Weekly Indicators for May 6 – 10 at Seeking Alpha – by New Deal democrat My “Weekly Indicators” post is up at Seeking Alpha. The majority of short leading and coincident indicators continue to show strength rather than weakness. This week it was commodity prices’ turn to show that the global economy is getting stronger. As usual, clicking over and reading will bring you up to the virtual moment as to the economic data, and reward me with...

Read More »2024 SOCIAL SECURITY REPORT IS OUT THE MEDIA MISS THE POINT

The 2024 Social Security Trustees Report came out on Monday, May 6. You can find dozens of press reports and other commentary online, most of which are written by people who actually know nothing about Social Security except what they read in the papers. Some are written by people who do know what they are talking about but write in a way that is likely to mislead. For today I am just going to look at the May 6 analysis: “Analysis of the 2024...

Read More »Inflation Is Scrambling Americans’ Perceptions of Middle-Class Life

Inflation Is Scrambling Americans’ Perceptions of Middle-Class Life, businessinsider.com, Jennifer Sor Yes, we have inflation. It is a given. Inflation is scrambling the lives of middle-class Americans. Income is not keeping up with the costs of maintaining a Middle-Class Life. I have sat here in AZ watching this play out in the nation. In many cases we are fighting a supply chain shortage which is entirely controllable in the US. Similar happened...

Read More »First Quarter GDP Growth at 1.6 Percent

by Dean Baker Commerce Department reported that GDP grew at a 1.6 percent annual rate in the first quarter, some-what lower than had generally been predicted. However, the headline number was held down by slow inventory accumulation, which subtracted 0.35 percentage points from growth, and a big rise in the trade deficit, which lowered growth by 0.86 percentage points. Pulling out these factors, final sales to domestic producers grew at a...

Read More »Coronavirus dashboard, 4 years into the pandemic: all-time low in hospitalizations, deaths likely to follow

– by New Deal democrat The Bonddad Blog On Friday the CDC updated its COVID death statistics through March 31, which means that we now have 4 full years of data. It also updated its hospitalization data through April 20, and to cut to the chase, last week saw a record low hospitalizations for COVID – 5,615 – since its onset. So this is a good time to look at the state of the now-endemic pandemic. When it comes to both hospitalization and...

Read More »Another strong personal income and spending report, but beware the uptick in inflation

– by New Deal democrat The Bonddad Blog Personal income and spending has become one of the two most important monthly reports I follow. This is in large part because the big question this year is whether the contractionary effects of Fed tightening have just been delayed until this year, or whether the fact that there have been no rate hikes since last summer mean that the expansion will strengthen. Because real personal spending on services...

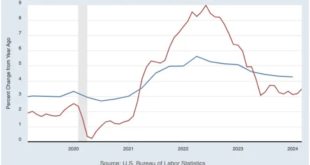

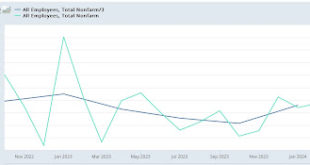

Read More »Scenes from the robust March jobs report

– by New Deal democrat The Bonddad Blog New Deal democrat has been writing and featured at Angry Bear for years now. His economic outlooks have been accurate with few exceptions. As always the US economy is independent of us in the short term. Read on as NDd’s remarks are focusing on a sound labor market. ~~~~~~~~ As I wrote Friday, the news from the employment report was almost all good. Let’s follow up on the most important points...

Read More »March jobs report: almost uniformly positive, making a “soft landing” the default 2024 scenario

In sum, this month’s report was very much consistent with a “soft landing” scenario, which must be regarded as the default outcome at this point. Read-on for the details . . . – by New Deal democrat The Bonddad Blog In the past few months, my focus has been on whether jobs gains are most consistent with a “soft landing,” i.e., no further deterioration, or whether deceleration is ongoing; and more specifically: Whether there is further...

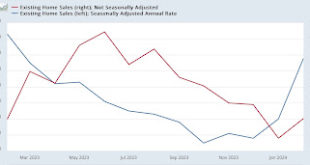

Read More »Signs of a thaw in the frozen existing homes market, but a very long way to go

– by New Deal democrat There’s no big economic news today, but yesterday existing home sales were released. While they have historically constituted up to 90% of the entire market, they have much less economic impact than new home sales, which involve all sorts of construction activity, followed by landscaping, furnishings, and other sales. Since the Fed started raising rates two years ago, the two markets have gone in entirely different...

Read More »Republican Budget Cuts Earned Benefits; Keeps Trump Tax Cuts

Angry Bears’ Social Security expert Dale Coberly emailed this to me about the same time it showed up in my inbox. Republicans again are trying to sell the public on the need to cut Social Security and Medicare Budgets for those over 65. Cutting them while keeping the Trump tax breaks which will result in a $2 trillion deficit by the time Reconciliation measures end in 2025. The cuts makes no sense as both programs are far more efficient and effect...

Read More » Heterodox

Heterodox