main players and more big names entering the game, it’s worth considering if we’ve seen peak robo advisor?My view has always been the same – robo advisors are mostly just just a fancy interface implementing a low fee indexing strategy that amounts to little more than a target date mutual fund...

Read More »Why I Never Vote for One Political Party

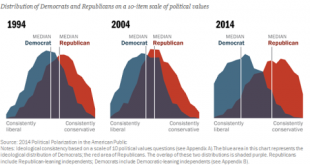

Share the post "Why I Never Vote for One Political Party"The US political system is designed around one simple concept – compromise. Our constitutional republic was constructed with many checks and balances intended to keep one political party from gaining too much power. This design ensured that the USA was not a simple democracy with majority rule as the Founding Fathers feared tyranny of the majority as much as they feared tyranny of the minority.In recent years the USA has become...

Read More »Obama’s Great Economic Blunder

Share the post "Obama’s Great Economic Blunder"President Obama inherited an economic disaster. And since then the US economy has made a huge rebound. Yeah, it has been a bit underwhelming as growth has been somewhat sluggish, but we’ve been growing and we’ve recovered all of the jobs we lost during the crisis. The stock market has more than tripled and Americans are better off than they’ve ever been. A lot of great things have happened in the last 8 years, but it still feels like we’re not...

Read More »The Pitfalls of the Passive Investing Marketing Pitch

Share the post "The Pitfalls of the Passive Investing Marketing Pitch"Here’s a crazy headline from Reuters this morning:Largest exodus in five years hits U.S.-based stock mutual funds: ICIThis is what most people will describe as the migration from “active” to “passive”. In other words, index funds are taking the place of more active stock picking funds. Of course, regular readers know there’s no such thing as passive investing. And this debate is front and center in the context of this...

Read More »The Biggest Risk of a Clinton Presidency

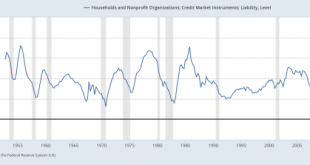

Share the post "The Biggest Risk of a Clinton Presidency"Hillary Clinton will be a one term President. The reason I say this is because I suspect that her economic plan will not be very stimulative and I think that four more years of weak economic growth will be intolerable. And the main driver of my thinking here is deeply rooted in Bill Clinton’s presidency.Back in the late 90’s the US government ran a brief budget surplus. It was heralded as an act of “fiscal responsibility” at the time....

Read More »How Do Indexers Do Better Than Average?

Share the post "How Do Indexers Do Better Than Average?"One of the more common investing myths is the idea that indexing is necessarily “average”.¹ It makes sense at first. If you bought all of the stocks in the market then you’d generate the average return. It would be like playing fantasy football and picking all of the players in the NFL. You would lose more often than not because there is no way you’re going to beat the team that has Tom Brady, Adrian Peterson, Antonio Brown or, well,...

Read More »How the GOP Lost A Slam Dunk Election

Share the post "How the GOP Lost A Slam Dunk Election"As Donald Trump’s poll numbers crash to Earth the autopsy team is starting to assemble to assess what exactly went so wrong with the 2016 election process. How did a slam dunk election turn into such a catastrophic loss for the GOP? And yes, this should have been a slam dunk. In a world of populist discontent in which the Democratic party was torn between Bernie Sanders and Hillary Clinton, a Clinton victory set the stage for the perfect...

Read More »Do the Financial Markets Prefer Clinton or Trump?

Share the post "Do the Financial Markets Prefer Clinton or Trump?"I recently got an email from someone who said they were going to sell all of their stocks until after the election was settled. They think that Clinton will win and that her “tax and spend” policies will cause interest rates to skyrocket which will crash the stock market. He says he will then “reinvest after the election and earn some easy profits”. Does this really make sense though? Let’s dig a little deeper.First, I...

Read More »Three Reasons I Bought a New Home

Share the post "Three Reasons I Bought a New Home"If I’ve seemed unusually busy in the last 6 weeks there’s a good excuse for that – we bought a new house. Our first house, actually. As a Southern Californian I’ve never been convinced by the financial benefits of owning a house. After all, buy/rent comps in this area tend to be similar to those of New York and many other big metropolitan areas where it has been a smart financial move to rent because buying is relatively expensive. But my...

Read More »Chart of the Day: Golden Era of Low and Stable Growth

Share the post "Chart of the Day: Golden Era of Low and Stable Growth"One of the dominant themes in economics these days is that low growth means we are worse off. Some people call this “secular stagnation” or something similar. I’ve challenged this view and say this doesn’t account for how stable our economy has become. In other words, it doesn’t adjust for the risks we face.You see, in portfolio management low growth isn’t necessarily bad. After all, would you rather earn 8% on a...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism