Yen: Euro:

Read More »Macro review, Rig count, Redbook same store sales, Consumer credit, Philly Fed state index, Jolts

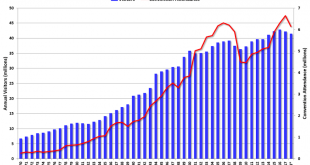

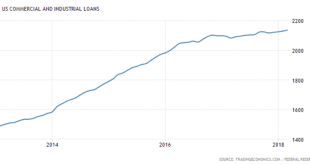

There is now growing evidence that the economy’s deceleration that followed the collapse of oil related capital expenditures at the end of 2014 continued for about two years after which it reversed course. This means the collapse in private sector deficit spending was replaced by other sources of deficit spending, some of it public, the rest private. The increase in private sector deficit spending was apparently not bank financed, as indicated by bank lending statistics, so...

Read More »Employment, Durable goods, Bank loans, Collections index, China phone sales

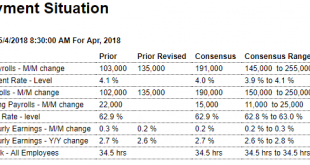

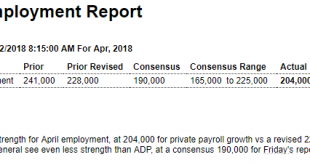

Economic intuitive sectors of employment were mixed with truck transport contracting. This month’s report internals (comparing household to establishment data sets) was inconsistent with the household survey showing seasonally adjusted employment expanding only 3,000 vs the headline establishment number expanding 164,000. The point here is that part of the headlines are from the household survey (such as the unemployment rate) and part is from the establishment survey (job...

Read More »ADP employment, Light vehicle sales

Auto sales continue to slow: The BEA released their estimate of April vehicle sales this morning. The BEA estimated sales of 17.07 million SAAR in April 2018 (Seasonally Adjusted Annual Rate), down 1.7% from the March sales rate, and up slightly from April 2017.Read more at http://www.calculatedriskblog.com/#kXZuxyjWLR2MW4ME.99 Light truck sales were slowing until getting a boost from the hurricanes:

Read More »GDP, Bank lending, Construction spending, Capital investment, Emerging market debt, Smartphone exports

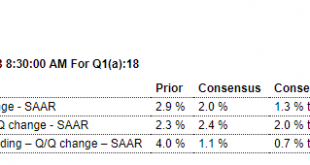

As previously discussed, something has to give to bring the savings rate inline, and the low reported personal consumption expenditures are a step in that direction, and housing has also been soft, as were prices. Also, while inventory building adds to GDP, combined with slower sales growth it doesn’t bode well for the future: Highlights A sharp rise in service spending helped keep first-quarter GDP in the respectable range, at an annualized 2.3 percent rate and 3 tenths...

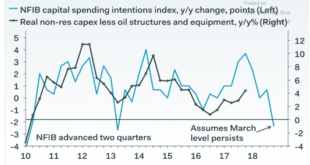

Read More »Capex forecasts, Euro area GDP, Gasoline prices, Richmond Fed, New home sales

Trumped up expectations reversing? Growing modestly, and still below levels of the early 1970’s, and well below levels of the 2001 recession. The chart is not adjusted for population:

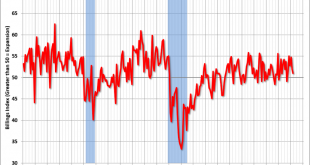

Read More »Architectural index, Corporate leverage, Saudi oil pricing

Muddling through at depressed levels: Saudis set price. If they decide to hike as below, it will happen: OPEC’s new price hawk Saudi Arabia seeks oil as high as $100 Apr 18 (Reuters) — Top oil exporter Saudi Arabia would be happy to see crude rise to $80 or even $100 a barrel. OPEC, Russia and several other producers began to reduce supply in January 2017 in an attempt to erase a glut. They have extended the pact until December 2018 and meet in June to review policy. OPEC...

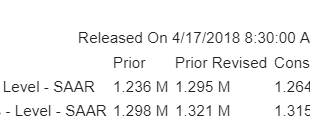

Read More »Housing starts, Industrial production

Must be some tax thing driving multifamily last month: Highlights The residential construction business had a very strong March: housing starts easily topped Econoday’s high estimate at a 1.319 million annualized rate while permits came in just shy of the top estimate at a very strong 1.354 million. Multi-family units are the standout in the March report. Starts for this group rose 14.4 percent in the month to a 452,000 rate with permits 19.0 percent higher at 514,000....

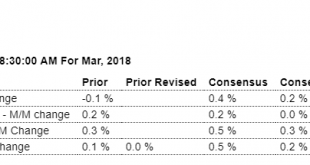

Read More »Retail sales, Business inventories, Port traffic, Infrastructure

Propped up by autos, as the rest continues weak, and autos aren’t looking so good longer term either: Highlights In a slight reversal of expectations, retail sales proved stronger at the headline level, up 0.6 percent in March, than the core readings which did however still post respectable gains at 0.3 percent less autos and gas and 0.4 percent for the control group. Autos are the big story in March, jumping 2.0 percent and finally shaking off the long lull following the...

Read More »Budget comments, ISM forecast, Global bank lending, Fed rate expectations, ECB Euro comments

Eine neue wissenschaftliche Wahrheit pflegt sich nicht in der Weise durchzusetzen, daß ihre Gegner überzeugt werden und sich als belehrt erklären, sondern vielmehr dadurch, daß ihre Gegner allmählich aussterben und daß die heranwachsende Generation von vornherein mit der Wahrheit vertraut gemacht ist. “A new scientific truth does not triumph by convincing its opponents and making them see the light, but rather because its opponents eventually die, and a new generation grows...

Read More » Heterodox

Heterodox