No sign of recession, and lots of indications the rate hikes that are adding to deficit spending as supporting the economy and prices, and not depressing them, and more rate hikes will only do more of same. And it doesn’t end until the Fed understands it has had it all backwards: This is about 85% of the economy. No recession yet. More and more the data is telling me debt/gdp is plenty high for rate hikes to be supportive of total spending in the economy: Housing has been...

Read More »Employment, durable goods orders

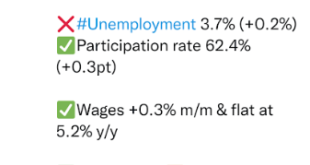

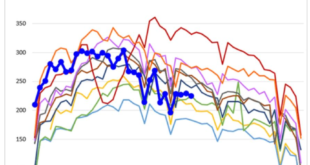

No recession here either: Asymptotically approaching pre-Covid levels: Wage growth continues to lag (not cause) the growth rate of the CPI: Government had more employees under President Trump vs Presidents Obama and Biden? ;) This doesn’t look like a recession either:

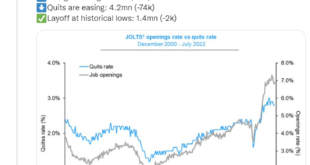

Read More »JOLTS, ISM manufacturing, fed funds rate

No recession yet, at least partially due to the increased federal deficit spending on interest payments as the Fed hikes rates: With debt/GDP the rate hikes have had the effect of about $500 billion/year of additional (highly regressive) federal deficit spending:

Read More »Car sales, Dallas Fed, Gasoline supplied

Maybe stabilizing? Post-Covid bounce followed by a dip from the post-Covid cuts in fiscal spending, but no recession yet: A bit of a slowdown but no recession here yet:

Read More »GDP, Jobless claims, personal income and consumption

No recession yet: Income and consumption not yet indicating recession:

Read More »Chicago Fed, new home sales, manufacturing

Back to slow growth: At least so far, the post-Covid spike has been nearly reversed. We’ll see where it goes from here: Post-Covid bounce reversed, still above 50 which signals modest growth:

Read More »Retail sales, existing home sales, Philly Fed, Jobless claims

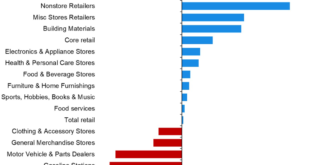

Sluggish growth but not recession, and no one giving credit to the Fed for hiking rates to increase the deficit and help keep it to a soft landing ;) At least so far it looks to me like a large Covid dip followed by a larger post-Covid bounce followed by a correction to prior levels: More signs of no recession yet:

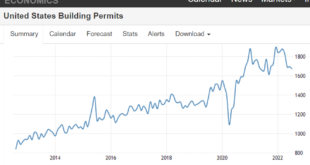

Read More »Housing starts, industrial production, NY Times quote

Permits and starts have fallen off but are still above pre-Covid levels. This particular sector is presumed to be the target of Fed rate hikes. I suspect it is a temporary setback with buyers taking a wait and see attitude, as employment continues to grow: The post-Covid bounce continues with no sign of recession. US energy costs are relatively low which is helping drive the export component: Peter Coy’s NYT article today was about my assertion that rate hikes are adding...

Read More »Mortgage purchase apps, consumer sentiment, bank loans, Fed Atlanta GDP nowcast

Down from the post-Covid bounce but not in any kind of collapse: More evidence we had a soft landing, cushioned by the rate hikes that supported personal income. And no sign the rate hikes have slowed lending. If anything looks like they support it: Back to pre-Covid levels of GDP growth:

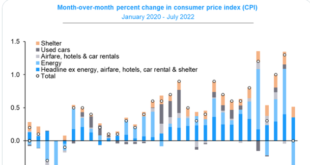

Read More »CPI, PPI

As previously discussed, with oil prices coming down the inflation problem ends. (The month to month change in CPI was 0) And what happens next depends on what oil prices do next. I suspect they go a lot higher as Saudi OSPs remain elevated and speculative long positions taken on when the war in Ukraine started seem to have been sold in anticipation of recession. And while refining margins are down from the highs, they remain elevated, indicating refiners, the only buyers of...

Read More » Mosler Economics

Mosler Economics