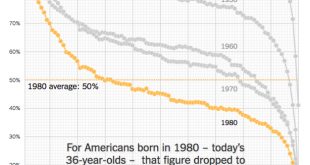

from David Ruccio My students are worried—many of them obsessed by the possibility—they’re not going to be better off than their parents. As it turns out, they’re right. According to new research by Raj Chetty et al. (pdf), the rates of “absolute income mobility” (the fraction of children who earn more than their parents) have fallen from approximately 90 percent for children born in 1940 to 50 percent for children born in the 1980s. And the likelihood is, that rate is going to fall...

Read More »Pushing to full employment: a Trump dividend?

from Dean Baker Economists are not very good at economics. We repeatedly get reminded of this fact when we see the economy act in ways that catch the bulk of the profession by complete surprise. The most obvious example is the housing bubble, whose collapse gave us the financial crisis and the Great Recession. Almost no economists saw the bubble or the potential hazards posed by its bursting. But this is just the beginning of what economists got wrong in recent years. Not only did the...

Read More »The IMF about Greece: right…!

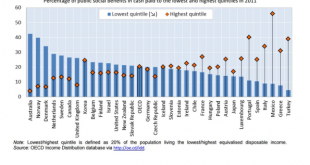

ht graph: @lugaricano The IMF is totally right: the EU is mistreating Greece – and the EU knows. The IMF is also right about this: Greece is – even within its budgetary confines – also mistreating its poor as too much money is flowing to the rich (graph). From the IMF website: The IMF is not demanding more austerity. On the contrary, when the Greek Government agreed with its European partners in the context of the ESM program to push the Greek economy to a primary fiscal surplus of 3.5...

Read More »RWER issue no. 77

real-world economics review Please click here to support this journal and the WEA – Subscribers: 26,498 subscribe RWER Blog ISSN 1755-9472– A journal of the World Economics Association (WEA) 14,588 members, join – Sister open access journals: Economic Thought and World Economic Review back issues Issue no. 77 10 December 2016download the whole issue Human growth and avoiding European disintegration: lessons from Polanyi 2Jorge Buzaglo ...

Read More »The half that will never be told. . .

from David Ruccio Certainly not by mainstream economists—not if they continue to defend their turf and to attack the new literature on “Slavery’s Capitalism” with the vehemence they’ve recently displayed. It makes me want to forget I ever obtained my Ph.D. in economics and the fact that I’ve spent much of my life working in and around the discipline. A recent article in The Chronicle of Higher Education [ht: ja] highlights Edward E. Baptist’s novel book, The Half Has Never Been Told...

Read More »P6: Historical context for Keynes

from Asad Zaman This post, 6th in a sequence about Re-Reading Keynes, continues to borrow heavily from Brian S. Ferguson, “Lectures on John Maynard Keynes’ General Theory of Employment, Interest and Money (1): Chapter One, Background and Historical Setting” University of Guelph Department of Economics and Finance Discussion Paper No. 2013-06. However the first three paragraphs are mine. Distinguishing between ideologies and science: Deduction: According to Lionel Robbins, economic theory...

Read More »Bewildering Irish GDP data once again (but employment data are sound)

The new quarterly Irish GDP statistics are in. They are, again, bewildering. Ireland grows because investments are down…. I’ll explain. On the one hand we read: ‘Overall total domestic demand declined by 1.8% in Q3 2016 compared with Q2 2016.’. This decline was led by a 17,8% decline in investments. On the other hand we read: “The National Accounts results show an increase of 4.0% in GDP and an increase of 3.2% in GNP in Q3 2016 compared with Q2 2016“ A heft growth of GDP in combination...

Read More »Disagreeing with Paul Krugman: His friends probably do vote against the interest of the working class (white and other)

from Dean Baker Paul Krugman told readers that intellectual types like him tend to vote for progressive taxes and other measures that benefit white working class people. This is only partly true. People with college and advanced degrees tend to be strong supporters of recent trade deals [I’m including China’s entry to the WTO] that have been a major factor in the loss of manufacturing jobs in the last quarter century, putting downward pressure on the pay of workers without college...

Read More »Insane inequality

from David Ruccio Income inequality continues to grow in the United States—which represents the very definition of insanity: “doing the same thing over and over again and expecting different results.” According to recent data by Thomas Piketty, Emmanuel Saez, and Gabriel Zucman, from 1979 through 2006, the share of pre-tax income going to the bottom 50 percent of U.S. households fell from an already-low 20.1 percent to an even-lower 13.5 percent. During that same period, the top 1...

Read More »Statistical significance is not real-world significance

from Lars Syll As shown over and over again when significance tests are applied, people have a tendency to read ‘not disconfirmed’ as ‘probably confirmed.’ Standard scientific methodology tells us that when there is only say a 10 % probability that pure sampling error could account for the observed difference between the data and the null hypothesis, it would be more ‘reasonable’ to conclude that we have a case of disconfirmation. Especially if we perform many independent tests of our...

Read More » Real-World Economics Review

Real-World Economics Review