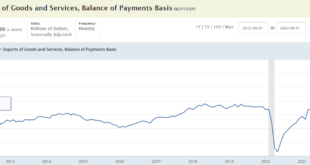

This is about borrowing to spend, indicating positive spending and GDP: Pressures easing here: And this may indicate global spending is holding up: So in short we had Covid deficit spending north of 15% of GDP supporting strong growth, followed by a collapse in deficit spending that resulted in a strong deceleration of growth. However sufficient deficit spending remains (about 5% of GDP) to sustain more modest levels of growth.

Read More »Exports, employment

This is adding support to employment and output, even as consumption weakens. The relatively low cost of energy should keep it going for a while: No sign of recession here: Still falling short of price increases so obviously not the cause:

Read More »Manufacturing PMI, construction spending, hires, loans

Still in positive growth: A bit softer after a post-Covid acceleration: Took a zig down last month but still very high and still trending higher: Lending continues higher well after the rate hikes, which presumably work to cut demand by dampening lending:

Read More »Personal consumption and income, personal interest income

Flattening with the fiscal contraction, but no recession yet: Thank goodness for the rate hikes and their support of personal income ;)

Read More »GDP, population, vehicle sales

Weak headline, but so far not looking as bad as most mistakenly expected with Fed rate hikes: Slowing in real terms but growing: Growing fast in nominal terms: This is telling: They’ve generally been falling off for several years, though up a bit for the last three months since the rate hikes:

Read More »Durable goods orders, oil prices, Saudi OSP’s

Not adjusted for inflation but not showing signs of recession: If oil prices remain near current levels the inflation is over and we’re back to pre-Covid low inflation and slow growth, with a government deficit of maybe 5-6% of GDP (including the new interest expense from the rate hikes which support the economy) supporting demand and a Congress that believes the deficit has to come down to contain inflationary pressures. But I think it’s far more likely that oil prices...

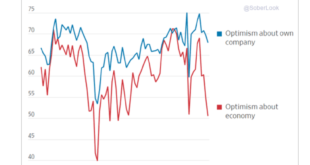

Read More »DFO optimism, homebuyer competition, Architecture index, mortgage purchase apps, builder confidence

This makes sense to me. We have had a post-Covid war slowdown in federal spending that is evidenced by the decelerating economy. But the federal deficit is still high enough to keep things muddling through at modest growth, helped some by the rate hikes whichare universally believed to slow things down when in fact the increased deficit spending for the additional federal interest expense adds a bit of (highly regressive) support for the economy: It has fallen off with the...

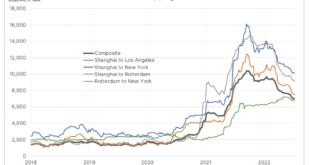

Read More »Shipping, CPI

Worst of the shipping issues are behind us: Wholesale price growth is moderating as well: Core CPI growth also moderating: Headline CPI continues to grow, and it is mainly driven by energy prices: Recently, however, energy prices, which have been the primary driver of higher prices, have dropped substantially, so the next CPI report will show a substantial reduction:

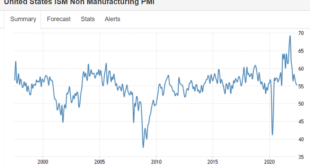

Read More »ISM services, employment

The rate of growth has been decelerating due to the fiscal contraction, but remains over 50 which means positive growth: No recession here as employment growth continues and unemployment isn’t rising. Yes, growth is slowing from the post-Covid fiscal collapse, but not yet to the point of negative growth. And the increase in prices that exceeds wage growth further works to cause people to take whatever jobs they can to make ends meet.

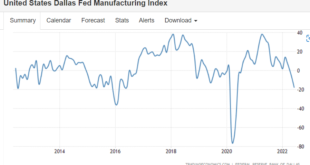

Read More »Dallas Fed, consumer confidence, manufacturing PMI, durable goods orders

Decelerating from post-Covid bounce expansion rates of growth: Decelerating but still at reasonably high levels: Decelerating from the post-Covid war fiscal consolidation but still positive:

Read More » Mosler Economics

Mosler Economics