In addition to what you will hopefully read below. Repubs and Dems went to court and presented their reasoning for and against new laws allowing for a “reasonable inquiry” to be conducted before election certification and gives election workers the ability to “to examine all election related documentation created during the conduct of elections.” You can surmise who was for and against this.. New Georgia Law Spurs Bogus Challenges to Voter...

Read More »The real nowcast for the economy as of the end of Q3

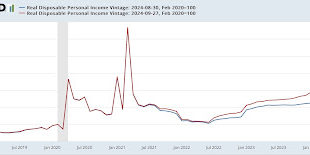

– by New Deal democrat On Friday I highlighted the sharp positive revision to the personal saving rate. That was a byproduct of a similar sharply higher revision to real personal income over the past two years. Here is what those revisions, to real personal disposable income, look like: Instead of being up 6.8% since just before the pandemic, real disposable income is up 10.6%. A historical look at the most salient economic indicators...

Read More »Rebalancing of the Housing Market Continues, as New Home Sales and Existing Home Prices are Consistent with the “Soft landing”

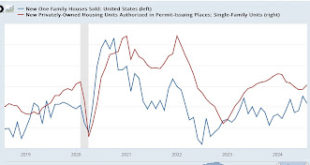

– by New Deal democrat With this morning’s release of new home sales, we have all of the important housing data releases for the month. So let’s integrate that into the overall housing outlook. Let’s begin with my usual overview that new home sales are the single most leading metric for the entire sector, but they suffer from the fact that they are extremely volatile and also heavily revised. So it is best to look at them in comparison with...

Read More »“An Aging Salesman Trying to Close One Last Deal”

September 23, 2024 Prof. Heather Cox-Richardson Letters from an American That is how they are describing a desperate Trump . “There’s nothing sadder than an aging salesman trying to close one last deal,” MSNBC’s Ryan Teague Beckwith wrote on September 21. Beckwith went on to list seven of Trump’s most recent campaign promises, most delivered off the cuff at rallies, that are transparent attempts to close the deal with different groups of...

Read More »Out in the Open Election Officials Strategizing to Undermine 2024 Results

More issues with the upcoming 2024 election. Again in Georgia which had election counting issues in 2020. Now, election deniers are openly planning. Network of Georgia election officials strategizing to undermine 2024 result, US elections 2024, The Guardian. Emails obtained by the Guardian reveal a behind-the-scenes network of county election officials throughout Georgia coordinating on policy and messaging to both call the results of...

Read More »Out in the Open Election Officials Strategizing to Undermine 2024 Results

More issues with the upcoming 2024 election. Again in Georgia which had election counting issues in 2020. Now, election deniers are openly planning. Network of Georgia election officials strategizing to undermine 2024 result, US elections 2024, The Guardian. Emails obtained by the Guardian reveal a behind-the-scenes network of county election officials throughout Georgia coordinating on policy and messaging to both call the results of...

Read More »Economically weighted ISM indexes show an economy on the very cusp of – but not in – contraction

– by New Deal democrat Recently I have paid much more attention to the ISM services index. That’s because, since the turn of the Millennium, manufacturing’s share of the economy has contracted to the point where even a significant decline in that index has not translated into an economy-wide recession, as for example in 2015-16. When we use an economically weighted average of the non-manufacturing index (75%) with the manufacturing index...

Read More »Manufacturing and construction together suggest weak but still expanding leading sectors

– by New Deal democrat As usual we start the month with two important reports on the leading sectors of manufacturing and construction. First, the ISM manufacturing index showed contraction yet again, with the headline number “less negative” by way of increasing from 46.8 to 47.2, and the more leading new orders subindex declining sharply by -2.8 from 47.4 to 44.6: Including August, here are the last sis months of both the headline...

Read More »A Perspective: One Evening at the Democratic National Convention August 20, 2024

by Prof. Heather Cox Richardson The Democratic National Committee today released a platform that lays out the history of the last four years and explains how and why the Biden-Harris administration has oriented the United States government toward ordinary Americans. It is in many ways a snapshot of the United States of America in this moment. At the most basic level, it shows how rapidly the political world is changing. Approved on July 16, five...

Read More »The Truth About High Prices and Increasing Prices

A bit of The Atlantic’s Anne Lowrey on high prices and increasing prices. The article says there are few or great tools a president has at their disposable. I beg to differ on Annie’s comment. One of those tools a President Kamala has is take the issue to the citizenry making the case many of the high prices do not need to be. They are artificially high because industry can control supply which can drive prices up. This is no surprise the nation...

Read More » Heterodox

Heterodox