from David Ruccio Greece is a perfect example of how to turn a bad economic situation into something even worse. As Reuters reports, Rescue funds from the European Union and International Monetary Fund saved Greece from bankruptcy, but the austerity and reform policies the lenders attached as conditions have helped to turn recession into a depression. As a result, the poverty rate in Greece almost doubled (between 2008 and 2015), rising from 11.2 percent to 22.2 percent. And average...

Read More »Cutting wages is not the solution

from Lars Syll A couple of years ago yours truly had a discussion with the chairman of the Swedish Royal Academy of Sciences (yes, the one that yearly presents the winners of The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel). What started the discussion was the allegation that the level of employment in the long run is a result of people’s own rational intertemporal choices and that how much people work basically is a question of incentives. Somehow the argument...

Read More »How India became Bill Gates’ guinea pig: A conspiracy as recounted by the main actors

from Norbert Häring Microsoft’s Bill Gates is one of the richest and most influential people on earth. He announced in 2015 that his Bill & Melinda Gates Foundation was aiming at achieving full digitalization of the payment systems of India and other populous developing countries by 2018. This “financial inclusion” program for India dates back to well before Narendra Modi came to power. It was elevated to official US policy by Executive Order in 2012, because the President saw vital...

Read More »The Indian ‘no more cash’ experiment

“Our major competitor is cash. Cash is what we seek to eliminate” Recently, the Indian government overnight abolished most cash. With dire consequences. What are the economic consequences, why did the Indian government do this? Economies like those of India have, for a bunch of reasons, often relatively high rates of inflation. After the abolishing of cash, India suddenly experienced ‘ugly’ deflation (‘ugly’ i.e. provoked by a fall in demand as well as contributing to this fall in...

Read More »Financialization, austerity and pension funds

from Maria Alejandra Madi By 2020, the largest pools of pension fund assets are projected to remain concentrated in the US and Europe. In North America, pension fund assets reached $19.3 trillion in 2012 and PwC estimates that by 2020, pension fund assets will rise by 5.7 percent a year to achieve over $30 trillion of the $56.5 trillion in total global assets, more than 50 percent of the global total. Indeed, according to the PwC report, Asset Management 2020: A Brave New World,...

Read More »Bill Gates wants to undermine Donald Trump’s plans for growing the economy

from Dean Baker Yes, as Un-American as that may sound, Bill Gates is proposing a tax that would undermine Donald Trump’s efforts to speed the rate of economic growth. Gates wants to tax productivity growth (a.k.a. “automation) slowing down the rate at which the economy becomes more efficient. This might seem a bizarre policy proposal at a time when productivity growth has been at record lows, averaging less than 1.0 percent annually for the last decade. This compares to rates of close to...

Read More »Austerity, civil society and statistics

From The lancet Remarkably, 8 years after the onset of the global financial crisis, the consequences for health are still being debated, even in Greece, the country most severely affected by the economic downturn. There can be few better indications of the low priority accorded to health within governments than the difference between the concerted efforts dedicated to understanding the state of the economy and the apparent scarcity of concern about the health of populations. Economists...

Read More »Ideas Towards a New International Financial Architecture

Ideas Towards a New International Financial Architecture (Wea-Books) Paperback – February 2017 by Oscar Ugarteche (Editor), Alicia Payana (Editor), Maria Alejandra Madi (Editor) In the short span of a few essays, this book takes the reader on a trip from the historical roots of the current financial architecture to the imaginable futures one can envision for it, only if there is the political will to change it. If we accept that, as put by the editors, financial markets’...

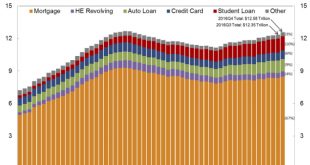

Read More »Chasing the American Dream into a deadend

from David Ruccio The latest Quarterly Report on Household Debt and Credit (pdf) from the New York Fed’s Center for Microeconomic Data showed a substantial increase in aggregate household debt balances in the fourth quarter of 2016 and for the year as a whole. As of 31 December 2016, total household debt stood at $12.58 trillion, an increase of $226 billion (or 1.8 percent) from the third quarter of 2016. Total household debt is now just 0.8 percent ($99 billion) below its third quarter...

Read More »New Keynesian DSGE models and the ‘representative lemming’

from Lars Syll If all agents are supposed to have rational expectations, it becomes convenient to assume also that they all have the same expectation and thence tempting to jump to the conclusion that the collective of agents behaves as one. The usual objection to representative agent models has been that it fails to take into account well-documented systematic differences in behaviour between age groups, income classes, etc. In the financial crisis context, however, the objection is...

Read More » Real-World Economics Review

Real-World Economics Review