So far so good for Q3 that ended Sep 30- about in line with pre-Covid growth rates: Much like the US, much of the rest of the world is hiking rates with high debt/GDP and supporting their economies that had slowed from fiscal contraction with massive government interest payments- universal basic income for those who already have money: Looks like the pro forecasters see accelerating earrings ahead- yet more evidence the rate hikes aren’t working in the intended...

Read More »Commodity prices, PMI index

Lots of commodities to or near pre-Covid levels: Still looking lower but still positive and not yet indicating recession:

Read More »Personal income and spending, consumer sentiment

Modest growth continues.The data keeps telling me the rate hikes are helping the economy rather than hurting it: This is nominal, not adjusted for inflation, and there is no evidence of rate hikes slowing anything down: Same here for inflation-adjusted consumption: Too soon to say it is turned up, but better than expected and not indicating a recession: “The University of Michigan consumer sentiment for the US was revised lower to 58.6 in September of 2022 from a...

Read More »Durable goods, housing permits, new home sales, consumer confidence

No recession here: Permits for new home construction are down from the post-Covid bounce but remain above pre-Covid levels: New home sales recovering from rate hike fears and returning to pre-Covid highs, as in fact rate hikes increase gov deficit spending on interest expense paid to the economy, adding to incomes and spending:

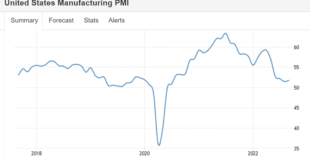

Read More »US manufacturing, bank loans

Stabilizing at modest expansion levels, helped by exports due to relatively low cost US energy: No sign yet the Fed rate hikes have worked to slow lending and demand as presumed they would:

Read More »Exports, multi-family housing starts, unemployment claims

US exports continue to grow rapidly as the US has the least expensive energy costs.It’s an indirect way to export energy and it works to keep the $US relatively strong: New highs and growing rapidly: No sign of stress here:

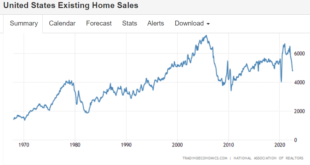

Read More »Existing home sales, architecture billing index, Biden response

Sales had leveled off pre-Covid, then took a Covid dip followed by a recovery bounce,and now seem to be maybe a touch below the pre-Covid range: Moderate growth in this leading indicator: I have no idea what this response means as we gravitate towards nuclear war:

Read More »Housing starts, consumer sentiment

Housing may be bouncing back as the fear of rate hikes is overtaken by the increase in incomes: Nice move up away from recession, though too soon to say things have reversed:

Read More »Industrial production, retail sales, unemployment claims, comments

This index is settling in to about a 3.5% annual rate of growth.No recession indication here: No recession here either: No sign of recession here: Markets are being driven by the understanding that the Fed will continue to raise rates until there is a recession, not realizing that rate increases, with debt/GDP as high as it is,result in a sufficiently large increase in government deficit spending on those interest payments to support both the growth of private sector total...

Read More »CPI, Restaurants and airlines, optimism index

Gone flat since oil prices broke, and means that the strong nominal personal income growth becomes strong real income growth: Still negative but making a comeback even with the rate hikes:

Read More » Mosler Economics

Mosler Economics