Highlights The Small Business Optimism Index retreated by 0.6 points in June to 107.2, the sixth highest reading in the NFIB survey’s 45 years history. Beating the consensus forecast calling for a more substantial decline after May’s upward surge to the second highest level in the history of the survey, the optimism index remained exceptionally strong in June mainly thanks to improvement in the employment and inventory components. Gains of 2 points to a net 20 percent in...

Read More »Employment, Auto sales, Japan

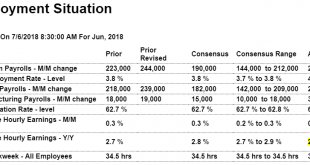

Low wage growth tells me spending remains under pressure: Highlights A very healthy employment report that shows brisk growth and also a movement into the workforce is headlined by a stronger-than-expected 213,000 rise in nonfarm payrolls for June which just tops Econoday’s consensus range. A sharp rise in the number of unemployed actively looking for a job, to 6.564 million from 6.065 million in May, lifted the unemployment rate 2 tenths to 4.0 percent and also lifted the...

Read More »Construction spending, NYC real estate, Saudi pricing, Trump on Harley

Last month revised a lot lower, and this month weak as well, as inflation-adjusted spending growth remains negative: Note from US Census: Notice: With this release, unadjusted data have been revised back to January 2016 and seasonally adjusted data back to January 2011. All revised estimates are available on our website. With each May release, seasonally adjusted data will now be revised for an additional five years beyond the revision period for unadjusted data. Research...

Read More »MMT For You and Me – Part 3: Why Does the Government Tax?

An introductory video on why the US government taxes, based on lessons learned from Ghana. Based on the works of Warren Mosler. The 7 Deadly Innocent Frauds free PDF: http://moslereconomics.com/wp-content... Molser Economics Blog http://moslereconomics.com/

Read More »MMT for You and Me – Part 2: Taxing and Spending

An introductory video on the way how the US government taxes and spends. Based on the works of Warren Mosler. The 7 Deadly Innocent Frauds free PDF: http://moslereconomics.com/wp-content... Molser Economics Blog http://moslereconomics.com/

Read More »MMT for You and Me – Part 1

An introductory video to get you thinking about where the money comes from. Based on the works of Warren Mosler. The 7 Deadly Innocent Frauds free PDF: http://moslereconomics.com/wp-content... Molser Economics Blog http://moslereconomics.com/

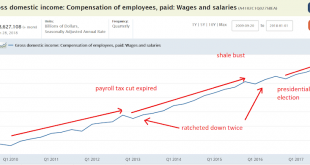

Read More »Gross domestic income, Personal income and spending

The above are quarterly from GDP data. Today’s release is monthly, and, as suggested by the far too low personal savings rate, consumption was revised down a bit and has come in lower this month. However, income was also revised lower, with wage income growth weak even with the reported employment growth, keeping the savings rate remains depressed. And with prices a bit higher it means real consumption and income are that much lower. Also, note how the inflation rates...

Read More »Mtg purchase apps, Durable goods orders, Pending home sales, Rental vacancy, International trade, Trump threat

Highlights Disruption tied to a fire at an auto supplier not only pulled down the previously released manufacturing component of the industrial production report but it also helped pull down durable goods orders in May which fell an as-expected 0.6 percent. Vehicle orders fell 4.2 percent in the month with vehicle shipments down 4.4 percent. Civilian aircraft orders, which had been very strong earlier in the year, fell for a second month, down 7.0 percent following April’s...

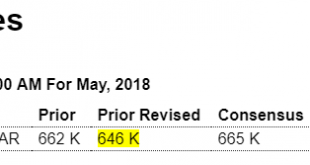

Read More »New home sales, OPEC, Tariffs, bank lending

Up more than expected, but last month revised quite a bit lower as well, as housing overall remains depressed: This is not population adjusted: OPEC ministers strike deal on oil production levels A source confirmed to CNBC that a deal has been struck and a statement critical of the U.S. that Iran wanted to include would not be in the final communique. A report from Reuters put the agreed upon level at a boost in oil output by around 1 million barrels per day (bpd). The...

Read More »Mtg apps, Current account, Existing home sales, Wage growth, Equity valuations

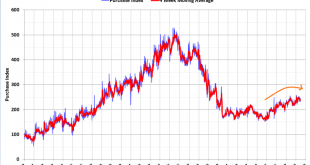

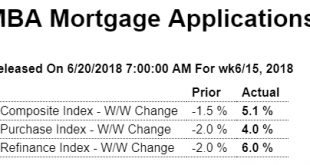

Purchase applications remain negative this year vs last: Highlights The June 15 week was an active one for mortgage bankers as the purchase index rose a solid 4.0 percent and the refinance index 6.0 percent. Despite the jump in the purchase index, its year-on-year rate remains in the negative column for a second straight week, at minus 1.0 percent. Turning back to refinancing, the outsized gain increased the share of mortgage activity to 36.8 percent of total applications vs...

Read More » Mosler Economics

Mosler Economics