Just hit an all time low yield as markets anticipate a weakening economy will lead to lower rates from the Fed: Crude oil demand is falling with the weakening global economy. While oil producers in general sell their entire output at market prices, the Saudis are the ‘swing producer’, setting price and letting the quantity they sell to their clients vary with demand. Therefore, a drop in global demand results in reduced Saudi production and sales, while prices remain at...

Read More »Income, Consumption Chicago PMI, Trade, GDP forecasts, France, Canada, India

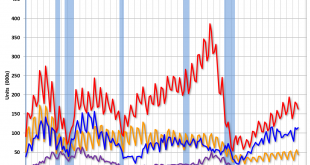

Continues to decelerate from the tariffs, and this is before the virus: Also decelerating before the virus: Before the virus, the downtrend is obvious as it remains below 50: Exports and imports both slowing as global trade continues to wind down: GDP forecast to decelerate, before the virus: Unsold inventory piling up: Gone negative well before the virus:

Read More »Durable goods, Air freight, Macro economic comment

The decline continues, and this was well before the coronavirus: Rolling over: The charts show the economy has been continuously decelerating from the time the tariffs took effect, and now with the coronavirus it’s likely to decelerate that much more quickly into negative growth. The private sector tends to be pro cyclical, which is why back in 2009 it took a federal deficit of maybe 10% of GDP to turn things around, and why it is likely it will take same to turn things...

Read More »New home sales, Mtg purchase apps, HK, Chemicals,

New home sales continue to grow at a slower pace than prior cycles, with absolute levels remaining historically depressed. The chart is not population adjusted: Can also be a reflection of what’s going on in China: Another one of those recent moves up that is now likely to reverse:

Read More »Richmond Fed, Mexico, Housing

Back below 0 but could still be trending higher: From the quarterly report. Historically depressed and recently fading:

Read More »Dallas Fed, Chicago Fed, Rails, Bank loans, Population growth

Settling in near 0 after the fall: Settling in near 0 after the fall: Negative growth since August:

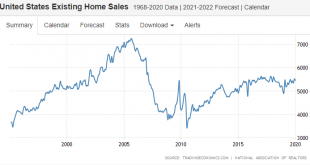

Read More »PMI services and manufacturing, Existing home sales, Kudlow comment, Trump comment

This one is for the lion’s share of the US economy and it’s fallen back: Same with manufacturing: Also fell back some and in general remains depressed and going nowhere: Kudlow says market is wrong… ;) Looks like the President’s mental capabilities are rapidly deteriorating:

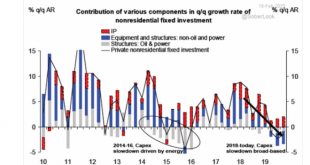

Read More »Capital expenditures, Philly Fed, Tariffs

The Philadelphia Fed’s survey just gapped up, much like some of the others. Could be that manufacturing has stabilized at current levels, but too soon to say: White House Admits That Trump Trade Stance Did Depress Economy

Read More »Housing starts, Stock buybacks

Reversed some but still higher than expected, and still historically depressed: However, the weather was very nice again in January (just like in December), and the weather probably had a significant impact on the seasonally adjusted housing starts number. The winter months of December and January have the largest seasonal factors, so nice weather can really have an impact. A huge driver of stock prices got off to its worst start in 7 years, but that could change Share...

Read More »NY PMI, Walmart, Japan, Oil

Another move up that may or may not reverse: Walmart earnings and outlook fall short as holiday season disappoints This price drop will negatively effect capital expenditures as well as the value of oil being produced, both negatives for GDP:

Read More » Heterodox

Heterodox