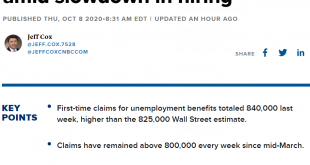

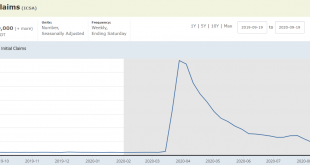

Still way high and moved up again- not good! The survivors are feeling a bit better:

Read More »Jobless claims, electricity production

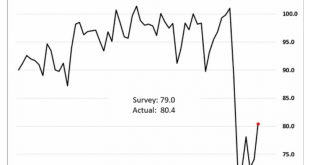

Consumer sentiment, job openings, trade, new US covid cases

Up a bit but still way down overall: Familiar pattern. Down big, partial recovery, downtrend resumes: And weak from covid and the tariffs: Moving in the wrong direction as flu season approaches:

Read More »Vehicle sales, real estate loans

Still very weak: Since April, sales have increased, but are still down 4.3% from last year. The second graph shows light vehicle sales since the BEA started keeping data in 1967. Note: dashed line is current estimated sales rate of 16.34 million SAAR. Sales-to-date are down 18.8% in 2020 compared to the same period in 2019. In 2019, there were 12.70 million light vehicle sales through September. In 2020, there have been 10.31 million sales. Real estate loan growth is...

Read More »Employment, durable goods orders

Leveling off at very low levels of total employment: This is not adjusted for inflation:

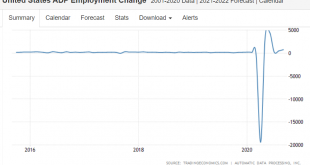

Read More »Mtg apps, ADP payrolls

Private businesses in the US hired 749K workers in September of 2020, the most in three months and above market expectations of a 650K rise raising hopes the labour market recovery strengthened. Still, only half of the near 20 million jobs lost since March when the coronavirus crisis started have been recovered.

Read More »Durable goods orders, air travel, hotel occupancy, gasoline supplied, miles driven, freight index

Same pattern- dip, partial recovery, leveling off and never got back to 2008 levels inflation adjusted:

Read More »Unemployment claims, Architecture index, New home sales

Slightly higher than last week as they remain alarmingly high: Same pattern- big drop, some recovery, leveling off at lower levels: Same pattern developing but sales holding up at least for now:

Read More »Consumer sentiment, Existing home sales, Services

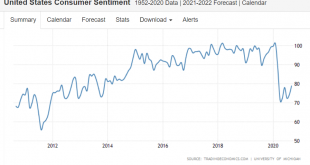

Not looking good: Up from the massive setback as some sales were delayed rather than cancelled: The emerging pattern seems to be the big collapse, a partial recovery, and then a tapering off from there:

Read More »Consumer sentiment, current account

The current account deficit in the US widened by $59 billion, or 52.9%, to $170.5 billion in Q2 2020, the biggest gap since Q3 2008. It is equivalent to 3.5% of the GDP, compared to 2.1% in Q1. It mostly reflects an expanded deficit on goods and reduced surpluses on primary income and on services. All major transactions declined in part due to COVID-19, as many businesses were operating at limited capacity or ceased operations, and the movement of travelers across borders...

Read More » Mosler Economics

Mosler Economics