Decelerating faster than previously reported: Weakness in imports may be confirming weak US consumer demand: Highlights January’s trade deficit came in at a much lower-than-expected $51.1 billion as exports rose a solid 0.9 percent to $207.3 billion while imports fell a sharp 2.6 percent to $258.5 billion. The goods deficit is the surprise in the report, at a still steep $73.3 billion but 10.1 percent lower than December’s outsized $81.5 billion gap. The nations surplus on...

Read More »Housing starts, Consumer Confidence, Auto sales, Rail traffic

Rolling over: Also rolling over, and inline with the drop in retail sales: U.S. auto sales are falling as vehicle prices climb, indicating that buyers at the lower end are getting squeezed out of the new car market, according to a new industry forecast. First-quarter auto sales are expected to drop by nearly 2.5 percent from a year earlier, to 4 million units, according to J.D. Power and LMC Automotive. Retail sales, which exclude sales to rental car companies and other...

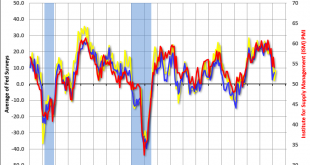

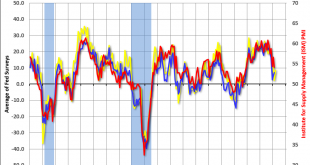

Read More »ISM and Fed surveys, Temp employment, Sentiment, MMT alerts, DB response

No let up!

Read More »Rate policy, Wholesale inventories

While there’s no dispute that there’s been a substantial global economic slowdown, stocks have been doing well due to investor belief that Fed will be there with lower rates to stem the deceleration and reignite growth. However, seems obvious to me that the Fed’s tools- low rates and QE- aren’t all they are cracked up to be, as per Japan, the euro zone, and the US for the last 10 years. To the contrary, seems to me the Fed may be confusing the accelerator with the brake,...

Read More »ISM and Fed surveys, Temp employment, Sentiment, MMT alerts, DB response

No let up!

Read More »Factory orders, Architecture billing, Corporate outlook

Rolling over: A growing list of companies from FedEx to BMW are warning about the world economy Executives at FedEx, BMW, UBS and others are describing bleak macro-economic conditions around the world this week, which they say are weighing on business. The head of UBS says it was “one of the worst first-quarter environments in recent history,” while FedEx cited slowing international conditions and weaker global trade growth trends.

Read More »US manufacturing, and growth forecasts, LA port traffic, Japan trade

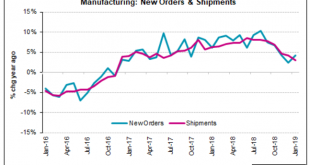

Decelerating global trade hitting home: U.S. manufacturing sector slowing as economy loses steam (Reuters) The Fed said manufacturing production dropped 0.4 percent last month. January was revised up to show output falling 0.5 percent instead of slumping 0.9 percent. Production at factories increased 1.0 percent in February from a year ago. Motor vehicles and parts output slipped 0.1 percent last month after tumbling 7.6 percent in January. Excluding motor vehicles and...

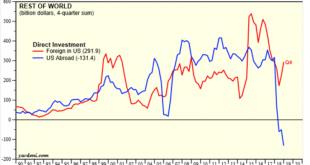

Read More »Roreign direct investment, Construction spending, Durable goods orders, New home sales

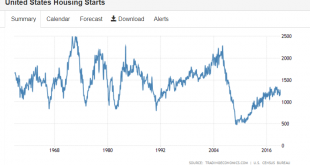

Gone negative year over year adjusted for inflation: This series looks to me like it’s flattened and adjusted for inflation remains well below 2008 highs, and hasn’t fully recovered from the collapse of oil capex at the end of 2014: New home sales appear to have rolled over at very low levels. They are pretty much only at levels of the early 1960’s when the population was maybe half of what it is today:

Read More »Small business index, BOJ on trade, China, Atlanta Fed

Trumped up expectations largely reversed: Highlights At 101.7, the small business optimism index fell short of expectations in February, recovering only 5 tenths of January’s 3.2 point dip. Econoday’s consensus was looking for 102.5 with the low estimate at 101.8. Employment plans lost ground for a second straight month with a turn lower for earnings trends the biggest negative in the month. One plus is that the he outlook for economy, after dropping sharply in January, did...

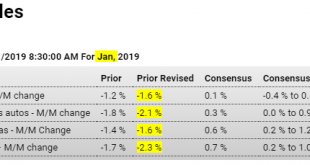

Read More »Retail sales, Non financial corporate and federal debt

A bit of an uptic from a very low number, with last month’s data revised still lower and the outlook still looking very soft: Highlights For retail sales, no period has more seasonal extremes than the busy days of December vs the quiet days of January. This and weather make adjustment difficult and are likely part of the explanation for the extreme volatility of the December and January retail sales reports. Retail sales managed only a 0.2 percent headline gain in January...

Read More » Heterodox

Heterodox