Best to all for the New Year, and may our trumped up expectations eventuate! And last chance to make a 2016 PMC donation. Over $47 million raised, and the same $47 million donated. All costs are sponsored so your donation goes directly to Dana Farber for research! click here to donate:http://profile.pmc.org/WM0015 Why should he? They spend lots of $ there…Putin says Russia will not expel anyone in response to US sanctions Expectations Trumped up, but current conditions...

Read More »Trade, Inventories, Proposals before Congress

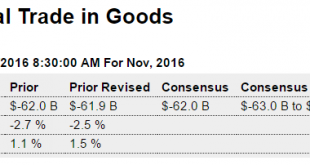

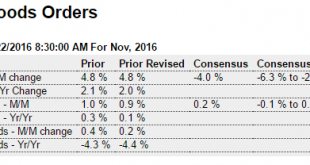

As previously discussed, exports are falling and imports climbing, with lots more to go: Highlights Trade looks to be a major negative that will be holding down fourth-quarter GDP. The advance trade deficit in goods widened sharply for a second straight month in November, to $65.3 billion following a revised $61.9 billion deficit in October that was nearly $5 billion higher than the last month of the third quarter, September. Exports have been very weak so far this fourth...

Read More »Redbook retail sales, Pending home sales, Stock buy backs, Spending, Japan stocks, Bank regulation, UN resolution

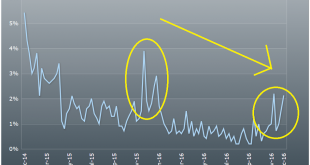

This is the time of year when year over year growth tends to increase, pulling up the rest of the year’s growth. But note how that increase has declined along with the general increases: Along with what looks to me like Trumped up expectations actual sales remain depressed: Any expected Trump bump in home sales didn’t materialize in contracts for homes signed in November. Higher mortgage rates hit home sales, driving the National Association of Realtors Pending Home Sales...

Read More »Consumer confidence, Housing prices, Dallas and Richmond Fed manufacturing indexes, Moore comments

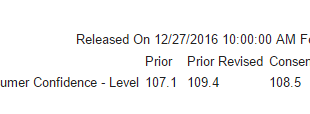

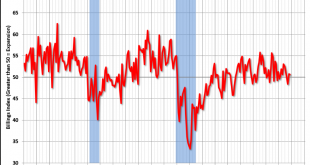

Apart from the Trumped up future expectations and the sagging retail sales reports, expectations remain elevated: Highlights Consumer confidence shows no sign of slowing. The index is up 12.9 points since the November election in gains driven by older consumers. The level for December is 113.7 which is the highest reading since way back in August 2001. But not all the indications from the December report point to monthly acceleration. December’s gain is centered in...

Read More »GDP revision, Phily Fed state index

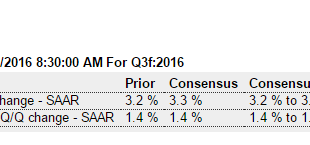

The Q3 blip up remains a soybean export, inventory building and healthcare premium story likely to be reversed in q4, as it all continues it’s general deceleration since oil capex peaked a couple of years ago: GDP 3.5% in Q3. The acceleration in real GDP in the third quarter primarily reflected an upturn in private inventory investment, an acceleration in exports, a smaller decrease in state and local government spending, an upturn in federal government spending, and a...

Read More »Auto production, Durable goods orders, Personal income and spending, Chicago Fed

As previously discussed- sales are slowing and inventory is too high: U.S. Car Makers Idle Plants Amid Oversupply Concerns By Mike Colias Adrienne Roberts and Christina Rogers Dec 21 (WSJ) — Detroit auto makers are pulling back on first-quarter production in response to a cooling in retail demand and a shift in consumer tastes, a speed bump for an industry that has laid the foundation for U.S. economic expansion in recent years. All three domestic car companies this week said...

Read More »Euronalysis, Architecture billings index, Bank income

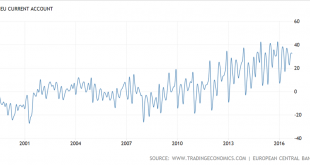

This looks like a large part of the ‘portfolio shifting’ that’s been going on out of a variety of ‘fears’. And it is my suspicion that those who are shifting euro assets to other currencies largely have euro liabilities to fund over time. This means they are getting themselves ‘out of balance’ which is another way to say they have gone ‘short euro’ and at some point will be back to cover: Record Capital Outflows Push Euro Toward Parity With Dollar By Mike Bird Dec 21 (WSJ) —...

Read More »Euro Area current account, Cass freight index, NY Fed

This is persistent, strong euro medicine that ‘absorbs’ the portfolio selling that’s been going on for over 2 years. And the lack of inflation and tight fiscal policy tell me it will persist until currencies adjust sufficiently to shift the balance: Euro Area Current Account Eurozone’s current account surplus rose to €32.8 billion in October 2016 from €30.9 billion in the same month a year earlier. The services surplus widened to €8.2 billion (from €2.4 billion a year...

Read More »PMI services, Oil capex

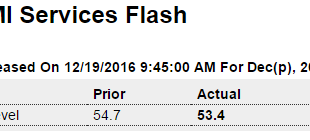

Less than the expected 55.2 as weakness in the services sector continues, and as post election hopes fade: Highlights Growth in new orders, though still near a 12-month high, has slowed so far this month, pulling down the flash services PMI for December by more than 1 point to 53.4. But, given the comparison with November’s unusual strength in new orders, the slowing is deceptive. Other readings in the report are clearly favorable including a gain in backlogs that has...

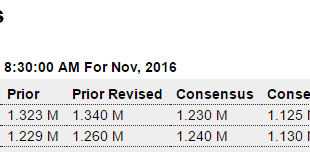

Read More »Housing starts, Euro trade, State budget shortfalls, Iowa farmland

Housing remains depressed, and not the driver of US growth that had been forecast by most analysts: Highlights Housing starts are being hit by huge swings. November starts fell 18.7 percent in November to a much lower-than-expected 1.090 million annualized rate following an upward revised gain of 27.4 percent to 1.340 million in October. There’s less volatility on the permits side where a roughly 30,000 undershoot in November, at 1.201 million vs the Econoday consensus for...

Read More » Mosler Economics

Mosler Economics