Looks like we’ve stopped digging out of the hole: Sales have returned, at least for now, though a lot of sales were lost ‘forever’ due to covid:

Read More »Unemployment claims, JOLTS

Not much evidence things getting anywhere near back to normal:

Read More »Loans, interest margins

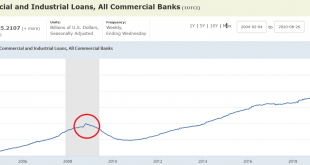

Business precautionary draw downs of lines of credit caused the spike, followed by a contraction as operational needs contract: Growth in real estate loans is slowing: Consumer borrowing dropped with the stimulus checks and then has flattened: Pause, recovery, and then a leveling off:

Read More »Options buying, employment

The gap closed but at a slower rate indicating the extent to which the economy remains subdued 6 months into the crisis: Interesting- never seem gov sharply procyclical like this:

Read More »Trucks and cars, Jobless claims, Trade

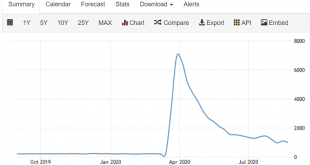

Same large dip partial recover story: Down a bit but still way high this many months after the initial surge:

Read More »Construction spending, payrolls, durable goods orders, NY Manufacturing

Growth has been working it’s way lower for a long time: Not much of a recovery here: Total orders for the last several months are way down:

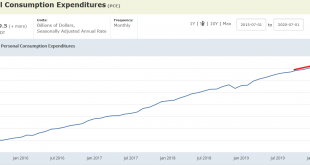

Read More »Personal consumption, personal spending, rig count

Settling down as fiscal transfers subside, but still elevated: Income falling faster than consumption is growing: Real Personal Income less Transfer Payments Transfer payments decreased by $70 billion in July, but were still $1.7 trillion (on SAAR basis) above the February level. Most of the increase in transfer payments – compared to the level prior to the crisis – is now from unemployment insurance. However, there will be sharp decline in unemployment insurance in...

Read More »Jobless claims, corporate profits, Fed, COVID testing

Still over 1million new claims last week. This is seriously bad: They had already leveled off well before the collapse: As the carpenter said about his piece of wood:‘No matter how much I cut off it’s still too short.’They still have the interest rate thing backwards: Testing is down as are new cases, just like the President said:

Read More »Job postings, Bank loans

Falling off again: After a typical precautionary draw down of credit lines, business loan growth turned and remains negative: Total bank credit has gone flat: Consumer borrowing is down, partly because of fiscal policy, and partly due to reduced spending: Real estate lending has slowed, but not by a whole lot:

Read More »Oil drilling, Oil demand, Jobless claims, Architecture billings

Demand for petrol products dropping with the end of unemployment comp: Back up over 1 million new claims last week. Relapse underway without immediate fiscal adjustments: This leading indicator remains seriously depressed:

Read More » Mosler Economics

Mosler Economics