Weakness continues and new tariffs kicking in will only make it worse: Highlights Is there slack in the labor market or isn’t there? Judging by September’s 3.5 percent unemployment rate, a rate that falls below Econoday’s consensus range, there may not be much available capacity at all. Yet wage pressures, as measured by average hourly earnings, eased significantly in September for a 2.9 percent year-on-year growth rate that is the lowest since July last year. Payroll growth...

Read More »ISM services, Durable goods orders, NYC, Trump comments

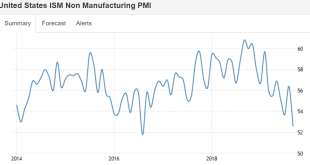

The service sector is in full retreat: Contraction: Trump says China should investigate the Bidens, doubles down on Ukraine probe

Read More »Employment, Vehicle sales, Consumer durables, NYC

Rapid deceleration: BEA: September Vehicles Sales increased to 17.2 Million SAAR “The job market has shown signs of a slowdown,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “The average monthly job growth for the past three months is 145,000, down from 214,000 for the same time period last year.” Negative year over year: BEA: September Vehicles Sales increased to 17.2 Million SAAR BEA released their estimate of September vehicle sales...

Read More »ISM Manufacturing, Construction, Trump Fed comments

The deceleration that’s been going on all year due to the tariffs seems to finally be getting some media attention after US manufacturing reports that it’s in contraction. Something like the 10th plague… Highlights Contraction in export orders is severe and is pulling composite activity for ISM manufacturing’s sample under water. September’s 47.8 headline is more than 1 point under Econoday’s consensus which is significant, since nearly all forecasters take a stab at this...

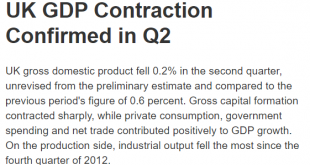

Read More »UK, Germany, Italy, India, Japan

Just a partial recap of today’s releases as the tariff induced global trade collapse continues:

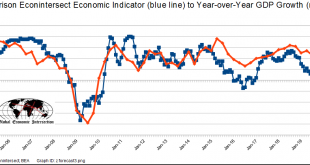

Read More »Econointersect indicator, South Korea, Fed Chicago, Dallas Fed, Trump comment

Been contracting all year: Contraction:

Read More »UK, China, Philli Fed index, Flipper lending

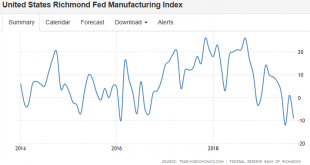

Still contracting: This indicator is flashing recession again. Last time this happened a few years ago the numbers were subsequently revised higher: Not a good sign: Lending to house flippers hits a 13-year high as prices and competition heat up

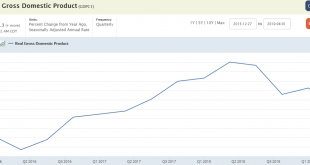

Read More »GDP, Corporate profits, Expectations vs conditions, Singapore

Tariffs taking a bite- deceleration in progress: Corporate profits had been flat, got a one time boost from the tax cuts, and then flattened again: The non financial’s have done even worse: Contraction:

Read More »New home sales, Chemical activity barometer

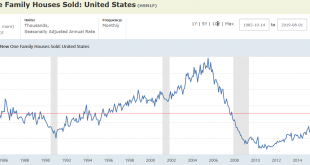

Up a bit last month, but note they are less than half of where they were the last cycle, and hovering around early 1980’s levels, when there were a lot fewer people: Down to no annual growth:

Read More »Home prices, Richmond Fed, Consumer confidence

More deceleration: US Home Price Growth Slows to New 7-Year Low The S&P CoreLogic Case-Shiller 20-city home price index in the US rose 2% year-on-year in July, missing market expectations of 2.2%. It was the smallest annual gain in house prices since August 2012. Phoenix recorded the biggest increase in home prices, followed by Las Vegas and Charlotte, while the smallest gains were seen in San Francisco, New York and Los Angeles. Prices in Seattle continued to drop....

Read More » Mosler Economics

Mosler Economics