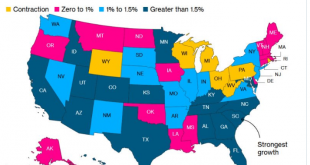

Contraction continues, not to be reversed any time soon by any kind of ‘trade deal’ with China:

Read More »States contracting, Job openings

Employment, Vehicle sales, Factory orders, Headlines, US and Japan services, US and Euro area trade, Credit standards

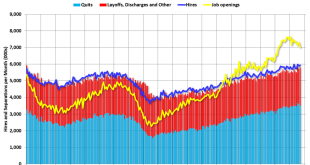

Job openings now in full retreat: The contraction continues: Highlights Unit vehicle sales, at a much lower-than-expected annual rate of 16.5 million, proved very soft in October and will lower expectations for next week’s retail sales report. October’s pace is the slowest since April reflecting sharp slowing in light truck sales. Vehicle sales have been soft this year, averaging a 16.9 million pace versus 17.2 million and 17.1 million in the two prior years. Despite this,...

Read More »Factory orders, ISM NY, Euro area

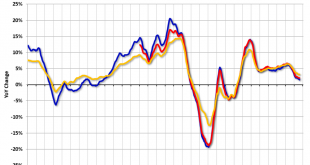

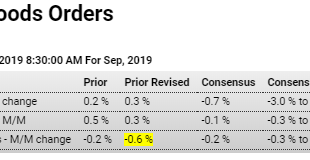

Contraction: Highlights September factory orders fell 0.6 percent with durable goods orders falling 1.2 percent (revised from an initial 1.1 percent decline in last week’s advance data) and nondurable goods (the new data in today’s report) up 0.1 percent. Total unfilled orders have been flat this year and were unchanged in September while inventories rose 0.3 percent in contrast to shipments which fell 0.2 percent. Orders for commercial aircraft, pulled down by the grounding...

Read More »Employment, Construction, ISM manufacturing, Chicago Fed

The slow motion train wreck continues unabated and when employment goes bad, it all goes bad: Highlights On the low side of expectations but not at increasing rates of contraction are the results of ISM’s manufacturing report for October. At 48.3, the index missed Econoday’s consensus by 1 point but gained a 1/2 point from September. New orders improved nearly 2 points in October but, at 49.1, are still under breakeven 50. New export orders, however, improved markedly, up...

Read More »Employment, GDP, Personal Consumption, Chem activity, Euro area

With today’s numbers private sector employment continues its rapid deceleration brought on by the collapse in global trade from the tariffs: GDP is also decelerating for the same reasons: Contraction: The collapse continues:

Read More »Home prices, Oil capex, ISM and Fed surveys

Not a good sign: Oil capex decline: Oil Rig Count Plunges To Lowest Level Since 2017 A Death Sentence For Small Oil & Gas Drillers Below 50 is contraction:

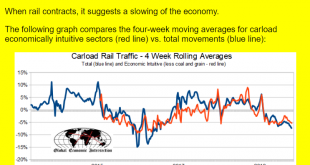

Read More »Rails, Trade, Chicago Fed, Dallas Fed

Deep contraction: Highlights The good news is that the trade deficit in goods narrowed sharply in September to a much lower-than-expected $70.4 billion, but the bad news is both exports and imports, in an indication of economic slowing, fell sharply. Exports dropped 1.6 percent in the month for year-on-year contraction of 3.0 percent, showing an oversized 12.6 percent monthly decline in foods, feeds & beverages that will raise talk of issues with China. Exports of autos...

Read More »Durables, Manufacturing employment, US composite PMI, Euro area manufacturing

The global collapse continues unabated: Highlights An emphatically weak set of durable goods headlines for September raises the alarm for the health of the manufacturing sector while unexpectedly substantial contraction in capital goods orders deepens specific questions on the outlook for business investment. Durable goods orders fell a monthly 1.1 percent in September, on its face significantly weak but roughly near expectations in contrast to ex-transportation orders which...

Read More »France, Inventory cycle, Unemployment benefits, Architectural billings

Never seen so many charts that look pretty much like this: Much harder to get this cycle means that unemployment and benefits as defined are lower than otherwise, and that the counter cyclical stabilizing effect has been disabled: Most Unemployed People In 2018 Did Not Apply For Unemployment Insurance Benefits from the Bureau of Labor Statistics In 2018, 77 percent of the unemployed people who had worked in the previous 12 months had not applied for unemployment insurance...

Read More » Mosler Economics

Mosler Economics