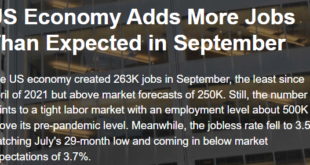

Looking up, as have been most indicators since the rate hikes, which continue to add serious amounts of interest income paid by government (deficit spending) to the economy: Still high enough for the Fed to keep raising rates, etc: Higher than expected: New claims went up a bit, probably due to the hurricane, but remain very low historically:

Read More »Employment, GDP Nowcast, oil prices, equity comment

Employment growth remains strong as rate hikes continue to contribute to a now rising federal deficit that is supporting growth, contrary to Fed expectations. This leads to more hikes intended to soften growth and inflation that in fact support growth and inflation: The Saudis are on the warpath after a falling out with President Biden, scrapping their July deal that included bringing down oil prices (which was probably accomplished by the Saudis confidentially discounting...

Read More »Employment, GDP Nowcast, oil prices, equity comment

Employment growth remains strong as rate hikes continue to contribute to a now rising federal deficit that is supporting growth, contrary to Fed expectations. This leads to more hikes intended to soften growth and inflation that in fact support growth and inflation: The Saudis are on the warpath after a falling out with President Biden, scrapping their July deal that included bringing down oil prices (which was probably accomplished by the Saudis confidentially discounting...

Read More »ISM services, ADP, oil, trade, Fed Atlanta GDP Now

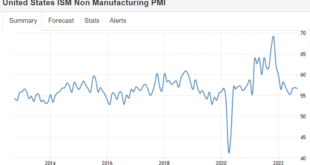

Remains in positive growth mode: No recession indication here- this is a forecast for Friday’s employment report: My take is at the July meeting with President Biden the Saudis agreed to bring prices down in return for various favors. The only way for this to happen was for them to confidentially discount their official selling prices with their customers, and for this was done without consultation with the rest of OPEC+. For reasons unknown to me that agreement has come...

Read More »ISM services, ADP, oil, trade, Fed Atlanta GDP Now

Remains in positive growth mode: No recession indication here- this is a forecast for Friday’s employment report: My take is at the July meeting with President Biden the Saudis agreed to bring prices down in return for various favors. The only way for this to happen was for them to confidentially discount their official selling prices with their customers, and for this was done without consultation with the rest of OPEC+. For reasons unknown to me that agreement has come...

Read More »CB gold purchases, heavy trucks, total vehicle sales, mortgage purchase applications, new homes under construction

Central Banks Are Stocking Up On Gold Which Countries Own the Most Gold | SchiffGold “Central banks purchase a net 270 tons of gold through the first half of the year. This fell in line with the five-year H1 average of 266 tons.” This is the driving force behind gold. When central banks buy it, they pay for it by crediting a central bank member bank’s account on their own books. It is spending that adds to currency depreciation and ‘inflation’ in general. I call it off...

Read More »CB gold purchases, heavy trucks, total vehicle sales, mortgage purchase applications, new homes under construction

Central Banks Are Stocking Up On Gold Which Countries Own the Most Gold | SchiffGold “Central banks purchase a net 270 tons of gold through the first half of the year. This fell in line with the five-year H1 average of 266 tons.” This is the driving force behind gold. When central banks buy it, they pay for it by crediting a central bank member bank’s account on their own books. It is spending that adds to currency depreciation and ‘inflation’ in general. I call it off...

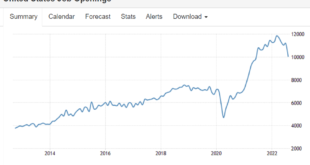

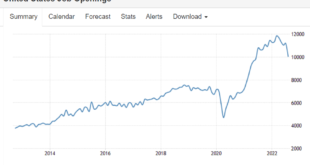

Read More »Job openings, hires, Manufacturers orders, real estate lending

Continues to look to me to like the increased government deficit from the rate hikes, at the macro level, continues to support output and employment and is not triggering a recession as feared? Still a very high number- well above pre-Covid levels: Back to pre-Covid trend line: A slight decline for the month but still trending higher. No sign of recession here: The rate of growth of bank real estate lending continues to increase since the rate hikes were initiated:...

Read More »Job openings, hires, Manufacturers orders, real estate lending

Continues to look to me to like the increased government deficit from the rate hikes, at the macro level, continues to support output and employment and is not triggering a recession as feared? Still a very high number- well above pre-Covid levels: Back to pre-Covid trend line: A slight decline for the month but still trending higher. No sign of recession here: The rate of growth of bank real estate lending continues to increase since the rate hikes were initiated:...

Read More »Construction spending, GDP forecast, Canada PMI, earnings forecasts

So far so good for Q3 that ended Sep 30- about in line with pre-Covid growth rates: Much like the US, much of the rest of the world is hiking rates with high debt/GDP and supporting their economies that had slowed from fiscal contraction with massive government interest payments- universal basic income for those who already have money: Looks like the pro forecasters see accelerating earrings ahead- yet more evidence the rate hikes aren’t working in the intended...

Read More » Mosler Economics

Mosler Economics