Weekly Indicators for November 13 – 17 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. After a brief pause, the coincident indicators have continued to improve. There are now very few that are not positive. The spotlight therefore remains on the short leading indicators, as to which manufacturing has not declined enough to tip the economy into recession, and construction has not declined...

Read More »New Bankruptcy Process for Student Loans is Proving to be a Cruel, Dangerous Joke for Borrowers.

Our opposition seeds stories (CNBC) in the media pretty frequently like this. They try to make it seem like getting a discharge on student loans in bankruptcy is possible for most people. It is not. AB: Alan is voicing his displeasure with media claiming many people are getting student loan relief. They are not. In the end the battle for relief for another 40 million people needs to occur. “More student loan borrowers walk away from their debt in...

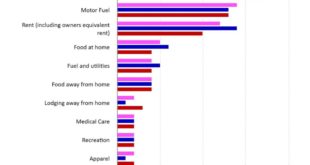

Read More »Except for fictitious shelter and motor vehicle insurance and repairs, consumer inflation is thoroughly contained

It appears inflation is coming down this year and probably into next year also. Maybe Biden will not have to twist the Fed’s arm to get them to lower the Fed rate. Except for fictitious shelter and motor vehicle insurance and repairs, consumer inflation is thoroughly contained – by New Deal democrat The October CPI report confirmed yet again what I have been saying for months: except for fictitious shelter, both headline and core inflation...

Read More »New Deal democrats Weekly Indicators for November 6 – 10

I have been sharing New Deal democrats Weekly Indicators with an Edward Jones consultant who handles our funds. He was pretty impressed with the detail New Deal democrat gives here and at Seeking Alpha. He has his own account so he can go every week (I am limited). If have some time, you should explore NDd’s stats. Weekly Indicators for November 6 – 10 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking...

Read More »“No new economic data, so let me follow up some more on the issue of longer-term unemployment”

Consumption leads (longer term) unemployment, too – by New Deal democrat Once again there is no new economic data, so let me follow up some more on the issue of longer term unemployment. Earlier this week I pointed out that just as initial claims lead continuing claims, so does short term unemployment (under 5 weeks) lead long term unemployment (15 weeks and over). Think of unemployment as a pipeline, and the intake flows before the main...

Read More »November 5, 2023, Letters from an American

Prof. Heather discusses Biden motivating the FTC to start the process of breaking up monopolies and weaken up the economic power of these large entities. She draws upon the history of Roosevelt in 1908 doing similar and meeting resistance from House politicians led by Joe Cannon as supported by big business to stymie his efforts. Sounds familiar to what we are experiencing today. November 5, 2023, Letters from an American, Prof. Heather Cox...

Read More »September JOLTS report shows continued deceleration in all trends – except layoffs

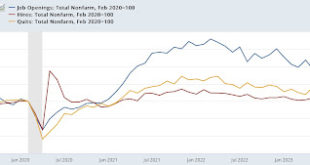

September JOLTS report shows continued deceleration in all trends – except layoffs – by New Deal democrat All of the major metrics in last month’s JOLTS report for August improved, most slightly, but the decelerating trend continued. In this morning’s report for September, that trend continued, as most of the metrics improved or declined very slightly, but the trends remained intact. Here are openings (blue), hires (red), and voluntary...

Read More »Impact of Inflation on Lower and Higher Income Households

Some BLS stats on High and Low Income consumers. The differences between the two, spending, what is bought, inflation, essentials, etc. Less is purchased and also more specific is bought by the lower end as compared to a variety of purchases at the upper end. Nice little and simple, readable report. Inflation Experiences for Lower and Higher Income Households, U.S. Bureau of Labor Statistics (bls.gov), Joshua Klick and Anya Stockburger...

Read More »‘$23 Billion Up for Grabs’

Just got done exchanging a couple of emails with Steve about Suzanne’s and his latest commentary about the growing privatization of the VA. Looks like the VA is farming out more of the veteran’s care to contractors which will come at a much higher cost. Outsourcing to for-profit entities is not a good practice. We can see how Medicare Advantage plans are costing far more than Medicare and depleting Medicare funding. Similar is happening with the VA...

Read More »Stock prices and bond yields during disinflationary, deflationary, and reflationary periods

Stock prices and bond yields during disinflationary, deflationary, and reflationary periods – by New Deal democrat This is an update of a post I wrote almost exactly 10 years ago. I’m doing this because of an important secular change I noticed that appears to have happened in the financial markets. Back when I first started delving into financial markets and economy 30 years ago, I noticed that, dating all the way back to the Great...

Read More » Heterodox

Heterodox