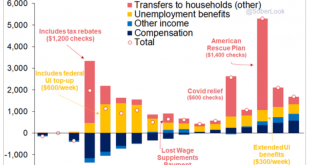

Transfers coming down is slowing GDP growth: Housing continues to slow/ the post covid bounce is fading: Making a comeback but still a long way to go. This is a major driver of personal income. It also shows a lot of people are taking jobs, contrary to headlines of worker shortages: This is only through April, but note that new hires are up to about 6 million jobs per month: Another indicator the pace of the post covid recovery is fading:

Read More »Personal income and expenditures, lumber

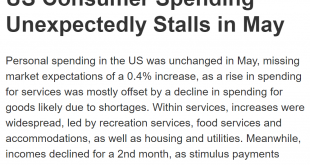

Consumption leveling off at pre covid trend, as personal income growth fades with expiring fiscal support: Fading as federal unemployment comp is being eliminated in several states. By labor day it all expires: Still falling back:

Read More »Housing, unemployment claims, durable goods orders, corporate profits, inventories, commodities

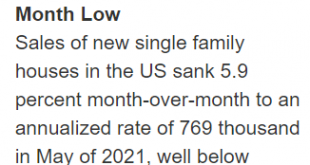

Another hint at a cooling housing market: Nearly double pre covid levels indicating a lot of people are still losing jobs every week: This chart is not adjusted for inflation. On an inflation adjusted basis it remains way below previous cycle highs: Profits seem to have flattened again: Inventories are growing/being restored from covid related disruptions: This is only through April: Covid disruption/dip followed by recovery that seems to be running its course:...

Read More »New home sales, existing home sales, crude oil

Settling back to pre-covid levels: After cutting price to shut down the higher cost producers, particularly US shale, the Saudis have moved prices back to pre covid levels and may be going higher, particularly if they feel oil’s days are numbered…

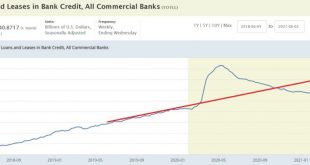

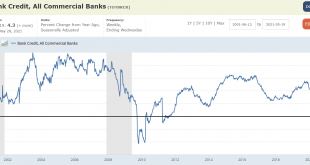

Read More »Bank lending

Private sector deficit spending needs to replace fading public sector deficit spending (as benefits expire) to sustain output and employment: A small pick up here but still well below where it would have been otherwise: Tax receipts are moving up aggressively with the recovery and further supported by ‘inflation:’

Read More »Shipping, retail sales, industrial production, NYC manufacturing

Another shipping crisis looms on Covid fears in southern China Still elevated though may be returning to trend? Still struggling:

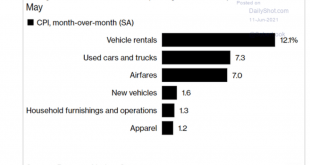

Read More »CPI, lumber

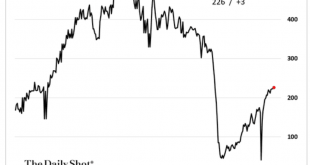

A rise in prices from an external shock can result in a slowdown of consumption, but to date fiscal transfers have worked to sustain incomes that support consumption. Expiring federal unemployment comp will remove some of that support, and we have a backdrop of a Fed 0 rate policy which itself is a deflationary bias: Lumber price made the news a lot more when they were going up than when they started going down:

Read More »Expiring unemployment benefits, mtg purchase apps, trade, cpi

Soft spot in progress, and all federal unemployment benefits expire Labor Day: Still seems to be weakening: Job openings offsetting the prior dip as covid restrictions are relaxed. Hirings coming back as well, though not as quickly: The drop in imports could possibly be a sign of weakness as well: From the Department of Commerce reported: The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $68.9 billion in...

Read More »Oil drilling, vehicle sales, unemployment claims, private payrolls

With oil prices working their way higher, so is US oil drilling: Looks like they are falling back to ‘trend’: Still lots of slack: So much for the notion that businesses can’t find employees? Still lots of slack:

Read More »Bank loans, vehicle sales, miles driven

Settling back to very low growth, partially because of the increased federal deficit spending: A bit of ‘catch up’ from the prior drop: Computer chip issues:

Read More » Mosler Economics

Mosler Economics