Looks like at best it’s going sideways: Bad!!! The Japanese economy shrank 7.8 percent on quarter in the three months to June 2020, compared with market forecasts of a 7.6 percent decline, and after a 0.6 percent fall in the previous period, a preliminary estimate showed. This was the third straight quarter of contraction and the steepest on record, amid the severe impact of the COVID-19 crisis. Private consumption (-8.2 percent vs -0.8 percent in Q1), capital expenditure...

Read More »Vehicle sales, retail sales, industrial production

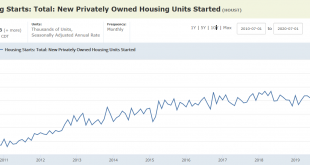

Remains depressed and had been slowing for several years: Seems back on track due to unemployment comp, etc. which has recently expired: Familiar pattern:

Read More »Employment

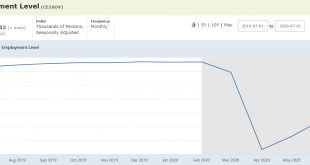

Some are going back to work, but employment is still dramatically low: Hiring of lower paid workers drives the average wage lower: Note the unprecedented drop in the labor force:

Read More »Consumer spending, trade, layoffs, jobless claims, political comments

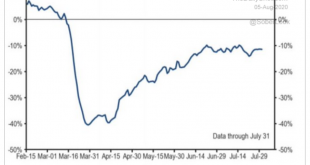

Still very weak- gone from increasing to decreasing: Slowdown plus fiscal adjustment supporting income increased imports vs exports, and oil production going from positive to negative is still in progress: Layoffs continue at a very high level as firms who kept employees with gov assistance are now letting them go: New jobless claims continue at over 1 million per week for the 20th week: Continuing claims remain above 16 million: fyi:

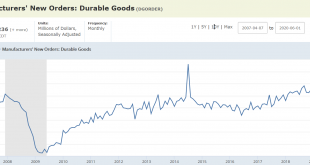

Read More »Durable goods orders, private payrolls

Familiar pattern, up a bit but still depressedWhat the President has been doing is expressing thesemoves up from the collapse in percentage terms, thenstating the percentage gains are the largest ever, as indicationsthat the economy is booming, etc.It’s either shameless spinning, or, worse, he actually believesit…

Read More »Personal income and consumption

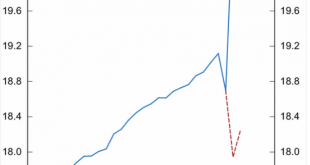

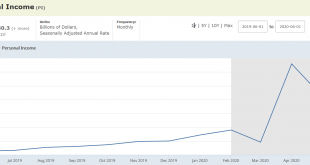

This shows the dependence on federal deficit spending to sustain incomes; Real personal consumption has collapsed-and particularly for services- far more than in 2008/09 even with the increasein personal income from the stimulus checks and enhanced unemployment compensation. A large part of the reasonis that it isn’t safe to go to work and those services simply aren’t available. A financial crisis has been averted, butnot an economic collapse:...

Read More »Income, Consumption, Savings, Consumer loans, Real estate loans

So jobs and paychecks and profits were lost, but gov deficit spending morethan made up for the lost personal income, but spending went down anyway,as personal savings went up. Then personal income fell back some, consumptionincreased some, and savings went down some.The $1,200 distribution was a one time event, and the new deficit spendingon unemployment benefits of $600/week just expired, making it all dependenton what Congress does next…...

Read More »GDP, Claims

Bad news on both fronts:

Read More »Continuing claims, Durable goods orders, Air travel, Dining, Hotels, Gasoline

Not getting any better: Still at depressed levels, and these numbers are not inflation adjusted:

Read More » Mosler Economics

Mosler Economics