No drama here: More housing weakness news: Highlights This has not been a good run for housing data. Pending home sales fell a very steep 2.6 percent in October which is far below Econoday’s consensus range. Existing home sales did end a long downturn in last week’s report but today’s results point strongly to another leg down for final sales. The West is the weakest region with pending sales falling very sharply in the month for a year-on-year decline of 8.9 percent. The...

Read More »Trade, New home sales, Federal interest payments

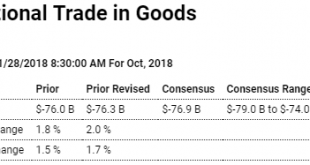

Trade deficit still increasing: Highlights The goods portion of October’s trade deficit is deeper than expected, at $77.2 billion vs expectations for $76.9 billion and compared with a monthly average in the third-quarter of $74.6 billion. October’s data opens fourth-quarter net exports on a negative note following the third quarter when trade pulled down GDP pace by nearly 2 percentage points. Today’s results point to further downward pressure for the fourth quarter. Exports...

Read More »Home sales, Durable goods, Philly Fed index

Last month revised lower and looking weak: Highlights A drop for primary metals, a sharp drop for machinery, and a reversal for defense aircraft all pulled down durable goods orders in October which fell a sharper-than-expected 4.4 percent. A very sharp downward revision to September, revised from a 0.8 percent gain to a 0.1 percent decline, is another unfavorable headline in today’s report. Orders for primary metals, down 2.3 and 1.2 percent the past two reports, continue...

Read More »Housing starts

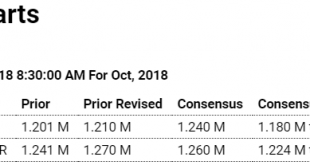

Not good: Highlights Yesterday’s housing market index may have unexpectedly plummeted but today’s housing starts and permits report, though soft, at least is in the ballpark of expectations. Starts in October rose 1.5 percent to a 1.228 million annualized rate that compares with Econoday’s consensus for 1.240 million. Permits edged past expectations, at a 1.263 million rate vs a consensus for 1.260 million though down 0.6 percent from September. The good news on starts comes...

Read More »Residential investment, Earnings, Saudi pricing, Vehicle sales

Note the deceleration began with the collapse in oil capex in 2015: The year end tax cut caused a onetime increase in earnings that subsequently flattened out and may now be declining: Seems Saudis are raising prices: Stopped growing a couple of years ago:

Read More »Mtg apps, China exports, Oil

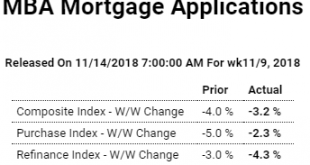

Continuing to be negative year over year: Highlights Rising interest rates continue to dampen mortgage activity, with purchase applications for home mortgages falling a seasonally adjusted 2.3 percent in the November 9 week to the lowest level since February 2017 while refinancing applications decreased by 4.3 percent to the lowest level since December 2000. Unadjusted, purchase applications fell further into negative year-on-year territory and were 3 percent below their...

Read More »Consumer credit, Employment

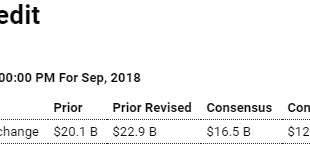

Highlights Consumer credit growth slowed more than expected to just $10.9 billion in September, below Econoday’s consensus range and less than half of the upwardly revised $22.9 billion August increase. Growth slowed in nonrevolving credit, which rose $11.2 billion in September versus $18.3 billion previously, while growth in revolving credit stalled completely and posted a marginal decline of $0.3 billion. Gains in nonrevolving credit reflect vehicle financing and student...

Read More »Mosler Governor Ad

Mosler Governor Ad

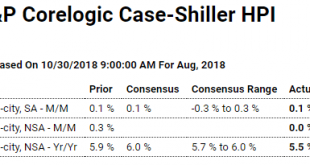

Housing prices, Consumer confidence, Investment

More housing weakness: Highlights Growth in home prices, as it is for home sales, is almost at a standstill, at least on a monthly basis for Case-Shiller’s 20-city adjusted index which inched only 0.1 percent higher in August. Year-on-year, the unadjusted index is still growing at healthy rate of 5.5 percent which, however, is down from 6.8 percent as recently as March and is the lowest rate since December 2016. Outright monthly declines were posted in two cities where price...

Read More » Mosler Economics

Mosler Economics