Agent Orange, AKA Tariff Man, taking down the global economy: Intel Projects Slower Revenue Growth This Year (WSJ) Intel Corp. reported a 9% gain in revenue. Customers’ robust appetite for server chips boosted data-center businesses by 45% through the first nine months of 2018, but now those buyers need to digest those purchases, finance chief and interim chief executive Bob Swan said. That slowdown will hit the next two quarters as well, he said. The company now...

Read More »Sentiment indicators, Shutdown slowdowns

Euro area business growth close to stalling at 5½ year low in January (Markit) Flash Eurozone PMI Composite Output Index at 50.7 (51.1 in December). Services PMI Activity Index at 50.8 (51.2 in December). Manufacturing PMI Output Index at 50.4 (51.0 in December). Manufacturing PMI at 50.5 (51.4 in December). The factory sector reported the weakest expansion since the current production upturn began in July 2013, while the service sector expansion was the smallest since...

Read More »Existing home sales, Trade, BOJ

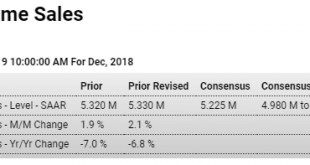

Bad: Highlights Mortgage rates began to move down in December but it wasn’t soon enough to help the month’s resales. Existing home sales fell a sharper-than-expected 6.4 percent to a 4.990 million annualized rate that is the lowest in more than three years and barely makes Econoday’s consensus range. Weakness across the board is a fair description of the results with single-family sales down 5.5 percent to a 4.450 million rate and condo sales down 12.9 percent to 540,000....

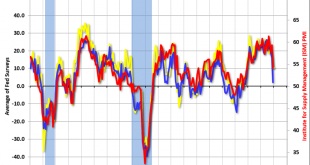

Read More »Surveys, Housing 55+ and investment, FT mention

Trade issues taking their toll: This too has gone flat: Nice mentions for Stephanie and a also bit for me here, as MMT is now on a roll: https://ftalphaville.ft.com/2019/01/16/1547640616000/America-has-never-worried-about-financing-its-priorities/

Read More »Budget, Asian airfreight, US profit forecast, Growth index, Capex, Share buybacks

December 2018 CBO Monthly Budget Review: Total Receipts Up by 1% And Spending Up 9% in the First Quarter of Fiscal Year 2019 The federal budget deficit was $317 billion for the first quarter of fiscal year 2019, CBO estimates, $92 billion more than the deficit recorded during the same period last year. Revenues were about the same and outlays were $93 billion (9 percent) higher than during the first quarter of 2018. Asian airfreight traffic drops for first time in 2.5...

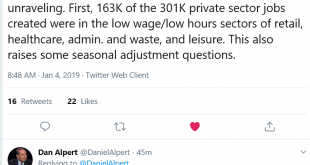

Read More »Employment, Euro pmi, Chile retail sales, Goldman index. Leveraged loans, Bank credit

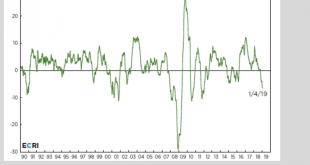

Agent Orange, the self proclaimed tariff man, taking the EU: US decelerating: I would have expected Chile to be affected most by global warming… It’s becoming more clear to me that lending shifted from banks to other investment entities via the leveraged loan process, and the growth in that credit channel is what supported GDP growth as other channels faded. Most recently, however, leveraged loan growth has faded, and the weakening economic indicators tell me this time...

Read More »Profits, Bank lending, Factory activity, Mtg apps, Auto sales

Corporate Profit Crunch Looms as Stocks Slide (WSJ) In December, analysts cut their earnings forecasts for 2019 on more than half the companies in the S&P 500, according to FactSet, the first time that had happened in two years. They expect earnings for S&P 500 companies to grow 7.8% in 2019, down from their forecast of 10.1% at the end of September, according to FactSet. That is a big climb down from the estimated 22% earnings growth rate in 2018. The last earnings...

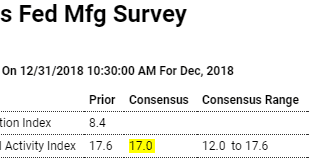

Read More »Dallas Fed survey, California home sales, Tariff exemptions

Not good: California Home Sales Slowest For An October In Seven Years (Econintersect) California home sales fell year over year for the third consecutive month, hitting a seven-year low for an October, as affordability constraints and a more cautious stance by many would-be buyers continued to weigh on the market. Interesting. Wonder if Agent Orange knows about this? US grants nearly 1,000 exemptions from China tariffs (Nikkei) The Trump administration has granted nearly...

Read More »Pending home sales, Richmond Fed, Holiday retail sales

Bad: Highlights Existing home sales have been leveling but the signal from pending home sales points to a new downturn. The pending home sales index for November fell 0.7 percent to 101.4 which is under Econoday’s consensus range and compared to expectations for a 1.5 percent gain. Year-on-year this index is down 7.7 percent vs a 7.0 percent decline in final sales of existing homes. Pending sales in November posted low single-digit contraction in both the South and Midwest...

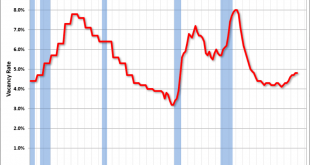

Read More »Rail traffic, apartment vacancy rate, durable goods orders, personal income and consumption, KC manufacturing

Rail Week Ending 15 December 2018: Economically Intuitive Sectors Continue In Contraction Written by Steven Hansen Week 50 of 2018 shows same week total rail traffic (from same week one year ago) improved according to the Association of American Railroads (AAR) traffic data. The economically intuitive sectors were in contraction this week. Weak: Highlights A swing higher for the always volatile aircraft group gave an outsized lift to durable goods orders in November, rising...

Read More » Mosler Economics

Mosler Economics