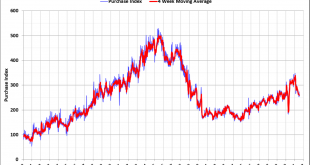

Not good. Analysts/politicians/voters expected more gains as Federal benefits expired: Not good: Not good: Typical bounce after the covid dip that followed the tariff decline, but so far only back to prior levels, and less when adjusted for inflation:

Read More »Pending home sales, Construction spending, ISM manufacturing, Saudi OSP

Same pattern: Also same pattern of covid dip, recovery, then weakness most recently: US Factory Growth Slows in July The ISM Manufacturing PMI fell to 59.5 in July of 2021, the weakest in 6 months, compared to 60.6 in June and below forecasts of 60.9. New orders, production, and supplier deliveries increased less and inventories contracted. Meanwhile, employment rebounded and price pressures eased. Looks like price hike mode?

Read More »New home sales, durable goods orders

The mood has changed: Not adjusted for inflation, so in real terms weaker than it looks:

Read More »Total initial claims, vehicle sales

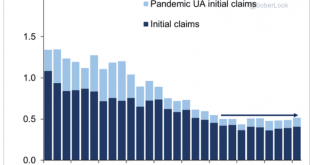

New claims still running high, as are continuing claims. Federal unemployment benefits expire in about 6 weeks: Same pattern- covid dip, recovery, fade, continuing the weakness that traces back to the tariffs:

Read More »Mtg purchase apps, housing starts and permits, Saudi pricing vs benchmarks, oil inventories

Covid dip, recovery, and now a decline: Covid dip, recovery, and now sideways at levels of some 25 years ago when there were a lot fewer people: Through June,Saudis caused the big dip and recovery, then attempted to stabilize.The most recent Reuters report suggested price increases vs benchmarks,which is a move to firm prices over time:

Read More »Retail sales, consumer sentiment, industrial production

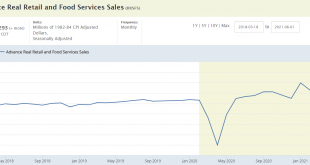

This chart is adjusted for inflation. Note the dip, recovery, and leveling off pattern: Dip, recovery, and falling back. Not a good sign: Dip, recovery, leveling off below pre covid levels:

Read More »Oil alert

Saudis have set in process a continuous increase in the price of oil.This is exactly what happened in 2008.The Fed’s reaction was to hike rates which only made the inflationary impact worseall triggering the financial panic and crash, with no fiscal relief from a panicked Congressrelying on the Fed until March 09. Only a change in Saudi pricing reverses this: SINGAPORE – Top oil exporter Saudi Arabia has raised the August official selling prices (OSPs) of all crude grades it...

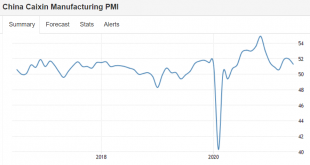

Read More »Asian PMI, trade, China services

Same pattern only more so: Americans spending more on imports= federal deficit spending that much less inflationary: May exports were $206.0 billion, $1.3 billion more than April exports. May imports were $277.3 billion, $3.5 billion more than April imports. Similar pattern:

Read More »Bank loans, vehicle sales

Fading- heavy and light have fallen back below pre covid levels:

Read More »China, construction spending, housing

Seems to showing the same pattern as the US- covid dip, recovery, fade: Same pattern here too: Higher prices bringing out supply? Epic housing shortage may finally be starting to lift (cnbc.com)

Read More » Mosler Economics

Mosler Economics